Oasis Petroleum CEO Tommy Nusz isn’t worried about the near term of its Permian Basin entry acquisition. “I’ve done deals in this business for 30 years and I can tell you, for most of them, people misunderstood the logic going in. But look five years down the road and it makes a lot more sense.” (Photo by Todd Spoth)

[Editor's note: A version of this story appears in the October 2018 edition of Oil and Gas Investor. Subscribe to the magazine here.]

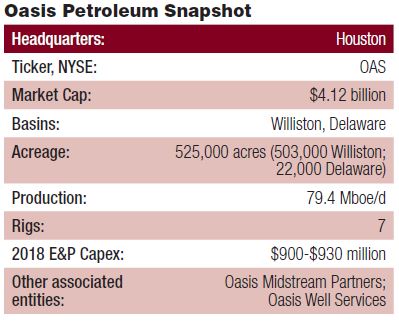

With so many public E&Ps coring up and selling down assets to become basin-specific pure players—a move to appease investors desiring focus and simplicity—it came as a surprise to many when the news wires last December announced that Bakken-only Oasis Petroleum Inc. (NYSE: OAS) had made a play to buy 20,300 net acres in the Delaware Basin. The acres are far to the south of the only assets Oasis has ever known in its decade-long history, and as close to the southern border as its Bakken assets are to the northern. The step-out met with mixed emotions from the investor community.

The deal, acquired from Forge Energy LLC for $946 million, presumably solved analysts’ concerns around inventory longevity in Oasis’ Williston Basin portfolio, effectively doubling the number of core locations to drill. But it also created new angst with a $36,000-per-acre price tag and a 33% shareholder dilution to help fund the purchase.

Oasis co-founder and CEO Tommy Nusz debunks both perceptions and is confident that the investor community will see the wisdom of the strategy shift in due time. “I don’t tend to focus on being judged in the first six months,” Nusz told Oil and Gas Investor. “I tend to focus on how are people going to judge the deal five years from now.”

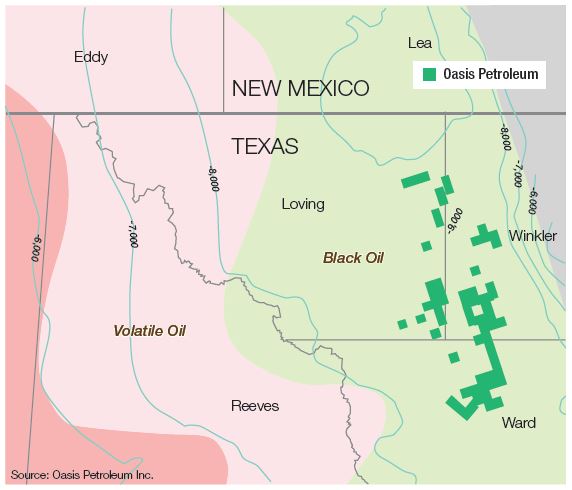

When the deal closed in February, Oasis acquired a position situated around the confluence of Loving, Winkler and Ward counties in West Texas, which it deems the deepest part of the Delaware Basin with more than 500 new locations. The Houston-headquartered company plans to target six primary horizons in the 3,000-foot-thick stacked pay—both upper and lower intervals of the Wolfcamp A & B, the Wolfcamp C and Third Bone Spring. It sees upside in four additional zones: Avalon, First and Second Bone Spring, and the Second Bone lower shale. It is currently running two rigs there.

Subsequently, Oasis sold portions of its Bakken acreage deemed noncore for $360 million to offset the cash portion of the Delaware acquisition.

Nusz co-founded Oasis in 2007 following a 21-year tenure with Burlington Resources and with equity backing by EnCap Investments LP. He and co-founder Taylor Reid, president and CFO, took the company public in 2010. Investor chatted with Nusz to explore the company’s shift in strategy.

Investor: Why would a prominent Bakken pure-player expand to the Delaware Basin?

Nusz: The things that are important to us are scale, inventory, diversity and financial strength. Everything we do always comes back to those four things. We set up a business development team back in 2012, and over the last six years we’ve done a number of deals in the Williston, and started working the Permian in detail probably three or four years ago.

We felt the Permian was a great complement to what we have in the Williston Basin, and to some of the learnings we’ve had in the Williston over the last 11 years since we started the company. We’re excited about it. We’re being measured and deliberate in how we approach it so that we don’t out-drill our knowledge and to gather as much information as we can before we go into full-field development.

