More than half of total U.S. oil output growth will come from privately held producers next year, compared with 20% in a typical year, according to IHS Markit. (Source: Hart Energy)

U.S. oil production is set to pick up steam again—this time led by little-known privately owned companies impervious to the demands of the stock market.

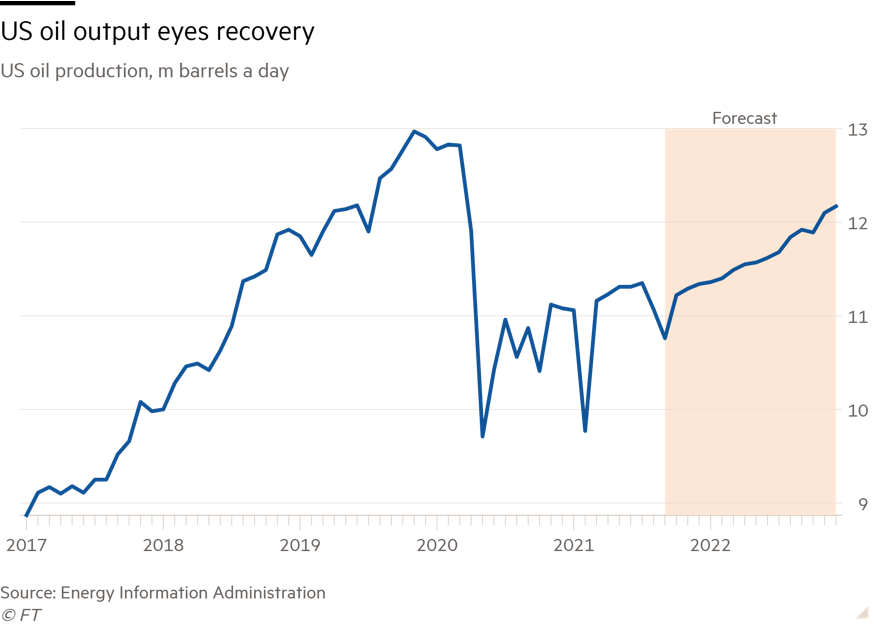

Forecasters project that the nation’s crude oil output will increase by about 800,000 bbl/d over the course of 2022, accelerating sharply from this year and making the U.S. the fastest-growing supplier outside of a producer alliance that includes members of the OPEC cartel.

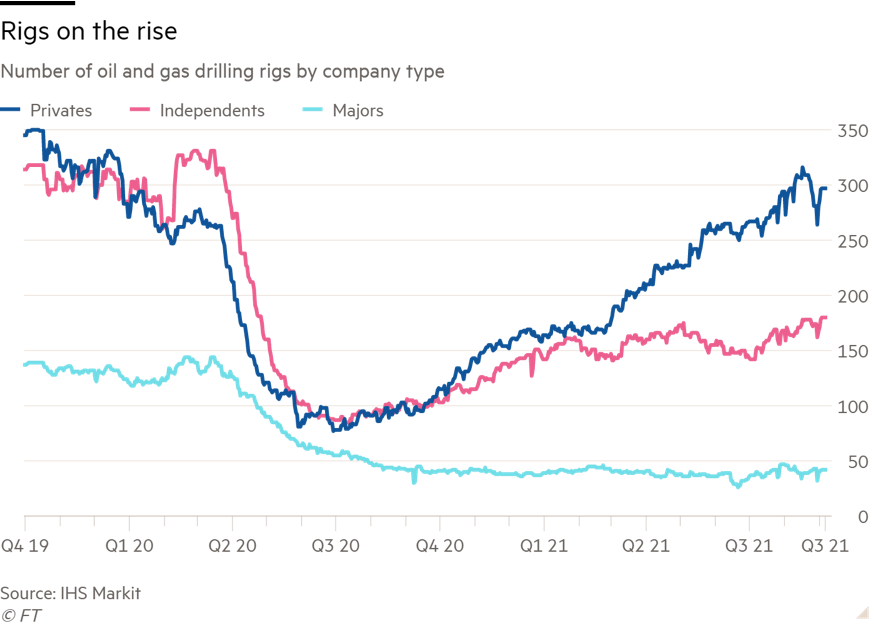

Marquee oil companies are not driving the rise. Instead, privately held producers, often smaller companies, will account for more than half of total U.S. output growth next year compared with about 20% in a typical year, said Raoul LeBlanc, an analyst at IHS Markit.

