Industry veteran Tom Ward founded Oklahoma City-based Mach Resources in January 2017 to pursue high-return, low-cost projects. (Source: Mach Resources LLC)

A partnership involving Tom Ward-led Mach Resources LLC agreed to acquire substantially all of the assets of bankrupt Alta Mesa Resources Inc. and its midstream subsidiary for a combined purchase price of $320 million.

According to a Jan. 28 news release, BCE-Mach III LLC executed purchase and sale agreements as part of Alta Mesa’s Chapter 11 bankruptcies and associated 363 sale processes. BCE-Mach III represents the third partnership between Mach Resources and Houston-based Bayou City Energy Management LLC (BCE).

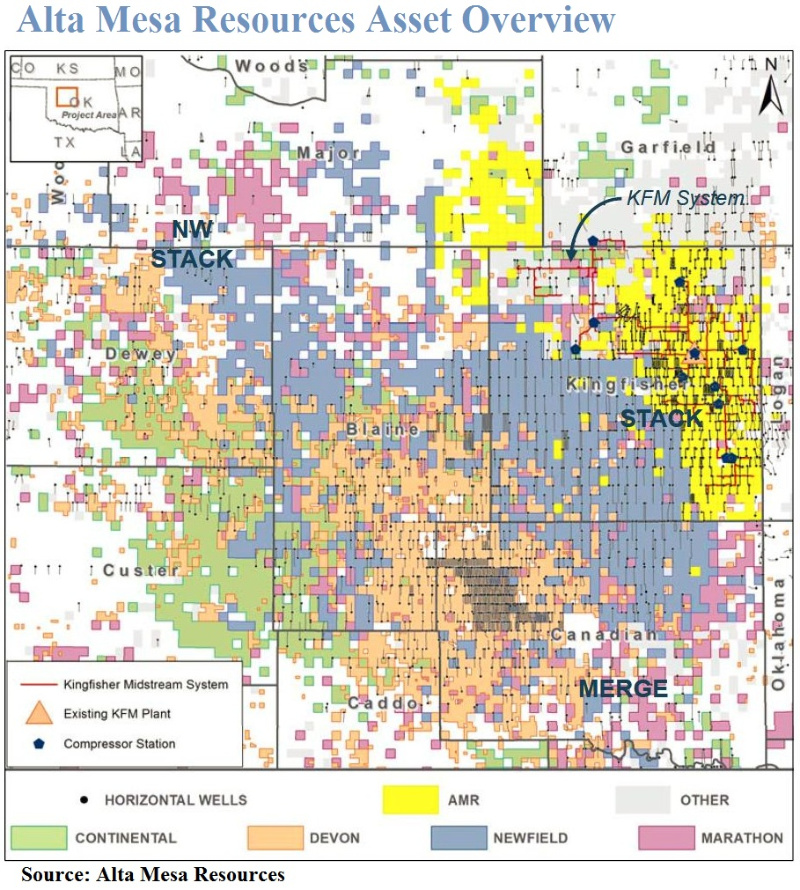

Alta Mesa Resources, a Houston-based independent which bet big on Oklahoma’s Stack, joined a growing number of U.S. shale producers that filed for bankruptcy last year. The company formed through a three-way combination in February 2018 of Alta Mesa Holdings LP, Kingfisher Midstream LLC with Silver Run Acquisition Corp. II—a special purpose acquisition company led by industry veteran Jim Hackett.

The purchase agreements with BCE-Mach III include 30,000 barrels of oil equivalent per day of production (67% liquids), about 72 million barrels of oil equivalent of proved reserves, more than 900 operated wells and 130,000 net acres (90% HBP). The company will also gain Kingfisher Midstream assets comprised of gas processing capacity of 350 million cubic feet per day, 453 miles of gas gathering pipeline, 157,000 barrels per day of produced water system capacity, 224 miles of water disposal pipeline, 108 miles of oil gathering pipeline and 50,000 barrels oil storage capacity

“This was a unique opportunity to acquire a sizeable cash-flowing asset with the supporting midstream infrastructure, through a bankruptcy process, in an area of our team’s expertise and still have an extensive inventory for future development,” Ward said in a statement on Jan. 28.

An industry veteran, Ward has formed and led several oil and gas companies throughout his career including shale pioneer Chesapeake Energy Corp., which he co-founded in 1989 alongside Aubrey K. McClendon. He also went on to start SandRidge Energy Inc. in 2006 and Tapstone Energy LLC in 2013.

The Alta Mesa transaction represents the sixth acquisition by partnerships between BCE and Mach.

“Our strategic aim in partnership with BCE has been to aggressively consolidate and maximize underdeveloped, undercapitalized or otherwise distressed areas in the Midcontinent,” Ward added in his statement. “We have been successful in buying assets at a discount, increasing production in a cost-effective manner and avoiding overspending. In a lot of ways, we have gone back to the fundamentals that were true when I began my career.”

Following closing of the Alta Mesa transaction, expected in February, the BCE-Mach partnerships will have net daily production of about 58,000 boe/d, interests in over 5,700 wells and roughly 500,000 net acres across the Midcontinent.

BCE-Mach III is being represented by Kirkland & Ellis LLP as legal adviser and UBS Securities LLC as financial adviser. The transaction will have a Jan. 1 effective date.

Recommended Reading

E&P Highlights: Sept. 30, 2024

2024-09-30 - Here’s a roundup of the latest E&P headlines, including concessions awarded in the Middle East and updates following Hurricane Helene.

With Montney Production Set to Grow, US E&Ps Seize Opportunities

2024-10-02 - Canada’s Montney Shale play has already attracted U.S. companies Ovintiv, Murphy and ConocoPhillips while others, including private equity firms, continue to weigh their options.

Chevron Pushing Longer Laterals in Argentina’s Vaca Muerta Shale

2024-09-13 - Chevron Corp., already drilling nearly 2.8-mile laterals at its Loma Campana Field in Argentina, wants to drill even longer horizontals, an executive told Hart Energy.

BP and NGC Sign E&P Deal for Offshore Venezuelan Cocuina Field

2024-07-28 - BP and NGC signed a 20-year agreement to develop Venezuela’s Cocuina offshore gas field, part of the Manakin-Cocuina cross border maritime field between Venezuela and Trinidad and Tobago.

E&P Highlights: July 15, 2024

2024-07-15 - Here’s a roundup of the latest E&P headlines, including Freeport LNG’s restart after Hurricane Beryl and ADNOC’s deployment of AI-powered tech at its offshore fields.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.