We took over the rig that the Forge guys were running and just added a second rig. It’ll probably be the latter part of ’19 before we add another, so two rigs from here to that point.

Investor: Did you see a limit in your running room within the Bakken, and therefore necessary to expand beyond the Bakken?

Nusz: No. We love the Bakken; we think it’s great. We’ve got 15 years of inventory with 1,500 locations, meaning the core of the core and the extended core that’s resilient down to under $45 WTI now. And that doesn’t account for the fairway acreage, which is over 1,000 additional locations. We’ve got a great position there. You’ve seen some (companies) that are transitioning out of the Williston and into the Permian. This is clearly not that.

We’ve got a great cornerstone position in the Williston, and we plan to have that for a long time. And it gives us much more optionality in capital allocation, which is always healthy. In an environment now where you see really good or low differentials in the Williston, we can get on pipe and get to Texas and export, and so our diffs are really low relative to what they’ll be in the Permian over the next several months.

Oasis Petroleum’s 22,000-acre initial entry into the Delaware Basin in West Texas is a foothold to building a program that looks like its Bakken Shale business, says CEO Tommy Nusz.

Investor: In doing the deal you guys did take on a lot of dilution, and your stock got hit at one point in time. How do you explain that to investors, and how do you see the value creation going forward from doing it that way?

Nusz: It’s a value proposition, and it isn’t necessarily the value proposition in the market today. It’s what the value is in five, 10, 15 years, which is what we focus on. In fact, we get back to breakeven here in about two years and then it starts to become accretive, just because of the massive resource potential that’s there.

I’ve done deals in this business for 30 years, and I can tell you, for most of them, people misunderstood the logic going in. But you look five years down the road, and it makes a lot more sense.

Investor: How do you explain that logic that people may not be recognizing today?

Nusz: It’ll come through the growth, and capital efficiency and full-cycle returns on our projects, whether you look at relative returns, Williston or Delaware, cost forward or full cycle. It just increases the depth of our inventory of projects that are resilient to low WTI prices, and in high WTI environments, we’re creating tremendous cash margins.

We didn’t go into it to buy production. We did it because of the value proposition, and establishing an anchor in the Permian Basin, and something that we can continue to grow off of just like we did in the Williston Basin from that original deal we did back in 2007.

Investor: How does this deal compare to that first deal in the Bakken?

Nusz: You know, I would say that one’s going to be hard to duplicate. We paid $83 million for 175,000 acres in the Williston on the west side of the basin, then one year later we did another 50,000 acres on the east side of the basin. Our average acreage cost in those two deals was, in total, somewhere around $400 an acre. You look at that in hindsight today, and that’s kind of hard to beat in the Williston.

Investor: You were early movers in the Bakken, but the Delaware entry is the opposite. You’re late movers and have a much smaller position. At $36,000 per acre, how do you justify that?

Nusz: It’s relative value and risk. True value creation comes with a differential view and, oh, by the way, it helps if you’re right. What we saw in the Williston at the time was a tremendous resource. It wasn’t a geology equation, it was an engineering problem. There was a lot of hydrocarbon in place, but how do we get the cost structure and technology right? That’s taken several years.

In the Permian, I’ve got three times the inventory per acre than I have in the Williston, right? Instead of 10 to 12 locations per DSU (drilling spacing unit), we’ve got 34 to 36, and maybe even more than that if you look at our main horizons and the upside horizons. On a same-same basis, then that comes to about $36,000 an acre. What did we pay for this? About $36,000 an acre.

Investor: How do you foresee developing that?

Nusz: That’s what we’re trying to figure out right now. We have a model that we’ve followed in the Williston of how we go from doing initial testing to full-field development. I will say this: full-field development in the Permian is going to be like the Williston on steroids.

The good news is that we’ve got a lot of experience in process and approach. They’re both resource plays, but they’re different. Water cuts are higher in the Permian. Pressure is higher. The rock is a little bit harder to drill than it is in the Williston. But it’s all technology and learning; we’ve been through the processes before.

We’ve got to make sure that we understand as we go and be very measured and deliberate about what we’re doing. We anticipate that to take a couple of years, so as we get through the end of 2019 and go into 2020, that’s when we start moving to full-field development where things get very capital efficient, returns really start to take off, and where you start to see this acquisition start to be accretive.

