The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

An undisclosed seller retained EnergyNet Indigo for the sale of a Permian Basin mineral and royalty opportunity.

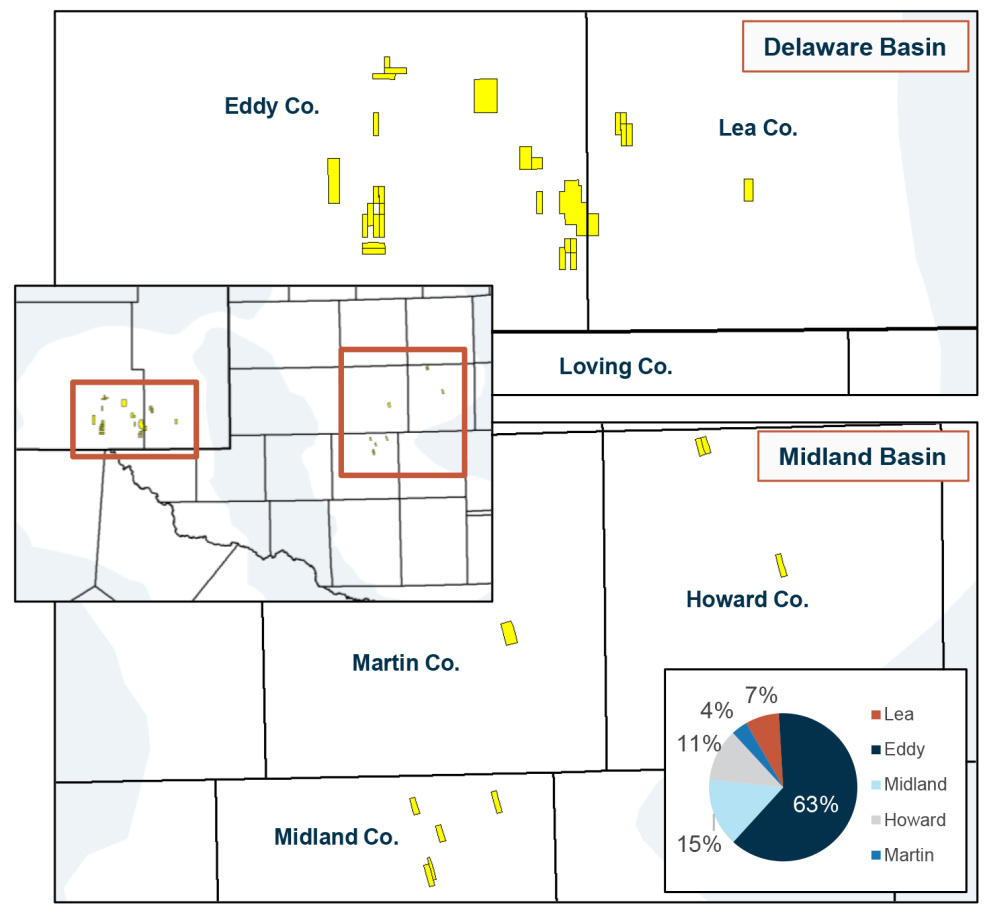

The offering, Lot 95071, includes about 277 net royalty acreage plus drilled, permitted and undeveloped locations within the Delaware and Midland basins across New Mexico’s Eddy and Lea counties and Howard, Martin and Midland counties in West Texas.

Opportunity Highlights:

- Asset Highlights

- 277 NRA (70% Delaware / 30% Midland)

- Averaging ~4 rigs and ~1.5 completion crews year to date

- Mewbourne and EOG operated ~51% of the asset

- Immediate cash flow with 20%+ annual growth

- Next 12-month cash flow: $2.9 million

- Next 36-month cash flow: $10.8 million

- 10-year cash flow (PDP+Permits): $20.5 million

- Remaining Undeveloped Inventory

- Drilled: 253 | Permitted: 175 | Undeveloped: 1,039

- Cash Flow Profile

- Accrued free cash flow is based on the production date of the income-producing wells, and the production month’s historical commodity prices

- Accrued monthly cash flow has averaged ~$315,000 / month over the last 3three months (April-June)

- $2.9 million of next 12-month cash flow is expected

- ~73% of the next 12-month cash flow is contributed by PDP wells

- Accrued free cash flow is based on the production date of the income-producing wells, and the production month’s historical commodity prices

Bids are due by 4 p.m. on July 28. [Editor’s note: Bid due date was updated from a previous deadline of July 27.]

For complete due diligence information visit energynet.com or email Zachary Muroff, managing director of business development, at Zachary.Muroff@energynet.com, or Denna Arias, executive director of acquisitions and divestments, at Denna.Arias@energynet.com. For technical questions, email Keith Ries, managing director of engineering, at Keith.Ries@energynet.com, or Reilly Bliton, director of engineering, at Reilly.Bliton@energynet.com.

Recommended Reading

Seadrill to Adopt Oil States’ Offshore MPD Technology

2024-09-17 - As part of their collaboration, Seadrill will be adopting Oil States International’s managed pressure drilling integrated riser joints in its offshore drilling operations.

CNOOC Makes Ultra-deepwater Discovery in the Pearl River Mouth Basin

2024-09-11 - CNOOC drilled a natural gas well in the ultra-deepwater area of the Liwan 4-1 structure in the Pearl River Mouth Basin. The well marks the first major breakthrough in China’s ultra-deepwater carbonate exploration.

US Drillers Add Oil, Gas Rigs for First Time in Four Weeks

2024-10-11 - The oil and gas rig count rose by one to 586 in the week to Oct. 11. Baker Hughes said the total count was still down 36 rigs or 6% from this time last year.

Smart Tech Moves to the Hazardous Frontlines of Drilling

2024-10-08 - In the quest for efficiency and safety, companies such as Caterpillar are harnessing smart technology on drilling rigs to create a suite of technology that can interface old and new equipment.

E&P Highlights: Aug. 19, 2024

2024-08-19 - Here’s a roundup of the latest E&P headlines including new seismic solutions being deployed and space exploration intersecting with oil and gas.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.