Samson Resources II CEO Joe Mills emphasized to the remaining staff post-bankruptcy that the days of being a diversified, large company were over. “We needed to focus on where we were going to put our money and rebuild the company.” (Source: Samson Resources II LLC)

[Editor's note: A version of this story appears in the April 2018 edition of Oil and Gas Investor. Subscribe to the magazine here.]

Samson Resources II LLC is a fallen hero rising. The once-proud, quiet independent emerged from a contentious bankruptcy in March 2017 with a much lighter balance sheet, a trimmed down portfolio, a fraction of the staff and a bevy of new distressed debt owners. It also introduced a new president and CEO: Joseph A. Mills, the former CEO of Eagle Rock Energy Partners and a veteran of the industry, who sees a promising future for the company.

“I am about as excited as I have been in a long time. We have a great set of assets, great people, a strong balance sheet, and we’re in a position to deliver on promises,” said Mills.

But a year into the restructuring, the path hasn’t been easy.

The Samson story is rich in history. Launched in 1971 by Charles Schusterman, the gas-weighted independent grew to become one of the largest family-owned companies in the U.S. In 2011, the Schusterman family exited to a private-equity consortium led by KKR & Co. LP for $7.2 billion. At that time, the Tulsa, Okla.-based company fielded 1,200 employees, registered 2.3 trillion cubic feet equivalent of proved reserves and produced 700 million cubic feet equivalent per day (MMcfe/d) from 11,000 wells.

The sale, though, was ill-timed, as the massive $3.5-billion debt taken on in the acquisition became too much to bear under retreating natural gas prices. The company sold down some $1 billion in assets to no avail, falling into bankruptcy in September 2015 for what would become the second-longest energy bankruptcy in history.