Investor: Many Permian companies are talking about block- or tank-style development. How many zones will you aim to target at full-field development?

Nusz: In simple terms, it’s six by six: six horizons that we’ve identified as the primary ones and six wells per horizon. That’s not counting the additional ones. We’ll feel that out as we go. In the Williston right now, where we’re drilling in the guts of the basin, we’re drilling 10 to 12 wells per DSU. We’ve drilled as many as 15, and had a couple of 17s or 18s in there. We gather information, do our modeling, and then come back to what we think is right.

And, hopefully, some of these other horizons work. We’ve been drilling some Second Bone Spring wells that look pretty good. Those were in the upside category, so it could be more.

Investor: You used the word ‘measured.’ Why the slow start?

Nusz: Three things. We try to focus on things that we can control, and manage the business risk around the things that we can’t control. As we looked at moving into the Permian, there were three things that we thought about. One is—especially as you move to the east and start to get to the edge of the Central Basin Platform—you’re getting to the deepest part of the basin with the highest pressure, and as Taylor Reid likes to say, ‘We don’t want to out drill our knowledge.’

Two, can we secure the services that we need to, given all the activity? We’ve been able to secure services, big surprise, from all the guys that work for us in the Williston. We’ve got some great service partners in the Williston Basin, and those are the guys that we’re using in the Permian. So we have not had a problem securing services at market prices because those guys like to work with us, and I think they want to be with us as we grow.

Then the third thing that we were concerned about was takeaway capacity, and we’re seeing it. Why run out there and ramp up to four rigs in a high diff (differential) environment? That doesn’t make any sense to us. It was something that we knew going in, which is another reason why we took a measured approach into how we modeled it in the acquisition. And that’s exactly how it’s played out.

Investor: How big of a concern is takeaway capacity?

Nusz: Right now we’re moving through third parties. The good news is that from just about anywhere on our acreage you can see that terminal at Wink (Texas)—there’s not much out there to obstruct your view—so we’re pretty close to the hub.

And it’s not a big volume. Keep in mind it’s 5% of our total volume right now. In fact, we’ve recently gotten WTI-plus on some of the Williston stuff. There was a point there several years ago where diffs in the Williston got to 17% before DAPL (Dakota Access Pipeline) came on. We’ve been enjoying really tight diffs in the Williston since.

Now, obviously, the Permian is a different story, but we knew that. It’s matching up your drilling program with your ability to move the stuff. We’ll look at how we play in that game. If we can partner with somebody that can give us surety and quality of service at a reasonable price, then we’ll do that. If we can’t, then we’ll do it ourselves, just like we did in the Williston with our midstream business and our well services business, and in our frack spreads.

Investor: Are you planning to bring those programs into the Delaware?

Nusz: We’ll see. The thing that you have in the Delaware that we didn’t have in the Williston, especially on the gas gathering and processing side, is you’ve got a number of players that are very competitive. We only had a couple of players in the Williston.

Investor: Is there any strategy or intent to accumulate some DUCs (drilled but uncompleted wells) and then wait for pipes to come on?

Nusz: Yes, and that’s another reason why scale matters. We saw this in the Williston; if you’re looking for one-off frack spreads, that’s a challenge. How do you get to a point to where you can get dedicated crews? And with dedicated crews comes a lot of efficiency, not the least of which is cost efficiency. Now we’ve got two rigs. We go to three rigs at the end of next year. We’ll start building DUC inventory to be able to support the front end of dedicated services. It’s probably the first part of 2020.

Investor: Is that when you see the pipe constraints being alleviated?

Nusz: Yes.

Investor: What messages are investors sending to you today, and do you think the cash-flow-vs.-growth sentiment is a short-cycle phenomenon?

Nusz: It’s like a lot of things that tend to overshoot. I do think how they evaluate companies and what they’re willing to fund is going to be different. I think they are going to evaluate companies more on financial metrics than on growth. I think there is probably going to be more of a reluctance for the capital markets to just fund growth.

You saw that during the 15 years before the downturn. The world’s going to be a little bit different than it was for the 15 years before we went into the downturn. We were in a 15-year time period of ‘up and to the right’ resource expansion and commodity price. I’m not real sure that that’s the case going forward. There is going to be more focus on financial returns. The capital markets are going to be more selective.

