(Source: Shutterstock)

In response to the pandemic, E&P companies have cut costs, embraced remote working and prioritized employee safety. But longer-term demand, price and social pressures highlight the need for holistic strategies to unlock further value.

COVID-19 has squeezed E&P operators. Though WTI futures prices have partially rebounded from April lows, they currently sit well below January levels. But even pre-pandemic, upstream players consistently underdelivered shareholder returns relative to historical performance. Majors’ median upstream return on capital employed (ROCE) has plunged from 27% in 2006 to just 3.5% in 2019 despite similar oil prices. While 2020’s cost reduction efforts will preserve value in the short-term, BCG’s research shows that companies pursuing both cost and future positioning boast up to 14% higher revenue growth and 7% higher EBIT growth versus laggards.

Beyond financial pressures, companies’ social license to operate is also under fire. Regulators, investors, employees and a spectrum of societal stakeholders are demanding action on climate and scrutinizing E&P operators’ decarbonization plans.

Oil demand declined by 26.4 MMbbl/d in April year over year as COVID-19 raced around the world and governments forced lockdowns. This is nearly 10 times the drop from the worst of the Great Recession. Rapid initial recovery is now slowing as countries grapple with successive waves of infection and weakened economies. Demand Oculus, BCG’s proprietary crude oil demand sensing model, predicts that demand will take at least 3 years to fully recover. Continued demand pressure means operators must move beyond 2020’s cost reductions, to position for a competitive post-COVID recovery. Winning in the next decade will demand bold vision, innovative strategy, and urgent action. BCG has identified four ways to build strategic resilience and unlock value, summarized in Figure 1 and discussed below.

1. Leverage “New Ways of Working” to streamline workflows and break down silos

COVID has transformed work in most industries, driving flexibility and technology adoption, and reducing travel. Since before the pandemic, however, leading companies have been pioneering better ways of working—new levers to reinvent and sustain value. These include digitally enabled teams, agile teaming principles, automated processes, and distributed ownership and empowerment. Documented benefits are impressive—more effective teams, stronger cross-functional collaboration and erosion of silos, streamlined internal processes and workflows, greater productivity and robust innovation, all of which translate into value via lower costs, increased efficiency and more agile pursuit of revenue generating opportunities.

In 2020, E&P companies focused on activity reduction including cutting capital spend, leveraging economies of scale and ‘traditional’ improvements like lean sigma and streamlining workflows. But the opportunities for value creation using ‘new ways of working’ remain largely untapped.

Fully automated and remote controlled field operations, use of artificial intelligence and machine learning for initial well/project design, automation or outsourcing of noncore activities, complete adoption of Agile to build dynamic platform organizations and use of strategic supplier relationships with a focus on breakthrough technologies can help double productivity in E&P. BCG’s work shows that these new work practices can increase workforce efficiency by more than 30% in technical functions and up to 50% in support departments. Success will increasingly rely on company culture emphasizing flexibility, adaptation and outcomes over processes.

2. Pursue consolidation to capture economies of scale and drive superior returns

Increased deal activity in the sector highlights consolidation as key to unlocking value, particularly in the fragmented North American unconventional resource plays. Chevron’s acquisition of Noble Energy was followed by four major transactions totaling about $50 billion: ConocoPhillips-Concho Resources; Pioneer-Parsley Energy; Devon-WPX; and Cenovus-Husky. All are structured as stock transactions, allowing buyers to avoid additional leverage while minimizing related oil-price risk. The deals’ lower premiums, in the 7 to15% range, reflecting today’s financial realities, are worlds away from the 62% Oxy paid for Anadarko.