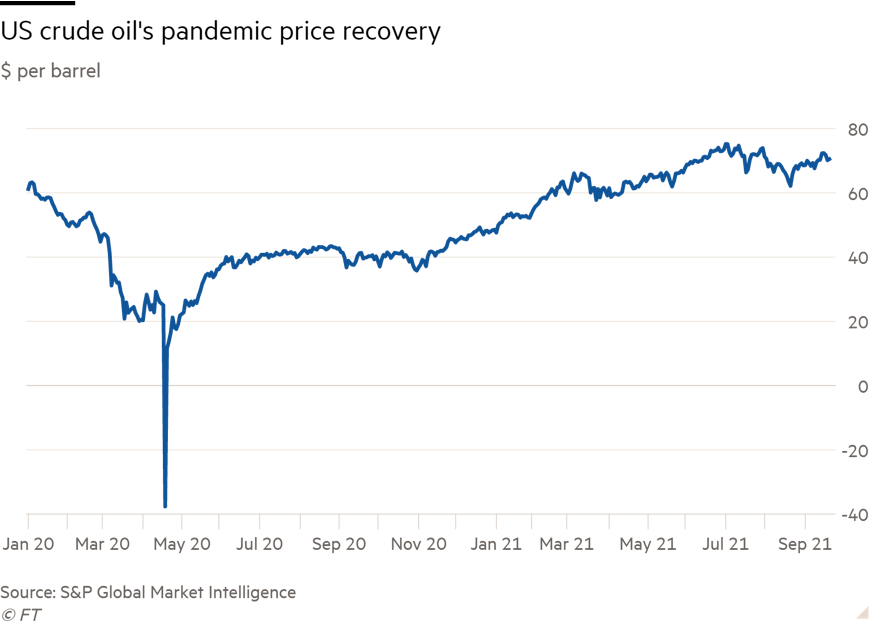

The anticipated output gains come as U.S. oil prices hover at about $70/bbl, which make most shale wells profitable to drill. But many of the largest producers have promised their shareholders they will cap spending on growth after racking up huge losses during a decade-long drilling binge.

Private companies, by contrast, have led the rise in the number of rigs drilling for oil and gas in the U.S. this year, which has more than doubled from this time last year. The businesses include larger producers such as Endeavor Energy Resources and Tap Rock Resources along with scores of tiny groups.

“The privates are not on board with this whole capital discipline thing. For them, this is their window,” LeBlanc said. “They’re thinking, ‘here’s my chance and I’m going to take advantage of it’ because they see it as maybe their last, best chance.”

Prolific production from shale oil fields enabled the U.S. to eclipse Saudi Arabia and Russia as the world’s largest oil producers, but the onset of the coronavirus pandemic hollowed out oil demand and crushed prices, forcing American producers to throttle back output from a peak of about 13 million bbl/d in late 2019 to about 11.1 million bbl/d by the end of 2020.

The U.S. Energy Information Administration now expects domestic crude oil production to begin to tick higher this autumn after Hurricane Ida disrupted offshore supplies, eventually reaching about 12.2 million bbl/d by the end of 2022. Spending on drilling and bringing new wells into production in shale patches onshore will rise from about $65 billion in 2021 to more than $80 billion next year as activity picks up and some drillers start to see cost inflation, LeBlanc said.

The return of U.S. growth would influence world oil market balances at a time many are warning of tight supplies. Saudi Arabia, Russia and others in the OPEC+ group of 23 oil-producing nations are adding about 400,000 bbl/d of supply to the market each month as they unwind historic cuts made last year.

Bank of America expects about 800,000 bbl/d of new supply from the U.S. in 2022, which it says will ease supply concerns. But the bank said last week that global oil markets remained tight, and even with a strong U.S. rebound crude prices should stay above $70/bbl next year and potentially shoot as high as $100/bbl.

Publicly listed independent producers have mounted a smaller recovery than private groups, while global oil majors such as Exxon Mobil Corp. and Chevron Corp. have been slow to bring investment back to their U.S. shale businesses.

Last year’s downturn accelerated a strategic shift among leading publicly listed US shale producers such as Pioneer Natural Resources Co., Devon Energy Corp. and Diamondback Energy Inc. They have been under intense pressure from their shareholders to put profits over production increases and direct cash flow to newly-created dividend schemes and paying down debt.

