This story will appear in the upcoming Hydraulic Fracturing special report presented by:

Forecasting production for unconventional wells needs a modern approach that is able to deal with the complexities of shale reservoirs, rather than old-school models devised for vertical wells.

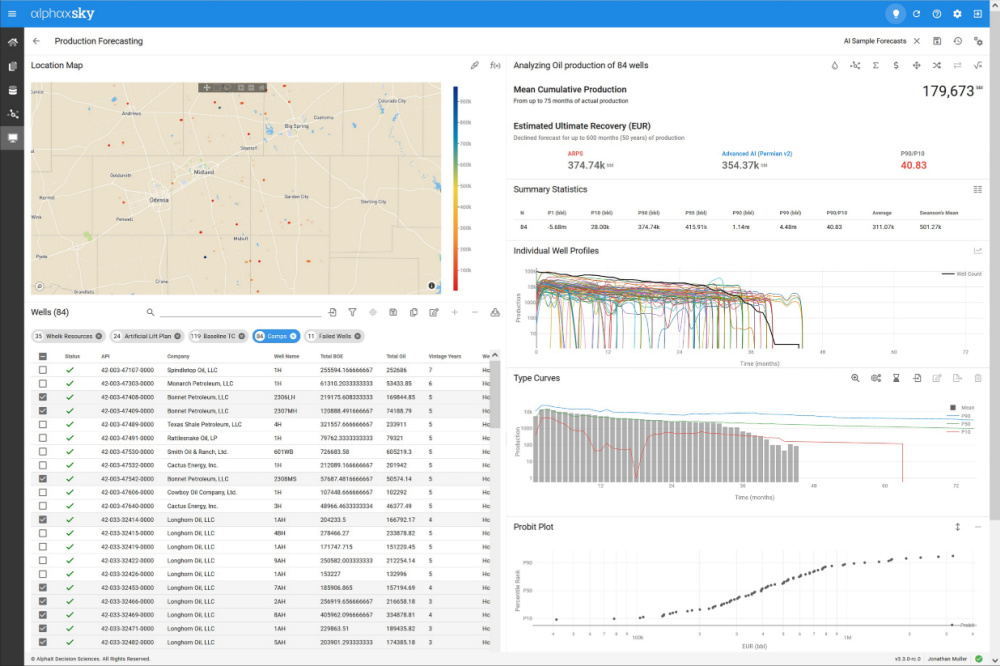

Artificial intelligence (AI) and cloud-native software is helping “gamify” production forecasting and enabling operators to refine their completion and production optimization plans and identify upside potential for assets in U.S. shale basins. The AI software for unconventional assets, developed by AlphaX Decision Sciences, decreases modeling and decision-making time, according to the company.

“With Sky, we can perform rapid sensitivity analysis between these variables to produce the optimal asset development strategy for our company.”—Ben Zapp, Lario Oil & Gas Co.

What has historically been done in production forecasting is taking “a set of equations developed in the mid-1940s and just slapping a user interface on the top of it,” said Ben Zapp, completions engineering manager at Lario Oil and Gas.

J.J. Arps was a geologist who described well production declines in conventional vertical wells in 1945, and his mathematical models are still in use for that purpose, today.

The problem is, this approach has worked for conventional and vertical wells but doesn’t translate well into how shale reservoirs and lateral wells work, Zapp said.

Up until a few years ago, Lario was faced with the challenge of how to expediently figure out the best way to test and check production forecasts resulting from variations in completion design and spacing. The reservoir engineers did their best to forecast based on statistics and histories, he said, but it wasn’t sustainable or objective. It took time, and results could vary.

“It was only as accurate as the humans that were doing it and the attention they put into it,” Zapp said. “These are people. We don’t have unlimited cognitive capacity.”

In addition, he said, biases can get rolled into production forecasting.

“You can put 100 reservoir engineers on a project and get 90, 95 different answers for what they think each forecast will be,” he said.

AI technology

By bringing AlphaX’s Sky, the AI-based and shale-savvy software, into the completion planning and production forecasting processes, Lario has been able to refine production optimization plans based on checking how changing different variables alters the production forecast, Zapp said.

An example of this, he said, is trying to answer the questions around the optimal spacing between wells, the optimal development methodology and the optimal completion size.

“With Sky, we can perform rapid sensitivity analysis between these variables to produce the optimal asset development strategy for our company. This analysis has yielded well performance enhancements greater than 10% of the P50 for our basin peers. This has real value, as our drillable inventory is currently in the hundreds of wells,” he said.

Sky is “heavily gamified” and intuitive, Zapp said, allowing him to “slice and dice” data sets.

He can see how the forecast changes based on spacing between certain wells, for example.

“It will give the arc for two different AI results,” he said.

One arc is for the next 12 months, which helps inform cash flow expectations, and the other predicts further out, which is useful, for example, for artificial lift conversion timing, he said.

And as such, it’s possible for Lario to forecast with AI what the 7,000-plus wells in the company’s inventory will do in different circumstances, he said.

“The oil field is coming around to artificial intelligence and machine learning and higher computational power that the rest of the world gets to enjoy,” Zapp said.

Using Sky, Lario was able to take their internal data sets, including proprietary and public data for over 7,000 wells in the basin, to determine the best way to complete them by plugging in variables and current best practices and then integrating the results into the company’s budgeting and asset development model, he said.