Investor: What will the next 15 years look like for shale players?

Nusz: I think it’s bright. In this country, we’ve been talking about energy independence for 30, 40 years, and we can see it from here. There’s tremendous resource—and don’t confuse resource in the ground with available supply. We’ve done a tremendous job of identifying those resources which are huge relative to what available supply is today, so it will be execution on that. It’s a long runway.

With the advancements in technology that we’ve seen, our ability to move down that (resource) triangle has been mindboggling. Just look at the Bakken. We think we’re recovering 15% plus or minus of the oil in place. What’s that tell you? There’s still a lot left.

And as you get into the unconventional you’ve made all these basins bigger. What’s the total runway on it? The further you get down that resource triangle the wider it gets.

Investor: What makes your Bakken fairway acreage noncore at this point?

Nusz: We identified it off of results from the early wells and in looking at offset operator activity. That being said, over time our core acreage has expanded, and with new technology we could go in there and improve the well results over when we drilled the first wells. But it’s probably always going to end up at the tail end of our portfolio unless we can really push technology to expand further resource access. What you’re seeing in the core and extended core in our portfolio has 15 years of running room, and so it’s always going to get pushed out in our portfolio.

Investor: You have some history with the Forge team. How did that affect bringing that deal together?

Nusz: All of the principals at Forge were ex-Burlington guys. In fact, Barry Winstead (Forge president and CEO) and I go back to Superior Oil back in 1982. We’ve known these guys for a long time. Just by virtue of the relationship that we have with the guys there is a level of trust that’s helpful when you start talking about a big chunk of consideration being in Oasis stock. Direct relationship always matters.

Investor: Has Oasis turned out like you imagined 11 years ago when you founded it?

Nusz: The short answer is no. One of the things that I said when we started was the last thing on earth I’d ever want to do is be the CEO of a publicly traded U.S. company. Everybody gigs me about it all the time. It’s like, ‘Hey, how’s that working out,’ you know? But it’s been better than what I had anticipated. That’s not to say that it’s easy. It’s hard.

The great news is look at what we’ve built over the last 11 years. Would I have ever imagined that we’d be at 80,000 barrels a day going to 100,000 barrels a day, and being the fourth largest producer in the Williston Basin, and a tremendous asset in the Delaware Basin? We’ve got 625 employees. We’ve got a meaningful midstream business. We’re in the frack business and running two frack spreads.

And it’s not just the assets, but I think organizationally the people that we’ve got here are just tremendous.

Investor: What’s your vision for Oasis for the next 10 years?

Nusz: We’ve got this tremendous cornerstone position in the Williston Basin, and now we’ve embarked on a new adventure in the Delaware. And I would think that over the next 10 years we’ve built something in the Delaware that looks like the Williston. We’ll see how all of that plays out, but we’ll continue to look toward scale, diversity, depth of inventory and financial strength.

Over time do we build more around this position? Yes, scale matters. And whether that’s scale in basin, whether that’s scale corporately, that matters, and it’s going to matter more in today’s world.

Steve Toon can be reached at stoon@hartenergy.com.

Recommended Reading

Lake Charles LNG Selects Technip Energies, KBR for Export Terminal

2024-09-20 - Lake Charles LNG has selected KTJV, the joint venture between Technip Energies and KBR, for the engineering, procurement, fabrication and construction of an LNG export terminal project on the Gulf Coast.

Entergy Picks Cresent Midstream to Develop $1B CCS for Gas-fired Power Plant

2024-09-20 - Crescent will work with SAMSUNG E&A and Honeywell on the project.

FERC Chair: DC Court ‘Erred’ by Vacating LNG Permits

2024-09-20 - Throwing out the permit for Williams’ operational REA project in the mid-Atlantic region was a mistake that could cost people “desperately” reliant on it, Chairman Willie Phillips said.

Diamondback to Sell $2.2B in Shares Held by Endeavor Stockholders

2024-09-20 - Diamondback Energy, which closed its $26 billion merger with Endeavor Energy Resources on Sept. 13, said the gross proceeds from the share’s sale will be approximately $2.2 billion.

Optimizing Direct Air Capture Similar to Recovering Spilled Wine

2024-09-20 - Direct air capture technologies are technically and financially challenging, but efforts are underway to change that.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.