“Getting into 2022, we do expect we’re going to limit our growth to 5%,” Scott Sheffield, CEO of Pioneer Natural Resources, the largest producer in the Permian Basin oil region, said at an industry conference this month. “We’re going to see the market start to get tight. There’s less investments on the supply side. We don’t have U.S. shale growth anymore.”

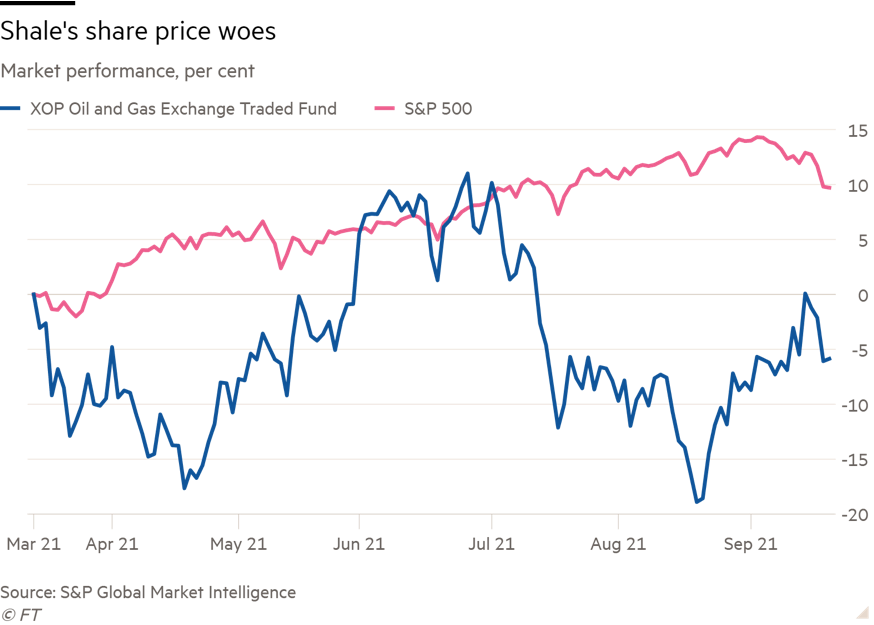

While top U.S. oil producers have stuck to their new shareholder-friendly strategies, their share prices continue to languish.

The XOP, an exchange-traded fund considered a proxy for listed U.S. oil and gas exploration and production groups, has fallen nearly 6% compared with an 8% rise in U.S. crude oil prices since mid-March. It has also posted lower returns than the broader S&P 500 stock index over that period.

There is still a “healthy level of skepticism” from public shareholders that the sector’s reforms will stick after a “decade of disappointment”, and emissions concerns will probably keep some investors away for good, said Matt Portillo, director of research at Tudor Pickering & Holt, a Houston-based investment bank.

But Portillo sees the tide turning as a combination of higher oil prices and continued producer capital discipline repairs the sector’s financial reputation.

“There’s going to be very fairly significant shifts in sentiment in this space, as we’ve seen in other sectors that have gone through these seismic shifts in business models,” he said.

Recommended Reading

Chevron Pushing Longer Laterals in Argentina’s Vaca Muerta Shale

2024-09-13 - Chevron Corp., already drilling nearly 2.8-mile laterals at its Loma Campana Field in Argentina, wants to drill even longer horizontals, an executive told Hart Energy.

US Drillers Cut Oil, Gas Rigs for First Time in Three weeks

2024-08-02 - The oil and gas rig count, an early indicator of future output, fell by three to 586 in the week to Aug. 2. Baker Hughes said that puts the total rig count down 73, or 11%, below this time last year.

Private Equity Looks for Minerals Exit

2024-07-26 - Private equity firms have become adroit at finding the best mineral and royalties acreage; the trick is to get public markets to pay more attention.

Baytex Energy Joins Eagle Ford Shale’s Refrac Rally

2024-07-28 - Canadian operator Baytex Energy joins a growing number of E&Ps touting refrac projects in the Eagle Ford Shale.

In Ohio’s Utica Shale, Oil Wildcatters Are at Home

2024-08-23 - The state was a fast-follower in launching the U.S. and world oil industry, and millions of barrels of economic oil are still being found there today.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.