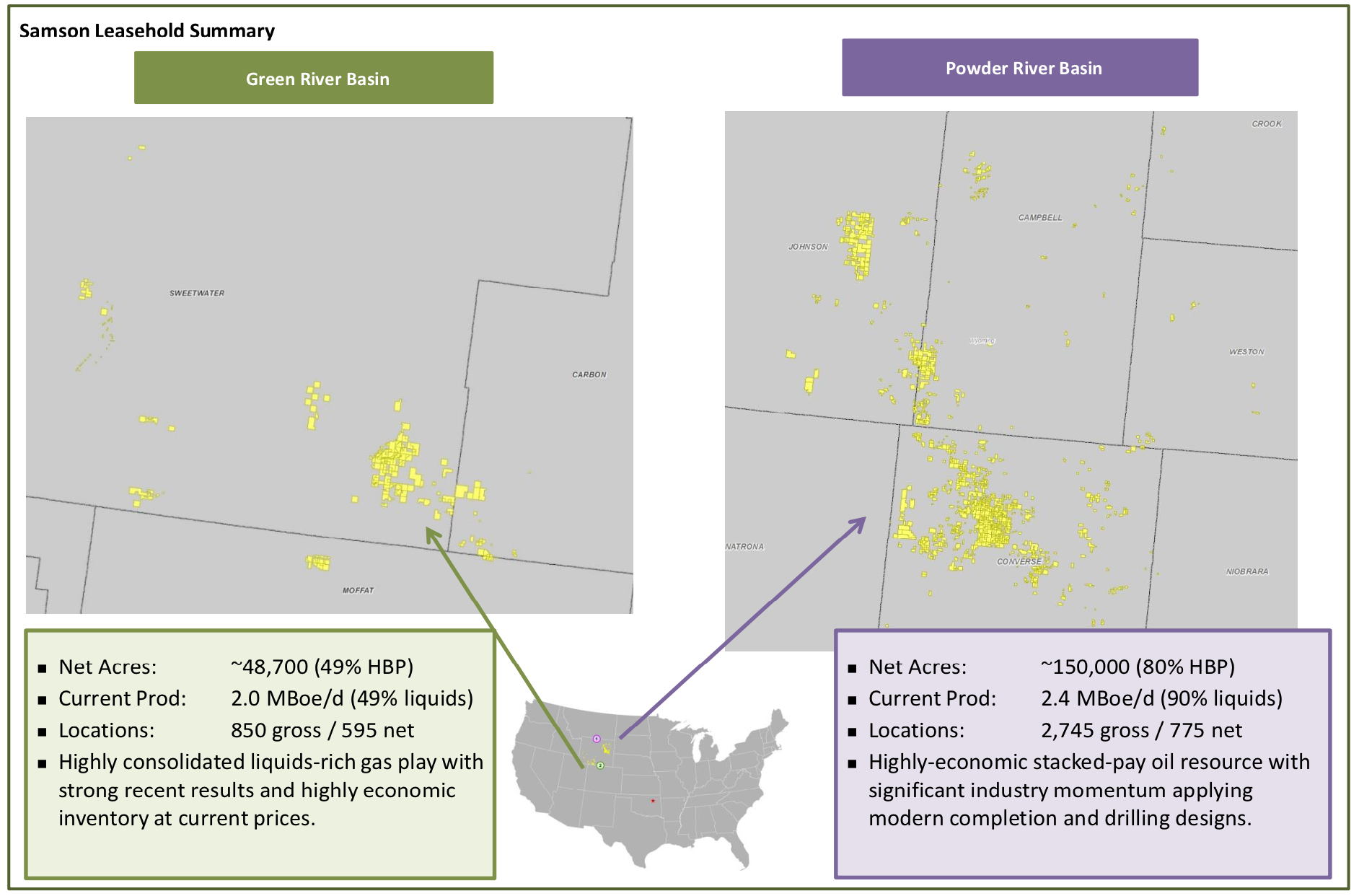

Samson emerged from bankruptcy with three assets remaining: its core East Texas properties, “historically the heartbeat of our company,” said Mills, the Green River Basin and the Powder River Basin. Production equaled 135 MMcfe/d, 72% gas, with 75% of the total from East Texas.

It still had $245 million in debt and little liquidity. Mills took control the day Samson came out of bankruptcy. “We recognized we needed to move fast. We were still saddled with too much debt and too many challenges.”

In April, Samson’s board engaged Jefferies and Houlihan Lokey to conduct a strategic review, and by August, the company had agreed to sell its legacy East Texas position to Rockcliff Energy LLC for $525 million. The sale provided a big gasp of needed financial air, enabling the company to pay down all of its remaining debt and make a $250-million equity distribution to its new shareholders. That left a cash position of $100 million and a new, undrawn revolver with $106-million borrowing base, providing $200 million in liquidity on the balance sheet coming into the New Year.

Today, Samson’s pared portfolio features 150,000 net acres in the Powder River Basin and just fewer than 50,000 net acres in the Green River Basin, together accounting for 1,370 net identified drilling locations. Mills sat with Investor to map out the road ahead for the company.

Investor Who currently owns Samson?

Mills It’s approximately 100-plus different equity owners. The second-lien group became the new equity owners from the bankruptcy.

The single-largest owner is a firm by the name of York Capital Management. York manages $18 billion in assets, controls about 45% of the company and has a board seat. York acquired the majority of its stake in October 2016, during the bankruptcy and after the unsecured creditors committee terminated exclusivity, creating a lot of uncertainty in the case. York led the process to eventually take control of the equity through the second-lien debt and in part backstopped the $60 million of new money needed to get the company out of bankruptcy.

The remaining owners are hedge funds, distressed-debt buyers and then some of the original second-lien holders from pre-bankruptcy.

Investor Why were you chosen to lead Samson?

Mills My calling card has been M&A and turnaround stories, so that’s how people know me.

When York hired me, honestly, it was to sell the company as fast as we reasonably could. When they approached me, they asked, “How can we stabilize it and then monetize it?” The whole idea was we were going to be done with it by the middle of 2018.

But when I arrived at Samson, I saw a lot of opportunities. The technical talent of the company is exceptional, but what really impressed me was the quality of the assets. We have some great assets. The board concluded that if we could stabilize the balance sheet and organization and, more importantly, give ourselves some breathing room, in particular around liquidity, we actually had something to work with.

Hence the reason we sold East Texas. We’ve shown our investors a path forward with the monetization by giving them back a pretty good chunk of cash. That’s extended the runway for us.

Investor Why did you decide to sell the East Texas position, which was Samson’s legacy core?

Mills One of the first things we talked about was focus, focus, focus. We were too diverse, too spread out. The days of being a diversified, large company were over. We needed to focus on where we were going to put our money and rebuild the company.

East Texas was our backyard. My initial reaction was that East Texas was where we were going to grow the company. But the truth is, through the strategic review, it became very clear that the upside was in the Rockies. Not that there wasn’t upside in East Texas, but it was better defined [in the Rockies.]. And with what was going on in the East Texas market, particularly with Covey Park Energy [LLC}, Indigo Minerals [LLC] and Vine Oil & Gas [LP] all talking about going public, we could see there was a strong appetite for Haynesville production and development opportunities.

The board felt very strongly that we needed to strategically reposition the company, refocus as an oil company. We were very concerned about natural gas prices. We could have monetized the Rockies, but we wouldn’t have gotten the premium valuation for the Rockies at that time. The Powder and the Green are where our future lies.

Investor What was your biggest challenge coming out of bankruptcy?

