The Department of Energy (DOE) hopes to close on a cooperative agreement award as soon as possible, said Todd Shrader, director of project management for the DOE’s Office of Clean Energy Demonstrations (OCED). (Source: Shutterstock)

Looking for word on when to expect first hydrogen from hubs selected for award negotiations nearly eight months ago by the U.S. Department of Energy?

It likely won’t come anytime soon, according to energy executives involved with some of the selected hubs. Contract negotiations between the hubs and the federal government are still ongoing to determine whether projects will be awarded some of the $7 billion up for grabs.

“Even once the contract is set, don’t expect that these companies are going to be that forthright with what’s happening because we go into a 12 [month]- to 18-month phase where we’re really trying to figure out what we really want to do and if we can do it,” said Steve Schlasner, senior engineer for the Energy & Environment Research Center, prime contractor for the Heartland Hydrogen Hub sprawled across Minnesota, North Dakota and South Dakota. “There’s going to be changes in the economy. The supply chain is going to change. You’re going to have to wait a little while before you start hearing, in my opinion, details coming out of the hubs.”

The seven projects were selected in October 2023 for $7 billion in federal funds to create regional hydrogen hubs, putting supply in close proximity to demand in hopes of growing the domestic industry while creating jobs and lowering greenhouse gas emissions. The federal investment, funded by the Bipartisan Infrastructure Law, is expected to attract tens of billions more in private investment in the hydrogen sector across 16 states. Combined, the hubs are targeting more than 3 million metric tons of hydrogen per year.

Hydrogen hubs were the topic of discussion during the recently held World Hydrogen North America conference in Houston, where Schlasner and others spoke.

The Department of Energy (DOE) hopes to close on a cooperative agreement award as soon as possible, said Todd Shrader, director of project management for the DOE’s Office of Clean Energy Demonstrations (OCED). All of the funding may not necessarily go out at once, he said.

Phased approach

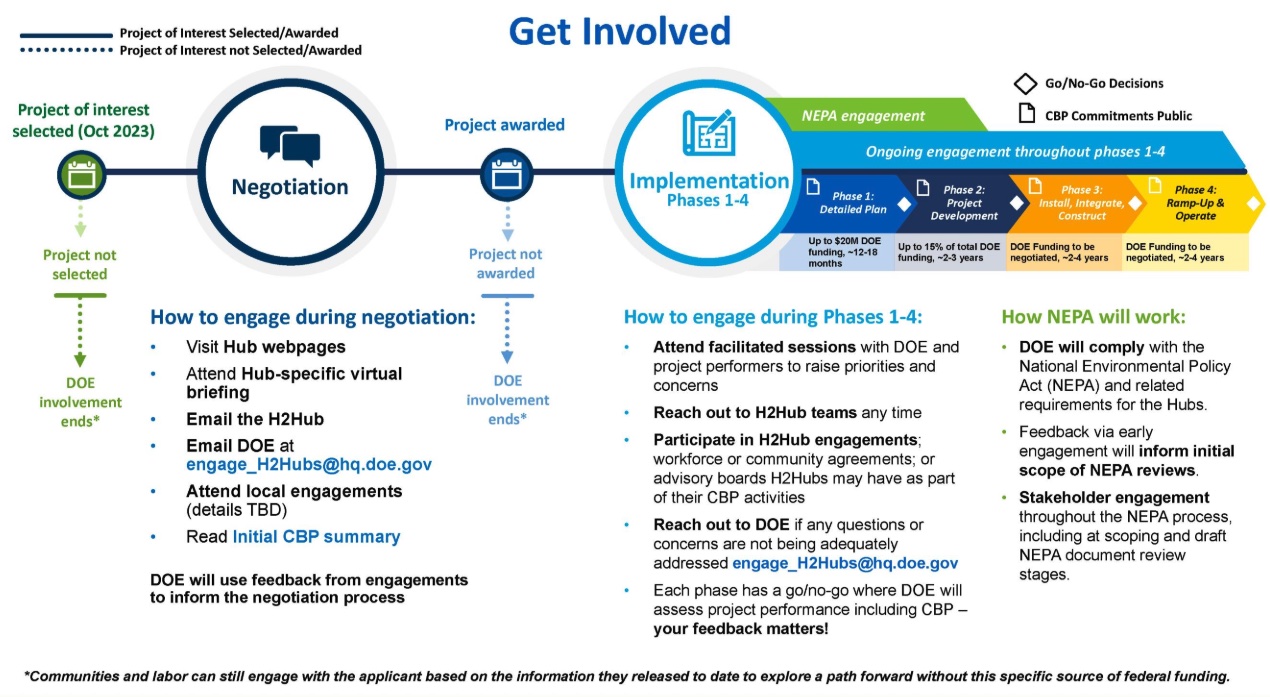

Phase 1 of the hydrogen hub process—the detailed plan phase—involves engagement of the National Environmental Policy Act (NEPA). How long before the first molecule of low-carbon hydrogen comes from a hub depends on the regulatory process and pace of various projects within the hub.

