Cerulean Winds wants to turn off traditional gas turbine generation and instead use an integrated 200-turbine floating wind and hydrogen development to power oil and gas facilities located at one site West of Shetland and two areas in the Central North Sea. (Source: Shutterstock.com)

Government leaders in Scotland and the U.K. are being urged to accelerate the decarbonization of oil and gas assets in the North Sea by using electricity generated from neighboring floating wind turbines to power offshore operations.

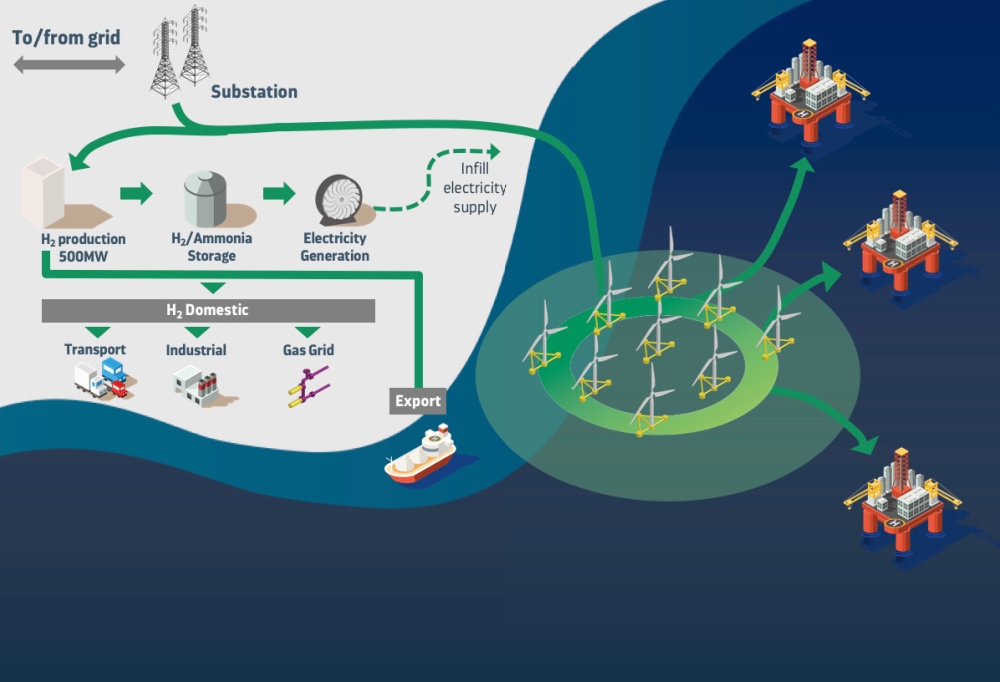

Currently, offshore platforms in the U.K. Continental Shelf (UKCS) produce 18 million tonnes of CO₂ emissions per year. Cerulean Winds, the green infrastructure developer, wants to turn off traditional gas turbine generation and instead use an integrated 200-turbine floating wind and hydrogen development to power facilities located at one site West of Shetland and two areas in the Central North Sea. Excess produced power will be used to generate green hydrogen at a commercial scale as shown in Figure 1.

The aim of the ambitious $13 billion project is to support both country’s goal to halve greenhouse-gas emissions by 2035. The scheme could effectively remove 9 million tonnes of the industry’s power generation emissions within the next five years, while sustainably securing the supply of oil and gas required in the energy mix to mid-century. This would ultimately stall costly decommissioning activity and bring new life and jobs into the sector.

Switching supply

Floating offshore wind is widely acknowledged as the answer to exploit deepwater sites with abundant wind resources. For example, in 2017, the Hywind floating wind farm off the northeast coast of Scotland, was the first in the world to be brought into operation. As the fossil fuel industry grapples with its net-zero target ambitions, switching gas turbine generation to 100% green power from neighboring turbines could be an efficient and sustainable step in the right direction.

“Floating wind farms can be developed faster with standardized floating turbine units and higher energy yield. Compared with fixed-bottom designs, they offer economic and environmental benefits due to less-invasive activity on the seabed during installation,” said Mark Dixon, a founding director with Cerulean Winds has 25 years’ experience in the planning, execution, and operation of floating offshore infrastructure projects.

“For the technical and economic aspects of the scheme to work, wind power needs to be generated close to the oil and gas facilities. We have selected sites that are unused, unallocated and in uneconomic seabed areas.”

The triangular template of each turbine foundation in the proposed floating field is expected to be based on a steel semisubmersible structure, though the benefits of a concrete or hybrid foundation have been considered. “The semisubmersible has several features which make it really suited to large-scale buoyancy requirements for flotation and stability. Steel fabrication is prolific around the world, and therefore, these structures will have the widest opportunity for local content.”

The design parameter and the need for rapid scale development and deployment by 2025 dictates the size, or capacity of each turbine. Whilst today’s turbines deliver in the range of 7 to 10 megawatts (MW), Dixon is confident that twice that capacity can be achieved: “You've got to forecast where the technology is going to be, not in a futuristic sense but in a near-future sense. Getting the turbine size spot on has been an important part of achieving the economics that we ultimately have.”

The developers had two options to solve the issue of electrification. The first was to place turbines within the local proximity of several, small developments. However, this meant additional systems were needed to ensure backup supply. The alternative was to select sites that could hold enough turbines to service the widest possible collection of platforms to the maximum capacity that they require, thus improving the economics.

To extract maximum energy from a single 150 m tall, 14 or 15 MW turbine, each unit will be separated by at least 1.5 km (Figure 2).

Therefore, a network could potentially cover an area of between 250 and 400 sq km grabbing, and never wasting, every gust and gale.