Lario has also done some history matching to assess the accuracy of the Sky forecast, he said. The accuracy has been within single digits on the wells over quarter-to-quarter checks, he said.

“It’s completely reasonable, especially given how dynamic things are and how much things move in that amount of time,” Zapp said.

And more recently, Lario has also used Sky to forecast upside potential for assets, using not just core targets but targets at other depths, he said.

“The use of this product has meant that we can run our workflow through the machine and trust it and get on with what we’re doing,” Zapp said. “This is a solution to a modern problem that’s been derived in the last five years, not the last 50.”

“

We have built the understanding of the subsurface in multidimensional space to comprehend and solve for the complexity of the geology and shale reservoir’s interdependencies.”—Sammy Haroon, AlphaX Decision Sciences

Sammy Haroon, founder and CEO at AlphaX Decision Sciences, said it just didn’t make sense to try to use a mid-20th century solution for vertical wells like Arps models to solve the 21st century problem of unconventional lateral wells.

“Arps is trying to replicate nature but with such minimal information” because it was developed at a time when computing was slow and expensive, and data was sparse and expensive to process, Haroon said. And “trying to twist and turn” Arps models to fit unconventional wells will lead to errors.

Part of the problem is that the industry “doesn’t really understand subsurface physics” of the shale reservoirs, he said.

“We comprehend the behavior of the subsurface based on how we are interacting with it” such as fracking, pumping fluid or perforating it, Haroon said, having observed the problem initially while managing Baker Hughes’s Enterprise Data Analytics group. “We have built the understanding of the subsurface in multidimensional space to comprehend and solve for the complexity of the geology and shale reservoir’s interdependencies,” he said.

What was needed is not just a multidimensional understanding of the subsurface but multidimensional mathematics, he said. And while the math can be done, it is too complicated for humans to cope with because of the sheer number of dimensions and variables involved, he said.

Enter AI, enabled by 21st century advances in computing power and data connectivity.

“AI must do two things; otherwise, it’s of no use,” Haroon said. “It should exponentially decrease the time to decision making and significantly increase the accuracy of the decision enabling a direct and measurable economic impact. This is now possible because algorithms which were computationally infeasible 20 or more years ago are now easily implemented even on mobile devices, making practical use of all the available data to rapidly make the best decisions possible.”

Removing bias

AlphaX COO Aruna Viswanathan said AI offers another benefit in that it removes bias from decision making.

“The evaluation of anything is biased to whatever data you have available or that you may be given or choose to go get. Your own mind can only process so much,” she said. AI is “not telling you what decision to make. It gives you an unbiased evaluation.”

Viswanathan said Sky helps value oil and gas assets.

“An oil and gas well is an asset that is declining in value every day, every week, every month, every quarter, every year,” she said. And as such, “timely decisions affect the value of the asset, especially early in the asset’s life when you have the least information.”

Sky’s interface makes it easy for every stakeholder in the decision-making process to understand a forecast, she said.

“Reservoir and production engineers, geologists, even financial analysts can all see the same thing and see the same answer,” she said. “This collapses the entire workflow, brings everybody onto the same page. It democratizes the information.”

“AI is not telling you what decision to make. It gives you the unbiased evaluation.”—Aruna Viswanathan, AlphaX Decision Sciences

The AI-driven Sky software helps operators better understand well depletion over time with faster and more accurate production forecasting, Haroon said.

“Our approach is pure mathematics overlaid with subject matter expertise,” Haroon said.

Sky has basin-specific AI models that use public data from a number of sources, including Hart Energy’s RexTag, he said, and customers can add their own data, such as pressure information or daily production, into the system to test or even further tune the models. Currently, Sky has models for the Permian, Eagle Ford, Haynesville, Williston and Bakken basins.

“It understands the complete basin behavior within the model, and it uses everything it knows about the well,” Haroon said. “It understands geology, the reservoir, drilling [and] completion.”

Sky also doesn’t remove outlier data from the models the way statistics does, he added.

“Interactions with the subsurface and its responses is still information,” Haroon said.

Haroon said reservoir engineers are using Sky to quickly project how much a well will produce over a period of time.

“It helps them look at the influence of parameters of a well in ways they were not able to do before,” he said. “They can now quantify, for example, based on how the well was completed, how it impacts production.”

Completion and production engineers can use Sky to see how the company’s wells compare to competitors, he said. It can help them answer questions such as, “Why am I not doing as well as my competitors? What is the completion style I should be using?” along with making decisions on their artificial lift strategies.

“For the engineer, what starts to happen is you don’t work with the past. You start looking into the future,” he said.

Recommended Reading

Occlusion and Envana’s ‘Grave to Grave’ Solution for Orphan Wells

2024-07-11 - Despite no longer producing, abandoned wells pose a significant environmental problem. Occlusion and Envana look to remedy the “couple hundred thousand-well problem” with their Go2Green process for well retirement.

Romito: Beware the Environmental NGO ‘Emissions Police’

2024-08-22 - Non-governmental organizations are effectively functioning as an unchecked extension of the executive branch.

Battling the Secret Army of Leakers in the Oil and Gas Field

2024-08-20 - When it comes to emissions reductions, AI and machine learning can help, but actually collecting and interpreting emissions data has often proven a daunting task.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.