“In a lot of the hubs, there can be anywhere from five to 20 projects that represent the entire hub, and they’re all going to move at different paces,” said Kristine Wiley, vice president of GTI Energy’s Hydrogen Technology Center. GTI is part of the HyVelocity Gulf Coast Hydrogen Hub, the Appalachian Regional Clean Hydrogen Hub and the Midwest Alliance for Clean Hydrogen hub. “So, some of them are further ahead. Some of them are still earlier stage.”

Asked when to expect first hydrogen from the hubs, she said “probably not within the next couple of years.”

The DOE has tried to put the hubs on somewhat of a similar track, Schlasner added. “But if we all have to go at the same speed, I’m afraid it’s going to be a little bit longer for some projects than we might otherwise expect,” he said.

There are about 100 different projects sites within the seven hubs, according to Shrader.

“Some are hydrogen generation. Some are hydrogen use. Some are hydrogen transportation. … So, lots of challenges from our standpoint in integrating how we’re doing the oversight of these projects,” Shrader said. “Once again, the government does project management oversight, not project management for these.”

Part of its project management approach is to build in checks and balances.

“This is a significant amount of taxpayer money. So, there’ll be phase gates and associated activities must be completed by the applicants, or at that point by our recipients, to move to each of these phases,” Shrader said. “And as you can imagine, phase 1 will be a lot of flushing the project out, figuring out where all the sites truly are, starting to look at your NEPA activities, your permitting … and who your EPCs are for construction, that type thing.”

Phase 2 involves detailed design, getting permits into place and finalizing engagements with NEPA, he said. Most of the funding is expected to go toward construction, phase 3, followed by the ramp-up and operation of phase 4.

At present, the challenge is maintaining project management oversight for multiple sub-projects, Shrader added. “They move at different paces. ... One piece may be in phase 3 while another piece is in phase 1. And how do we maintain oversight? But all the hubs partners that we have are working with us, and we’re trying to figure out the best way to approach that moving forward. We want the hubs to succeed, but we do want to protect taxpayer investments as we go forward.”

Demand, offtake

Efforts are also underway to spur demand. Just under $1 billion has been allocated toward the hydrogen demand initiative. Earlier this year, the DOE selected a consortium—consisting of S&P Global, the EFI Foundation and the Intercontinental Exchange—to design and implement demand-side support mechanisms to spur growth.

Securing offtake remains key to getting projects off the ground. Wiley and Schlasner agreed that targeting low-hanging fruit is a place to start. This includes converting users of less clean hydrogen into lower-carbon hydrogen.

“Customers make minimal changes for 10 million tons. The next step we see is low level injection in the pipelines for power generation distribution. … You can go up theoretically to 10[%] or 20% depending on what’s out there,” Schlasner said. “Finally, the big changes for the customers: the heavy equipment. This is going to take a lot expenditure.”

The Heartland Hub is located in a huge market for ammonia, Schlasner said, adding he sees that market as being an anchor for the hub. Green ammonia is seen as one of the most competitive hydrogen derivatives.

Looking longer term, Wiley sees hydrogen demand for methanol and sustainable aviation fuels.

“The hydrogen demand initiative … is one way to help kind of foster that market for hydrogen and kind of being able to drive down costs, increase transparency around a true hydrogen market and really spur the activation and growth that’s needed for the hydrogen economy,” Wiley said.

Recommended Reading

CEO: Coterra Drops Last Marcellus Rig, May Halt Completions

2024-09-12 - Coterra halted Marcellus Shale drilling activity and may stop completions as Appalachia waits for stronger natural gas prices, CEO Tom Jorden said at an industry conference.

Vitol CEO: US Shale Gas Growing Source of Shipping, Trucking Fuel

2024-09-18 - International commodities trading house Vitol sees growing demand for U.S. shale gas to spur LNG exports to China, India and emerging economies in Asia.

Midcon Momentum: SCOOP/STACK Plays, New Zones Draw Interest

2024-09-03 - The past decade has been difficult for the Midcontinent, where E&Ps went bankrupt and pulled back drilling activity. But bountiful oil, gas and NGL resources remain untapped across the Anadarko, the SCOOP/STACK plays and emerging zones around the region.

Non-op Rising: NOG’s O’Grady, Dirlam See Momentum in Co-purchase M&A

2024-09-05 - Non-operated specialist Northern Oil & Gas is going after larger acquisitions by teaming up with adept operating partners like SM Energy and Vital Energy. It’s helping bridge a capital gap in the upstream sector, say NOG executives Nick O’Grady and Adam Dirlam.

Dallas Fed: Low Natgas Prices Force Permian E&Ps to Curtail Output

2024-09-25 - Falling oil prices, recession fears and the U.S. election cycle are weighing on an increasingly pessimistic energy industry, according to a new survey of oil and gas executives by the Federal Reserve Bank of Dallas.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.