The technical and logistical aspects of developing floating wind technology benefits from the ‘last mover advantage’, or the lessons learned from fixed offshore wind. However, ensuring stability is as close to that of a fixed jacket as possible is key, given the unpredictable marine environment and wind conditions of the North Sea. The proposed coupled dynamic system will incorporate wind loading on the huge, composite rotor blades, wave loading on the floating foundation itself, as well as the mooring system.

Robust connectivity for constant electricity

The plan is to have more than 200 of the largest floating turbines at sites West of Shetland and in the Central North Sea with up to 3 GWh of capacity to feed power to the platforms.

“We have worked on the principle that an oil and gas facility wants a cable that is provided to them, that supplies them with 100% of the electricity needs that they have. It is 100% green, and it has 100% availability,” explains Dixon.

Offshore facilities have both a baseload and peak power demands that reflect the operating activities with larger/older and far less efficient facilities. Currently, West of Shetland and Central North Sea require around 250 MWh and 600 MWh respectively for baseload, increasing with peak requirements. Although widely studied, it is not as economic in the UK to run cables from shore to power the individual platforms or groups of platforms, and the grid cannot guarantee continuous green power for this purpose.

Therefore, wind turbines will be connected to an offshore, fixed jacket substation which will transmit that electricity via HVAC cable network running hundreds of kilometers to the offshore facilities. Each cable will be pulled up a J tube on the facility, routed through the facility and connected into the power system. For existing facilities, this requires an element of brownfield work to swap offshore gas turbines and associated systems to green power. For new developments, the use of green electricity supports a simpler architecture while potentially saving hundreds of millions of pounds in capex and attaining net-zero emissions. The cables will be configured in daisy chains or loops to cost-effectively connect a series of platforms together, for optimum resilience and contingency.

“What we've done, through the technical structuring and the commercial arrangement, is allow 100% availability of green power to offshore platforms at a price below current gas turbine generation through a self-sustained scheme with no upfront cost to operators. It’s a standard, robust electrical transmission system designed to build in resilience,” Dixon added. There will also be interconnection between sites for redundancy.

For periods when the wind does not blow sufficiently, onshore substations and hydrogen generation plants will buffer the system and guarantee 100% availability of green electricity to the platforms. A HVDC cable from the substation to shore at bases in Peterhead and Blythe, will also use an expected excess of 1.5GW per hour to generate hydrogen at a commercial scale, with an expected export potential in excess of £500m.

New life for a mature basin

Through the 2030s, the UKCS oil and gas industry is expected to produce over one million barrels of oil per day, assuming adherence to clean extraction, continued technological advances and MER. For West of Shetland and the Central North Sea, the scheme is expected to extend production by at least a decade in both regions.

As platforms have varying production and emission levels, power demands, and complex ownership structures, a single, strategic infrastructure approach will ensure decarbonization is basin-wide.

“Cross-sector knowledge is really important for bringing this forward at the pace we're doing,” believes Dixon. Following rapid construction and deployment, first electrification is anticipated in late-2024. This timely ‘switch-on’ will:

- Remove 10 million tons of CO₂ per year. The UK’s single biggest reduction in CO₂ emissions to date

- Allow the sector to continue production throughout the transition

- Enable the U.K. to implement emissions taxes on the industry whilst protecting 100,000 direct jobs

- Kick start a hydrogen economy and the drive for more floating wind.

Dan Jackson, the other founding director of Cerulean Winds, sums up the scheme: “We have a transformative development that will give the U.K. the opportunity to rapidly decarbonize oil and gas assets, safeguard many thousands of jobs and support a new green hydrogen supply chain.

“The decision to proceed with the scheme will ultimately rest with the Scottish Government and Marine Scotland and their enthusiasm for a streamlined regulatory approach. The ask is simply that an exceptional decision is made for an extraordinary outcome. We are ready to deliver a self-sustained development that will decarbonize the UKCS and be the single biggest emissions abatement project to date.”

About the Author:

Cerulean Winds is a green infrastructure developer founded by Dan Jackson and Mark Dixon, who have together, over 25 years, led large-scale offshore infrastructure developments. With exclusive Tier 1 contractor relationships in place, Cerulean Winds has a market funded infrastructure construct to deliver integrated floating wind and hydrogen developments at scale.

Both Jackson and Dixon have held a variety of leadership roles across multinational corporations advising on the planning, construction, and operation of some of the largest offshore projects. They have significant experience managing integrated contracting and project finance to enable funding of major capital projects from the financial markets, including both U.K. and international development with a variety of commercial models and Build Own Operate Transfer funding constructs.

Recommended Reading

Devon Energy Expands Williston Footprint With $5B Grayson Mill Deal

2024-07-08 - Oklahoma City-based Devon Energy is growing its Williston Basin footprint with a $5 billion cash-and-stock acquisition from Grayson Mill Energy, an EnCap portfolio company.

Avant Natural Resources Steps Out with North Delaware Avalon Tests

2024-08-21 - With the core of the Delaware Basin in full manufacturing mode, Avant Natural Resources is pushing an operated portfolio into the northern reaches of the New Mexico Delaware.

Powder in the Hole: Devon May Fire up its PRB in Coming Years

2024-08-23 - Devon Energy is perfecting its spacing and completion recipe in Wyoming’s Powder River Basin play to possibly unleash full-field development later this decade.

Crackin’ It at Kraken: Inside the Bakken’s Ramped-up Private E&P

2024-07-24 - Kayne Anderson-backed Kraken Resources is producing more than 80,000 boe/d today and has a new Fitch Ratings credit score to take to the M&A bank.

Private Equity Looks for Minerals Exit

2024-07-26 - Private equity firms have become adroit at finding the best mineral and royalties acreage; the trick is to get public markets to pay more attention.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.