The construction site of a Marcellus Shale gas drilling operation in shown in rural northern Pennsylvania. (Source: George Sheldon/Shutterstock.com)

Fresh off a proxy battle win, EQT Corp.’s newly named president and CEO Toby Rice laid out a plan July 25 that leverages technology and better development planning, aiming to improve operations for one of the biggest producers of natural gas in the U.S.

“A well-designed development schedule planned 36 months in the future is the key to consistent operational execution that will drive lower well costs and more free cash flow,” Rice said on the company’s second-quarter 2019 earnings call with analysts.

The call came about two weeks after shareholders ushered in a new board and management team for the company with Rice at the helm. The move closed a proxy fight led by Rice and one of his brothers, Derek Rice, against EQT. Pointing to poor operational results, the Rice brothers had claimed the company had been mismanaged since they sold Rice Energy to EQT in 2017.

With a new team in place, the company transformation is underway.

EQT has strengthened its management team since the July 10 board meeting, naming Tony Duran as chief information officer and Lesley Evancho as chief human resources officer. Both are new positions at EQT. Other added positions include vice presidents of digital technology, operational planning, asset performance and drilling and completions. The company also named William Jordan as general counsel.

EQT’s eight-member evolution team, which will help carry out the company’s 100-day plan, has also been created with members in place. In addition, EQT’s organizational structure has been trimmed from more than 50 departments to 16 to better match the lifecycle of a well, Rice said.

Each will play a role in EQT’s mission to become a “modern, digitally-enabled energy producer.”

Key to the plan is reaching what Rice called the “end state goal,” where all planning is complete at least 12 months before spud. “Combo developments” would dominate EQT’s Appalachian assets in Pennsylvania, West Virginia and Ohio.

The task could prove a challenge, considering Rice said less than 50% of EQT’s future schedule is set up for such development.

The combo development style, which was used at Rice Energy, entails simultaneously drilling multiple wells from multiple pads and is considered crucial to getting well costs down to $735/ft. The team is already seeing improvements using combo development at a project currently being drilled.

On the call, Rice compared what he described as a poorly planned development run to the well thought-out one drilled by the same team in the same service cost environment.

The drilling team, he said, was previously “forced to use complex well geometries to avoid wellbore collisions.” The result: fractured rock downhole causing mud losses while drilling, time-consuming rig maneuvers between wells due to poorly planned wellhead layouts, and a $325 per foot drilling costs (with an average lateral length of less than 8,000 ft) that was 80% higher than the targeted cost.

“Because these new wells were offsetting producing wells approximately 30 million cubic feet of gas per day had to be shut in for an extended period of time which contributed to EQT’s legacy curtailment issue,” Rice said. “Because of parent-child relationships, these newly drilled wells are expected to underperform our type curve by 10% to 15% once they are brought online.”

Rice, then, turned attention to the pad using combo development.

“Through the first six wells EQT has drilled at a rate of 1,500 foot per day—a 50% improvement vs. the previous pad. Drilling costs are trending to around $200 per foot—a 40% reduction in costs vs. our prior example. … When EQT’s operational teams are given properly designed development projects they are nearly at our targeted well cost goals, which for drilling are $190 per foot.”

The new team also has made a few other changes, although it has been largely in a listen-only mode with a primary focus on stabilizing the business, according to Derek Rice, who serves on the evolutions committee.

“When we walked in the door there were 30 different completion designs. We looked at all the data with the teams and we came to the conclusion that reducing that to one design—one proven design—was efficient,” he said. “What that allows us to do is not only predict the performance of our wells going forward, it also gives our completions team the ability to procure the appropriate amount of materials on a go-forward basis.”

The team also looked at drilling parameters and removed some self-imposed limitations, resulting in performance improvements, he said.

“The previous single-day 24-hour rate in the second quarter was 6,600 ft in a 24-hour period, and just last week this drilling team surpassed 7,800 ft in a 24-hour period,” Derek Rice said. As the team gets more hands-on moving forward, more efficiency and operational gains are expected, he added.

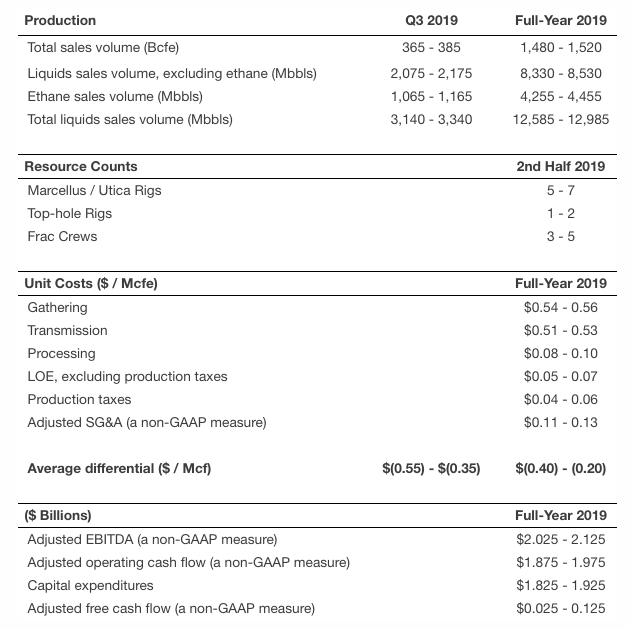

News on steps taken so far at EQT were delivered along with the company’s second-quarter 2019 earnings. The company reported sales volumes of 370 Bcfe, up from 363 Bcfe a year earlier. But the average realized price of $2.59 per Mcfe was down from $2.81.

The company generated $444 million net cash provided by operating activities, down from $637 million a year ago.

EQT spud 26 wells in the second quarter, including four each in the Ohio Utica and West Virginia Marcellus with the rest in Pennsylvania Marcellus. Plans are to spud 32 wells in the third quarter, most of which will be in the Pennsylvania Marcellus but the count is forecast to double to eight in the Utica.

Tudor, Pickering, Holt & Co. analysts said updated guidance is expected in the coming months.

“We continue to see 2020 as the inflection point for improvements to take effect, with our modeled $1.2 billion maintenance capex budget giving credit for 50% of D&C/ft savings with the balance materializing in 2021,” analysts said in a note.

EQT has suspended guidance beyond its 2020+ outlook.

Velda Addison can be reached at vaddison@hartenergy.com.

Recommended Reading

CrownRock Offloads Oxy Shares Two Weeks After Closing $12B Deal

2024-08-15 - Underwriters of the offering agreed to purchase CrownRock’s Occidental stock at $58.15 per share, which will result in approximately $1.719 billion in proceeds before expenses.

ISS, Glass Lewis Push Crescent, SilverBow Shareholders to Vote for Merger

2024-07-19 - Proxy Advisory firms Institutional Shareholder Services and Glass Lewis also recommend that Crescent Energy shareholders vote for the approval of the issuance of shares on Crescent Class A common stock.

Halliburton Sees NAM Activity Rebound in ‘25 After M&A Dust Settles

2024-07-19 - Halliburton said a softer North American market was affected by E&Ps integrating assets from recent M&A as the company continues to see international markets boosting the company’s bottom line.

Archrock Offers $500 Million in Secure Notes for TOPS Deal

2024-08-12 - Archrock is raising debt and selling equity to pay for its $983 million acquisition of Total Operations and Productions Services.

Permian Consolidation Piques Interest in Drill-to-earn Opportunities

2024-08-14 - Drill-to-earn arrangements have been utilized in the Permian for years in the forms of joint ventures, farm-outs and other customizable agreements.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.