[Editor's note: A version of this story appears in the May 2020 edition of Oil and Gas Investor. Subscribe to the magazine here.]

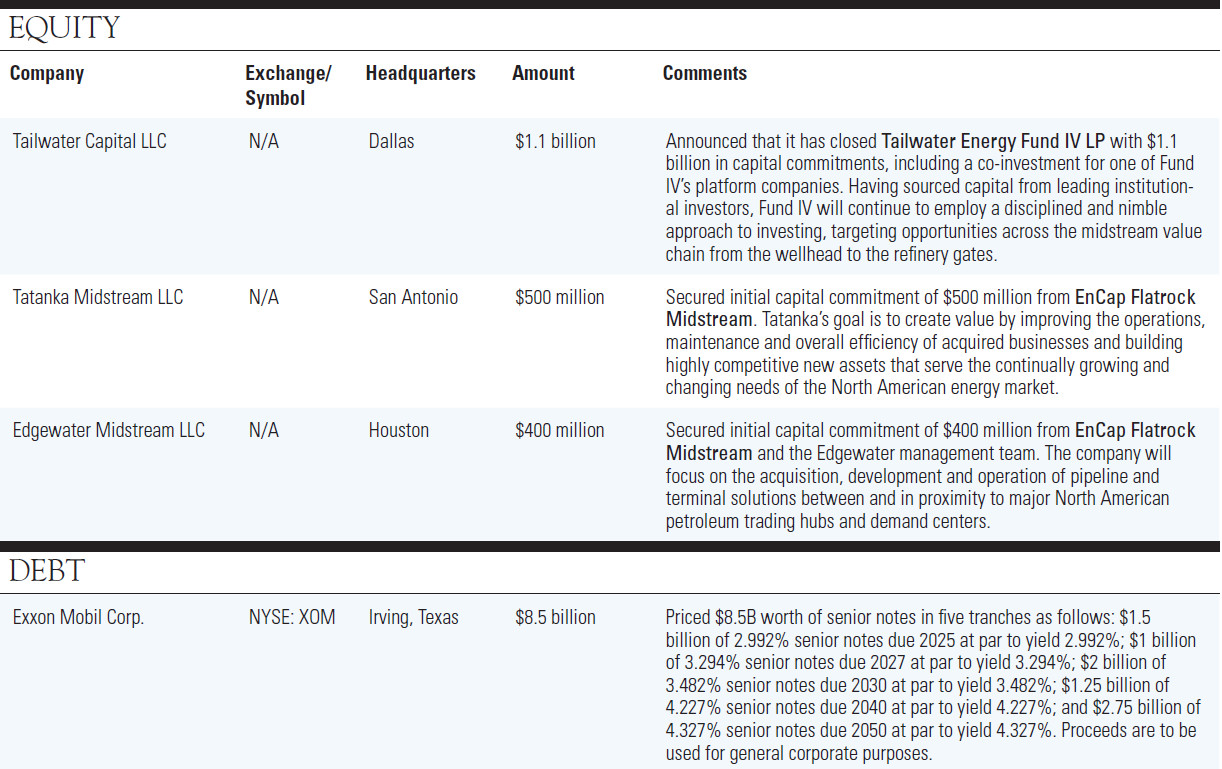

Private-equity sponsor Tailwater Capital LLC tied up a fourth fund in what otherwise has been a largely barren landscape for capital raising. Its Tailwater Energy Fund IV LP, focused on midstream infrastructure investments, raised $1.1 billion in capital commitments, including a co-investment in one of its portfolio companies.

Based in Dallas, Tailwater said it would target opportunities “across the midstream value chain from the wellhead to the refinery gates.” Jason Downie, co-founder of Tailwater with Edward Herring, said that as it puts capital to work in a “strategic and patient way,” it expects to see “some of the most compelling buying opportunities we have come across in many years.”

Tailwater said it had a total of over $1.3 billion of dry powder. The company noted it had backed management teams operating in all the core onshore basins in the U.S. Since its founding in 2013, it has raised over $3.7 billion and executed more than 100 transactions representing over $20 billion in value. Its prior Tailwater Energy Fund III raised $1 billion and has committed capital to six portfolio companies.

“Having invested through multiple cycles, we are confident private equity will play a critical role in solving the prevailing capital constraints of the energy industry,” said Downie.

A midstream funding was also announced by EnCap Flatrock Midstream, which made a $500 million commitment to Tatanka Midstream LLC. Headquartered in San Antonio, Tatanka is focused on creating value by improving operations, maintenance and overall efficiency of acquired businesses and building highly competitive assets that serve changing energy needs.

Tatanka is led by three industry veterans: CEO Keith Casey, president Nate Weeks and CFO Carlos Mata. Collectively, they have more than 75 years of experience in the midstream and downstream sectors.

Earlier, EnCap Flatrock Midstream made a capital commitment of $400 million to Edgewater Midstream LLC. Edgewater was formed to provide independent midstream logistics solutions to refiners, producers and marketers of crude oil, refined products and other bulk liquids.

Edgewater’s three founders are CEO Stephen Smith, COO Mike Truby and chief commercial officer Brian Thomason.

For more information, visit Hart Energy's New Financings database, a searchable database of oil and gas debt and equity offerings, at hartenergy.com/new-

Recommended Reading

DNO Buys Stakes in Five Norwegian Sea Fields from Vår Energi

2024-09-03 - DNO’s acquisition of stakes from Vår Energi includes interests in four producing fields—Norne, Skuld, Urd and Marulk— and the Verdande development.

Apollo to Buy $1B Stake in BP’s Trans Adriatic Pipeline

2024-09-16 - Apollo will purchase the non-controlling interest from BP subsidiary BP Pipelines TAP Ltd. for $1 billion as the oil major continues to make progress on a divestment target of up to $3 billion.

Firms Blast ‘Conflict-ridden’ Martin Midstream Deal, Launch Counteroffer

2024-07-11 - Two New York-based capital firms say a May proposal by Martin Resource Management to buy Martin Midstream for $100 million represents a “below market and conflict-ridden proposal,” while the firm’s own offer has been rebuffed.

Beyond Permian? Breaking Down E&Ps’ Second Half M&A Prospects

2024-07-22 - From Permian Resources and Diamondback Energy to Matador Resources and Civitas Resources, analysts weigh in on upstream companies’ M&A mindset as second-quarter earnings season gets underway.

Permian Resources Bolts-on Oxy’s Delaware Basin Assets for $820MM

2024-07-29 - Permian Resources will add Occidental Petroleum’s Barilla Draw assets in an $817.5 million deal as Oxy prepares to pay down debt for its pending $12 billion acquisition of CrownRock LP.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.