Mills We were running at over $36 million a year in G&A, which was unsustainable for our asset base. Our back office was geared for a company 10 times our size; we had more accountants and IT personnel than technical personnel. Ultimately we made some tough decisions to outsource accounting, which has worked out well for us.

Investor Was this a big cultural change?

Mills It was. Samson has a very proud culture and built some fantastic systems and processes inside the company when we were a much larger organization. We have preached since emerging from bankruptcy that we need to act like a start-up with a 40-year history. We have to challenge ourselves and start thinking like a start-up. That’s been a cultural change, and we are adapting quickly.

Investor What’s the new strategy?

Mills Reduce our cost structure, become extremely profitable and become really good at what we do. That’s a key message. To be successful in today’s E&P world, you have to be really, really good at what you do, which is finding oil and gas economically. We don’t have the lowest cost of capital, so we’ve got to generate higher returns to our investors to justify our existence. It’s all about being highly technical and applying technology prudently.

Our strategy is to deliver shareholder return with a balanced, low-risk growth strategy.

Investor Do you have a financial discipline mantra that you’re following?

Mills Very much so. We have zero leverage today. We have a strong cash and liquidity position on the balance sheet, and cash flow is quite good. We hedge aggressively to protect that cash flow. You’ll see us pick up some leverage as we grow through the drillbit, but we intend to maintain a balanced capital structure and a low leverage ratio.

We will slightly outspend our cash flow this year, but we define that as cash flow from operations plus asset sales. We intend to sell $40- to $60 million of noncore assets this year.

Investor Are you currently drilling?

Mills We have one rig running in the Green River Basin focused on the Fort Union Sands. It’s a liquids-rich gas reservoir, in which NGL account for 45% of the gas stream. We have identified over 850 gross locations in the Green River on 23-acre spacing, but we think ultimately we can take the spacing down to 10 acres, which more than doubles our inventory count to over 1,700 locations.

In 2014, we drilled a number of horizontal wells in the Fort Union Sands play. The wells had some phenomenal rates in terms of deliverability—20 to 25 MMcf/d—but unfortunately the wells were costing $12- to $15 million-plus to drill and complete. Not an economical program. The program was shut down right around the time of the bankruptcy.

Instead, we are approaching the play as a vertical well program; think of this as gas manufacturing. In Jonah Pinedale, it’s all about getting the cost structure in line and being able to repeat it over and over. We drilled four vertical wells in the fourth quarter of 2017 to test the concept. Historically, the vertical wells were completed with three stages and 300,000 pounds (of sand). We are now testing larger completions with 10 to 12 stages and over 1 million pounds. We are currently completing the last of the four wells and will have initial results in first-quarter 2018.

Our plan is to drill 10 to 15 wells in 2018, including multiple wells from one pad. We hope to get the cost down to $2.5- to $3 million per well. We also have deeper Lance and Lewis potential. One of our best wells in the field is a Lewis well, so we know it’s prospective.

Investor What’s your plan going forward with the Green River assets?

Mills We will prove up the concept of pad drilling and gas manufacturing and then look to monetize the asset, probably in early ’19. For an independent that likes the low-risk, high-return gas manufacturing story, it’s a great set of assets. Monetizing the asset will give us additional liquidity to allow us to continue our growth trajectory in the Powder River Basin.

Investor So your mission is to be a pure player in the Powder?

Mills That’s correct. That’s ultimately where we’re headed.

Investor What are your near-term operational plans in the Powder?

Mills We’re standing up one rig this summer, but based on success, we will go to two rigs.

We have a lot of opportunities in different horizons, but we are really focused on the Niobrara and the Mowry shales. We think the unconventional reservoirs have real upside potential. It’s not without risk. Pre-bankruptcy, Samson drilled a number of deep tests and obtained some excellent data—we’re one of the few companies that have a full core in both the Niobrara and the Mowry. It’s early in the life cycle, so it’s hard to say how good it’s going to be, but we think there’s a lot of potential there. Hence, we’re aiming to de-risk it.

Investor You don’t have any results currently?

Mills Not in the Niobrara or the Mowry. It’s early. We have a lot of results in the Shannon, Frontier and the Turner, which are really good. So, we know there is strong potential in the conventional reservoirs, and we will drill a couple of Shannon and Frontier tests in 2018. But it’s really the Niobrara and the Mowry shales that we want to test. We think the Niobrara and Mowry could have as many as eight locations per horizon to properly drain the reservoir.

Investor What has you so excited about the potential in the Powder River?

Mills: The Powder River basin has over 4,000 feet of overpressured oil-stacked pays, similar to the Permian Basin. We believe the basin contains a largely untapped resource potential, and only recently has the industry identified the potential.

