Yakaar-Teranga, one of the world's largest gas discoveries, holds around 25 Tcf of advantaged gas in place. (Source: Shutterstock)

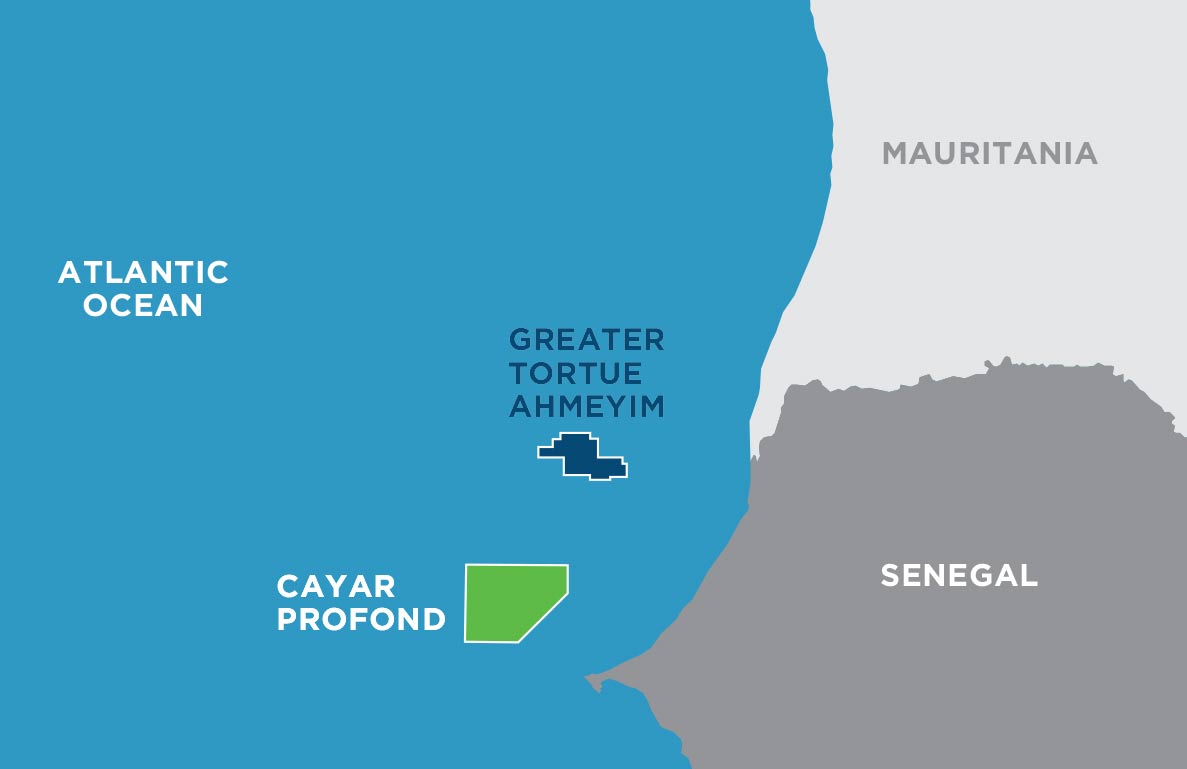

Kosmos Energy Ltd. announced on Nov. 6 that it has assumed operatorship and increased its working interest in the Yakaar-Teranga gas discoveries offshore Senegal. The increase in working interest follows BP's exit from the field. Kosmos now holds a 90% operatorship stake in the discoveries, with PETROSEN holds the remaining 10% stake.

Yakaar-Teranga, one of the world's largest gas discoveries, holds around 25 Tcf of advantaged gas in place, with minimal impurities and a small amount of CO2 content, which reduces the need for processing ahead of transportation and liquefaction.

In the announcement’s accompanying press release, Andrew Inglis, chairman and CEO of Kosmos Energy called Yakaar-Teranga one of Senegal’s “crown jewels,” saying it will provide “universal and reliable access to low-cost energy” to the country. He also expects the project to lower emissions and establish Senegal as a reliable supplier of energy to the world.

The current development concept for Yakaar-Teranga is an offshore development producing approximately 550 MMscf/d with domestic gas transported via pipeline to shore and export volumes liquefied on a floating LNG vessel. The concept is being optimized in order to meet domestic and international requirements, after which the project will move into front-end design and engineering.

Recommended Reading

Expand Lands 5.6-Miler in Appalachia in Five Days With One Bit Run

2025-03-11 - Expand Energy reported its Shannon Fields OHI #3H in northern West Virginia was drilled with just one bit run in some 30,000 ft.

EOG Ramps Gassy Dorado, Oily Utica, Slows Delaware, Eagle Ford D&C

2025-03-16 - EOG Resources will scale back on Delaware Basin and Eagle Ford drilling and completions in 2025.

New Jersey’s HYLAN Premiers Gas, Pipeline Division

2025-03-05 - HYLAN’s gas and pipeline division will offer services such as maintenance, construction, horizontal drilling and hydrostatic testing for operations across the Lower 48

E&P Highlights: March 10, 2025

2025-03-10 - Here’s a roundup of the latest E&P headlines, from a new discovery by Equinor to several new technology announcements.

Equinor Begins Producing Gas at Development Offshore Norway

2025-03-17 - Equinor started production at its Halten East project, located in the Kristin-Åsgard area in the Norwegian Sea.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.