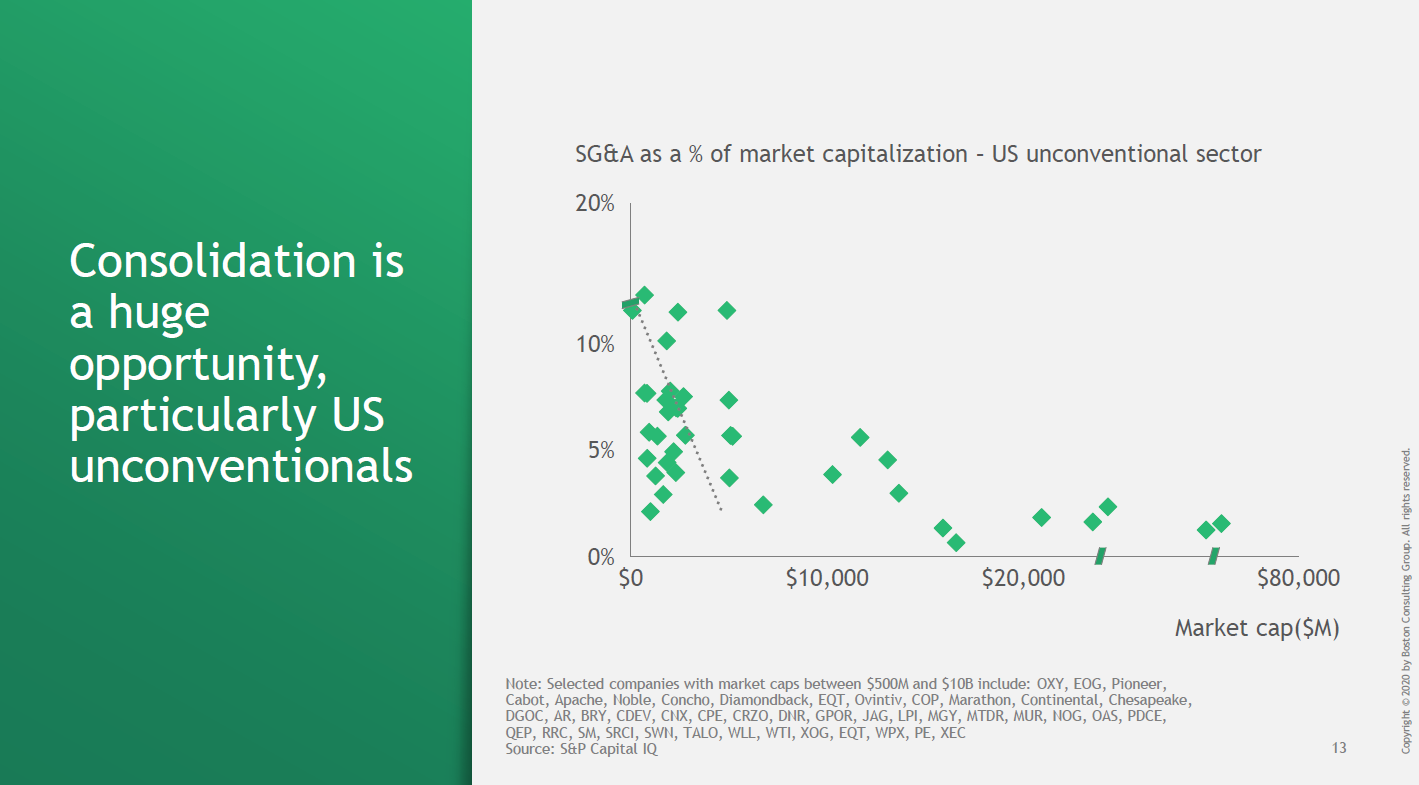

All-equity structures link value creation tightly to post-merger integration and cost reduction. As underlying business values decline, G&A reductions emerge as key. Figure 2 illustrates the opportunity, especially for independent E&Ps in the unconventional sector. However, BCG’s extensive work supporting Post-Merger Integrations shows it is critical to pursue all synergy levers, not just opex but also capex, market access, talent etc. It is important to assess asset performance before launching sweeping improvements. Front loading key IT/tech decisions, consistent focus & resourcing for legal and HSE compliance and appropriate attention to corporate culture and change management are key enablers of successful deal value delivery.

We should expect more consolidation in the coming months, both in the Permian, where there are multiple candidates with strong, scalable operations and only moderate debt, and in places with a fragmented E&P landscape, and applying lessons from prior integrations will be a key differentiator of success.

3. Recognize decarbonization as value-accretive

Beyond new ways of working and consolidation opportunities, E&P companies must also recognize decarbonization as value-accretive, not a threat to their social license to operate. Historically, upstream players have viewed decarbonization with hesitation. Today, the most innovative companies are exploring how carbon abatement can create value while strengthening their reputations for corporate social responsibility.

BCG’s extensive work with upstream operators reveals the opportunity to reduce carbon intensity by 20 to 40% in the next decade. Value-accretive decarbonization levers span the entire value chain from exploration (eliminating high carbon intensity exploration) to design and sourcing (lean operations, carbon-based supplier incentives etc.) and operations (electrification, reduction in flaring, carbon capture etc.).

Several independent E&P players, most recently Conoco, have announced their intention to achieve net zero carbon. To do so, they will need a detailed, de-risked decarbonization roadmap and specific levers. Operators need to urgently act to develop a clear starting point of their carbon footprint and a company-specific abatement curve to equip them to respond in a value-accretive manner. This can then enable a longer-term journey of decarbonization such as the evolution in exploration decisions based on carbon intensity, incorporation of carbon as a metric in capital decisions and a transformative change in the portfolio.

4. Enhance employer value proposition and attract diverse talent

A strong talent pool is key to acting effectively on these value creation levers. E&P companies must continue to enhance their employer value proposition, promoting a new culture of trust, delegation and flexibility that empowers middle management and attracts a young, diverse talent pool. Talent diversity increases both innovation and value.

Talent diversity can range in skill sets and demographics. As companies prioritize lower operating cost structures, they must protect and deliver on diversity & inclusion goals. COVID-19 has proven an unlikely ally, with remote work allowing greater flexibility and fewer offshore rotations in technical/field jobs to help drive gender balance. There is also a need to attract digital talent to enable the required innovative disruption and shift away from traditional talent pools (e.g., petroleum engineers).

E&P companies are struggling against current financial pressures and long-term structural weakness. 2021 promises to be challenging given COVID uncertainty. However, stronger players that can focus both on immediate priorities and longer-term transformation to navigate the crisis, will deliver robust shareholder value. Transcending the status quo will be essential, and operators that can shift their paradigms will come out ahead. The time to act is now.

Recommended Reading

The ABCs of ABS: Financing Technique Shows Flexibility and Promise

2024-07-29 - As the number of ABS deals has grown, so have investors’ confidence with the asset and the types of deals they are willing to underwrite.

Solaris Stock Jumps 40% On $200MM Acquisition of Distributed Power Provider

2024-07-11 - With the acquisition of distributed power provider Mobile Energy Rentals, oilfield services player Solaris sees opportunity to grow in industries outside of the oil patch—data centers, in particular.

Archrock Offers Common Stock to Help Pay for TOPS Transaction

2024-07-23 - Archrock, which agreed to buy Total Operations and Production Services (TOPS) in a cash-and-stock transaction, said it will offer 11 million shares of its common stock at $21 per share.

The ABCs of ABS: Financing Technique Shows Flexibility and Promise

2024-07-29 - As the number of ABS deals has grown, so have investors’ confidence with the asset and the types of deals they are willing to underwrite.

Cibolo Energy Closes Fund Aimed at Upstream, Midstream Growth

2024-09-10 - Cibolo Energy Management LLC closed its second fund, Cibolo Energy Partners II LP, meant to boost middle market upstream and midstream companies’ growth with development capital.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.