It’s also the adoption of new drilling and completion technologies that’s energizing the basin. Due to the downturn, the Powder River had a slow adoption rate of new completion technology. But that is quickly changing, and we’re starting to see it. EOG [Resources Inc.], Devon, Chesapeake, Anadarko and other big players are bringing new completion designs to the various reservoirs. We think this will help unlock the large potential.

Investor What challenges are you facing here?

Mills The biggest challenge is the current inability to run year-round drilling programs due to the federal lands requirements regarding environmental stipulation drilling windows, called “stip” windows. We have to stay away from the sage grouse and raptor nests. In the spring and early summer the animals are active, so we are restricted from conducting any new drilling or completion activities in those areas. Drilling windows vary by area but usually open back up by June or July and end in late February. Not the ideal time to be drilling, in the dead of winter.

The industry is working with the BLM to find ways to allow year-round drilling, and I believe it will come down to pad drilling. If you can keep a rig in one location and mitigate the noise and traffic during the stip window, then we might find ways to allow for a longer drilling season.

Investor How much capex will you deploy this year, and what are your production projections?

Mills We announced a $115-million capital program for 2018, but that could go up. Based on success, we could increase that to about $130 million, which is well within our current cash position plus operating cash flow. Under our current plans, we don’t draw on our revolver until late 2019, so we’ve got plenty of running room.

Based on the projected spend, we expect to grow production by over 20% year-over-year based on our 2017 exit rate. The Powder will be a big driver in that production growth.

Investor Are you looking to add to your position?

Mills We are. We’ve already made one small but highly accretive acquisition, and we are evaluating additional opportunities in the Powder River Basin.

Investor Isn’t the Powder rather locked up?

Mills The Powder is pretty tied up today. There are a handful of large independents with meaningful acreage positions, but there are areas of the basin that are not core to them, so I think you will see some acreage trades as operators core up in certain focus areas. There’s also a large number of smaller independents that have some pretty good positions that can total 10,000-acre positions. Those fit us. That’s the kind of bolt-ons we’re looking for. The smaller operators are getting challenged keeping up with the drilling activity, especially when you are staring at $10-million-plus AFEs.

Investor How much dry powder do you have for acquisitions?

Mills We have enough liquidity to evaluate $75- to $100 million in acquisitions. We’ve had a number of people approach us about possibly doing a Drillco (drilling partnership) as well. We are looking at that as a way to scale without having to add bank debt and still accomplish the same objective. Our main shareholder is very supportive as well; they are returns-focused but are always looking at opportunities to deploy more capital if the risk/reward works in their favor.

Investor Is the new Samson going to be a quick flip, or are you setting it up to be a longer-term entity?

Mills Our story has not been written yet. We think there’s a tremendous opportunity in front of us, particularly in the Powder. Some would say that the Powder could be the next Permian. It’s smaller than the Permian, but we believe it’s a great basin with a lot of upside, and we’re prepared to bring it forward. And obviously, it’s cheaper than the Permian today. In the next two years we expect the Powder to emerge as one of the premier oil plays in America, giving us years and years of drilling opportunities ahead.

But, ultimately, a full monetization of the company will more than likely occur, probably in 2019 or 2020. How do we exit? We could sell the entire company or take it public as a pure-play. We’ve talked about whether we should be the consolidator. We’re the seventh-largest leaseholder in the Powder. We have a big-enough position where we could eventually go public.

Let’s go drill it and see what happens. We’ll see what the right opportunity is soon enough.

Steve Toon can be reached at stoon@hartenergy.com.

Recommended Reading

US Drillers Cut Oil, Gas Rigs for Fifth Week in Six, Baker Hughes Says

2024-09-20 - U.S. energy firms this week resumed cutting the number of oil and natural gas rigs after adding rigs last week.

Western Haynesville Wildcats’ Output Up as Comstock Loosens Chokes

2024-09-19 - Comstock Resources reported this summer that it is gaining a better understanding of the formations’ pressure regime and how best to produce its “Waynesville” wells.

August Well Permits Rebound in August, led by the Permian Basin

2024-09-18 - Analysis by Evercore ISI shows approved well permits in the Permian Basin, Marcellus and Eagle Ford shales and the Bakken were up month-over-month and compared to 2023.

Kolibri Global Drills First Three SCOOP Wells in Tishomingo Field

2024-09-18 - Kolibri Global Energy reported drilling the three wells in an average 14 days, beating its estimated 20-day drilling schedule.

Permian Resources Closes $820MM Bolt-on of Oxy’s Delaware Assets

2024-09-17 - The Permian Resources acquisition includes about 29,500 net acres, 9,900 net royalty acres and average production of 15,000 boe/d from Occidental Petroleum’s assets in Reeves County, Texas.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.