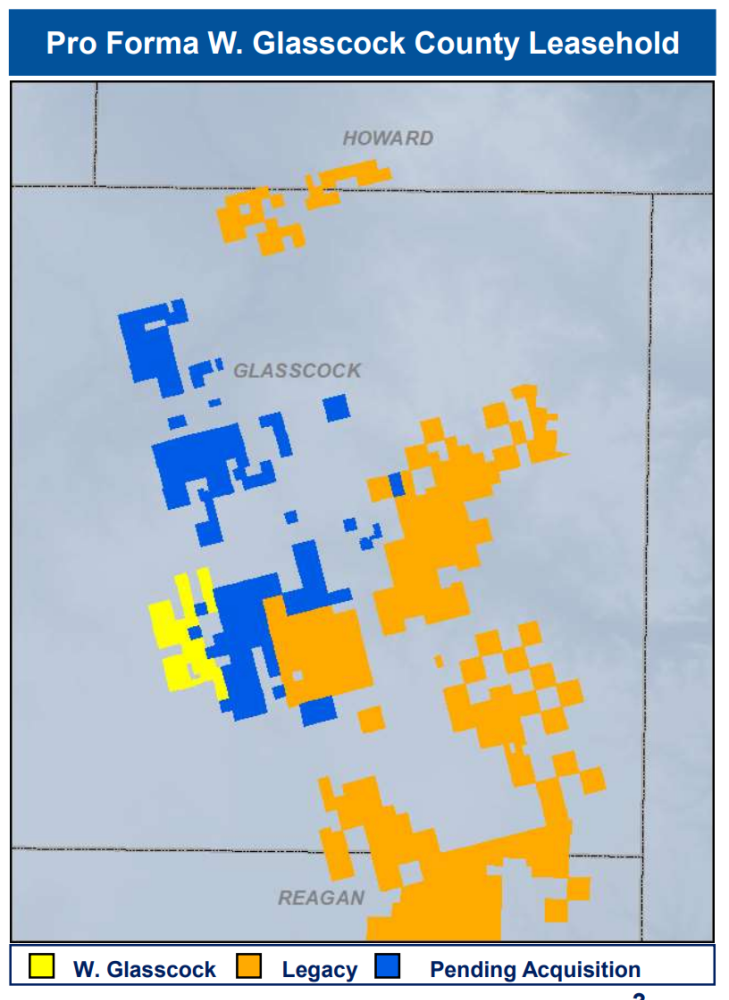

The Pioneer acquisition expands Laredo Petroleum’s core development area in western Glasscock County, Texas, to about 22,200 net acres. (Source: Hart Energy)

Laredo Petroleum Inc. agreed to acquire oil-weighted acreage in Glasscock County, Texas, for $230 million in cash and stock, marking Laredo’s second significant acquisition in the Midland Basin in 2021.

“Upon closing this transaction, we will have acquired more than 55,000 net acres of highly productive, oil-weighted inventory in Howard and western Glasscock counties in just two years, fundamentally transforming Laredo,” Jason Pigott, president and CEO of Laredo Petroleum, commented in a company release on Sept. 19.

In its latest transaction, Laredo will acquire approximately 20,000 net acres from Pioneer Natural Resources Co. that directly offsets Laredo’s existing leasehold in western Glasscock County. Current production is roughly 4,400 boe/d (59% oil, 82% liquids).

Laredo already added to its Midland Basin position earlier this year through the acquisition of the assets of Sabalo Energy LLC, a portfolio company of EnCap Investments LP, and a nonoperating partner for approximately $715 million. The transaction included roughly 21,000 contiguous net acres directly offsetting Laredo’s existing Howard County leasehold in West Texas.

The Pioneer acquisition, according to Laredo, continues its “transformational” strategy with the addition of 135 gross operated oil-weighted locations, which Laredo said doubles its high-margin, oil-weighted inventory. The acquired locations have an average lateral length of 9,700 ft.

“Seven years of inventory across these core areas will enhance our ability to deliver sustainable, long-term free cash flow generation and to rapidly deleverage,” Pigott added.

The transaction is expected to close in October. The purchase price is comprised of $160 million in cash plus the issuance of 959,691 shares of Laredo common equity to Pioneer.

Following closing, Laredo plans to maintain its current expected activity levels for 2022 of two drilling rigs and one completions crew.

The company also remains on track to achieve the previously stated year-end 2022 leverage target of 1.5x net debt/TTM adjusted EBITDA, according to the release.

Bracewell LLP is advising Pioneer Natural Resources on the acreage sale to Laredo Petroleum.

Recommended Reading

Vistra Buys Remaining Stake in Subsidiary Vistra Vision for $3.2B

2024-09-19 - Vistra Corp. will become the sole owner of its subsidiary Vistra Vision LLC, which owns various nuclear generation facilities, renewables and an energy storage business.

Kimmeridge Signs Natgas, LNG Agreement with Glencore

2024-09-19 - Under the terms of the agreement, set to be finalized later this year, Glencore will purchase 2 mtpa of LNG from Commonwealth LNG and source natural gas from Kimmeridge Texas Gas.

Matador Closes $1.8B Ameredev Deal, Updates Asset Development Plans

2024-09-19 - Matador Resources’ $1.83 billion bolt-on acquisition of the Delaware Basin’s Ameredev II adds 33,500 acres and brings the company’s inventory to approximately 2,000 net locations.

TotalEnergies Signs LNG Agreements in China, Turkey

2024-09-19 - TotalEnergies announced two separate long-term LNG sales in China and a non-binding agreement with Turkey’s BOTAŞ in an effort to grow its long-term LNG sales.

WhiteHawk Energy Adds Marcellus Shale Mineral, Royalty Assets

2024-09-18 - WhiteHawk Energy LLC said it acquired Marcellus Shale natural gas mineral and royalty interests covering 435,000 gross unit acres operated by Antero Resources, EQT, Range Resources and CNX Resources.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.