The Trans Mountain Pipeline under construction in the Rocky Mountains. Imperial Oil expects the completion of its expansion to provide significant additional transportation capacity and tighten WCS and WTI light and heavy oil differentials. (Source: Shutterstock)

Coming out of a record-setting production year, Imperial Oil Ltd. is expecting the completion of the Trans Mountain Pipeline expansion project (TMX) in the first half of 2024 to give its Canadian barrels a bigger advantage in the market.

Imperial Oil’s upstream volumes in fourth-quarter 2023 were the highest in company history, helping the Canadian oil producer and refiner to its second-best earnings performance, executives said on a Feb. 2 earnings call.

Majority owned by Exxon Mobil Corp., Imperial saw upstream production hit 452,000 gross boe/d in the fourth quarter, the highest quarterly production in more than 30 years when adjusting for the divestment of XTO Canada, CEO Brad Corson said on the call. Full year production averaged 413,000 gross boe/d.

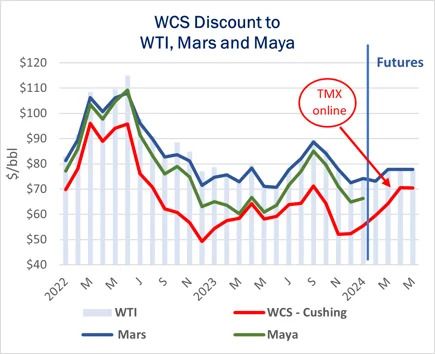

“This higher production for the quarter was driven by stronger performance across … major assets, and in the quarter, we saw WTI prices soften and the WTI to WCS [Western Canadian Select] differential widen,” Corson said. WCS is a heavy, sour crude compared to sweet, light WTI.

However, with the completion of the TMX expansion scheduled for completion in the first half of 2024—if all things go according to plan—Imperial expects the pipeline to provide significant additional transportation capacity and tighten WCS and WTI differentials, as well as light differentials, Corson said.

RELATED

Canadian Board: Trans Mountain Didn’t Address Pipeline Concerns

TMX’s expected start has increased WCS’ forward curve by $6/bbl vs WTI prices in 2024, according to an East Daley Analytics Feb. 6 note. Following its completion, refiners are set to pay $20 million more per day—$1.8 billion per quarter—for Canadian imports due to the increase in WCS prices.

Major structural shift coming

“There is … a major structural shift that’s about to occur,” Corson said. “When you bring that much additional capacity onto the system, that I think will have a structural impact on heavies.”

According to East Daley, TMX will initially displace 470,000 bbl/d of heavy sour crude imports to the U.S. market and lower throughput at several pipelines and terminals.

U.S. refiners are expecting a “gut punch” once prices increase for Canadian barrels, East Daley said. Once TMX is up and running, U.S. refiners will no longer have the advantage against a WCS barrel, which is currently heavily discounted against similar quality barrels from Mexico and the Gulf of Mexico and must travel approximately 2,000 miles to the Gulf Coast in congested pipelines.

Imperial is among oil producers, including Cenovus Energy Inc. and Canadian Natural Resources Ltd., that have made up to 20-year shipping commitments on the pipeline, according to Trans Mountain’s website.

Compared to the other shippers’ commitments, Imperial has made “relatively minor” reservations on the pipeline’s capacity, Corson said. What the pipeline gives Imperial is additional capacity for products and the potential to access higher value markets more efficiently, he said.

“The biggest benefit for us is not the individual barrels we ship, but our view of the impact it will have on our crude value,” Corson said. “We continue to see maximum value, primarily shipping our crude into the mid-continent, into the Gulf Coast, and so we'll continue to move most of our barrels in that direction.”

The company’s Kearl oil sands site in Alberta, Canada, jointly owned with Exxon Mobil Canada, hit a record for its highest quarterly total gross production with an average 308,000 gross boe/d (218,000 bbl Imperial’s share), according to Imperial’s fourth-quarter 2023 earnings report. Full-year production at the development hit 270,000 total gross boe/d (191,000 bbl Imperial’s share).

The company’s transition to an entirely autonomous haul fleet—81 heavy haul trucks—contributed to Imperial’s ability to achieve record volumes and improve operating costs at Kearl, Corson said.

Imperial is planning to continue investment and cost cutting at Kearl to get to its goal of delivering 300,000 bbl/d, including looking at processes to extract more bitumen from ore and materials recovery via floatation column cells, Corson said. And looking past heavy haul trucks, Imperial is looking to apply autonomous solutions elsewhere to continue improving productivity and safety and reduce costs.

At its Cold Lake asset, Imperial began injecting steam at Cold Lake Grand Rapids Phase 1 in December—the industry’s first solvent- and steam-assisted gravity drainage project—which is expected to produce 15,000 bbl/d at full rates and reduce greenhouse-gas emissions intensity by up to 40% compared to other steam processes. Cold Lake’s quarterly gross production averaged 139,000 bbl/d with annual production of 135,000 gross bbl/d.

Imperial reported its refinery quarterly throughput averaged 407,000 bbl/d from 94% refinery utilization, compared to 433,000 bbl/d in the fourth quarter 2022. Lower refinery throughput in the fourth quarter reflects the impact of turnaround activities at Imperial’s Sarnia chemicals manufacturing and petroleum research refinery.

Imperial’s estimated net income in the fourth quarter was CA$1.37 million (US$1.01 million) and cash flow from operating activities was approximately CA$1.31 million (US$967,000), compared to the third quarter’s net income of CA$1.60 million (US$1.18 million) and cash flow from operating activities of CA$2.36 million (US$1.74 million).

Full-year estimated net income was CA$4.89 million (US$3.61 million) with cash flow from operating activities of CA$3.73 million (US$2.76 million). Full-year cash flow from operating activities was CA$6.43 million (US$4.75 million), excluding the impacts of working capital.

The company also increased its quarterly dividend for the 13th consecutive year with a CA$0.10 increase to CA$0.60 per share (US$0.44 per share) on outstanding common shares for the first quarter of 2024, payable on April 1 to shareholders of record on March 4.

Recommended Reading

Solaris Stock Jumps 40% On $200MM Acquisition of Distributed Power Provider

2024-07-11 - With the acquisition of distributed power provider Mobile Energy Rentals, oilfield services player Solaris sees opportunity to grow in industries outside of the oil patch—data centers, in particular.

Offshore, Middle East Buoys SLB’s 2Q as US Land Revenue Falls

2024-07-19 - Driven by a strong offshore market and bolstered by strategic acquisitions and digital innovation, SLB saw a robust second quarter offset by lower drilling revenue in the U.S.

BP Awards Subsea Alliance Contract for UK North Sea Development

2024-07-31 - SLB, OneSubsea, Subsea 7 and the Subsea Integration Alliance will increase speed of tool delivery, optimize installation and reduce rig days at BP’s Murlach development in the North Sea.

Liberty Energy Warns of ‘Softer’ E&P Activity to Finish 2024

2024-07-18 - Service company Liberty Energy Inc. upped its EBITDA 12% quarter over quarter but sees signs of slowing drilling activity and completions in the second half of the year.

Halliburton Sees NAM Activity Rebound in ‘25 After M&A Dust Settles

2024-07-19 - Halliburton said a softer North American market was affected by E&Ps integrating assets from recent M&A as the company continues to see international markets boosting the company’s bottom line.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.