(Source: Shutterstock.com)

[Editor’s note: A version of this story appears in the August 2020 edition of E&P. Subscribe to the magazine here.]

This is the third article of a three-part series outlining why oil and gas industry companies should look externally for technology solutions. Part 1 discussed the merits of technology scouting. Part 2 provided examples of promising external technologies. This part explains how to find relevant external technologies and interact with early-stage companies.

There are four primary sources of innovation: universities, national laboratories, corporations and startup companies (Figure 1). There are relevant technologies in all four of these areas. Still, for the reasons outlined below, most companies in the petroleum industry should concentrate their technology scouting efforts in two areas: sourcing technologies from established companies in other sectors and accessing technologies developed by startups.

Technologies developed within universities and national laboratories

Universities and national laboratories have robust research programs that yield a substantial amount of intellectual property. However, universities and national laboratories are not set up to directly commercialize their discoveries. Instead, they license their innovations to startups or established companies. Many of the leading universities and research laboratories have long-standing relationships with the petroleum industry, and the largest oil and gas producers and oil service companies have the internal resources to pursue technology licensing arrangements with these research entities. However, for most other oil and gas companies, it is far simpler to interact with the startup companies commercializing university and national laboratory research.

Technologies developed by established companies in other industries

Regardless of the industry, almost every established company has an internal R&D program. Corporate R&D is inherently focused on the needs of the parent company, and yet the resulting innovations routinely have broader applicability.

For example, the leading construction equipment companies have developed proprietary coatings to protect the underside of their heavy equipment, and these coatings also have oil and gas industry applications. In the health care arena, numerous medical devices must be sterilized in autoclaves between uses. The leading medical device manufacturers have developed proprietary polymers and electronics that will tolerate repeated autoclaving under elevated temperatures. Some of these high-temperature polymers and electronics also have wellbore applications.

Under a nondisclosure agreement, companies in other industries will usually share information about their proprietary technologies. The legal personnel who manage these intellectual property portfolios and the researchers leading the corporate R&D programs frequently participate in conferences unique to their industries. Contact information for these critical legal and R&D personnel can usually be obtained from the conference organizers.

Technologies developed by startup companies

Universities and national laboratories routinely license their technologies to startups. On occasion, large companies also will license specific technologies to startups spun off from the parent company.

The venture capital (VC) model for funding startups was developed and refined in the U.S. in the 1940s. This innovative approach for funding early-stage companies took off in the 1960s in places such as Silicon Valley. For about 30 years, early-stage American companies received most of this VC. Research by the Center for American Entrepreneurship shows that, as recently as the late 1990s, American companies received 90% of the global VC dollars. However, this has materially changed. Today American companies receive only 50% of worldwide VC dollars—entrepreneurship is increasingly global.

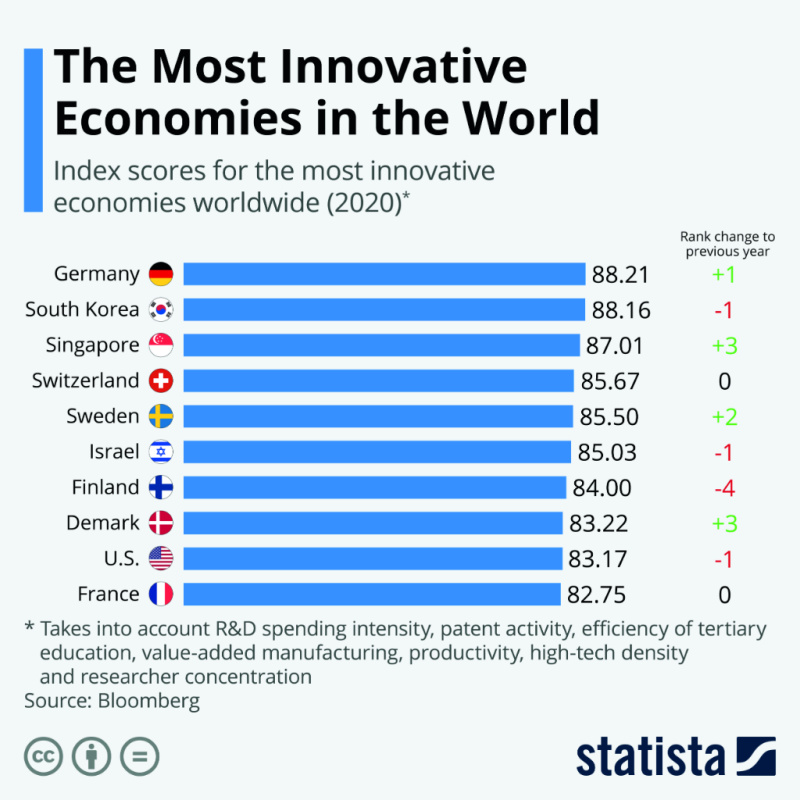

Figure 2 is a Statista ranking of the most innovative countries in the world using data from Bloomberg. Numerous organizations produce similar comparisons. The absolute rankings are not that important; the key point is the similarity in the country scores. None of the 10 leading countries in this figure has a material advantage over the other nine countries, which highlights another important point, namely that a comprehensive technology scouting program must have a strong international component.

Locating relevant startup companies

Fortunately, finding relevant startups is the same regardless of the company’s location. Entering keywords into search engines and scrolling through countless pages of results is the least efficient method. A more productive approach is to focus on the uses of the underlying technologies. For example, high-temperature sensors having potential oil industry applications also will be useful in the aerospace, automotive and even the medical device arena. A productive way to find these sensor startups is to scrutinize the accelerators, incubators and events unique to the aerospace, automotive and medical device industries.

For example, the Airbus BizLab is a global accelerator fostering startups having aerospace-related technologies in areas such as communications, electronics, metallurgies, sensors and software. The Starburst Accelerator also provides similar services to aerospace startups. In the automotive industry, there are multiple accelerators including Startup Autobahn, BMW Startup Garage, Future Mobility and the Honda Xcelerator. In the medical device industry, Johnson & Johnson has a top-notch business accelerator called JLabs.

Every year there are hundreds of startup competitions. Some of these competitions will attract startups across the technology spectrum, while other events are highly focused on just one type of technology. Rather than taking note of only the winning companies at these startup competitions, it is essential to review the solutions offered by every competing company or, at least, the finalists. The names of the competitors and occasionally even detailed information about their technologies can usually be found on the event website or in the conference agenda.

Setting expectations when working with startups

Successfully interacting with startup companies is far different from working with large oil and gas producers or oil service companies.

The management team in a startup will usually consist of only a few individuals who will be simultaneously involved in developing their core product or service, filing patents, fundraising, hiring staff, moving to a new office space or dealing with potential customers. Consequently, these management teams are often unable to devote significant time to any single task, including responding to product inquiries. Because of these workforce and time constraints, most startups do not have the ability to simultaneously engage with multiple, large oil and gas producers and oil service companies. As a result, there is a significant, first-mover advantage for oil industry firms that can successfully find and collaborate with the most promising early-stage technology companies.

Universities, national laboratories, companies in other industries and startups represent a vibrant source of innovation.

Except for a few places in the world, startups generally have access to financing and do not need equity funding from the oil and gas industry. However, these early-stage companies are almost uniformly interested in opportunities to pilot test or field trial their technologies.

If a startup has received funding from a VC firm, this is advantageous for two reasons:

- Prior to investing, the VC will validate the startup’s intellectual property portfolio; and

- The VC will continually prod the start- up to commercialize its technology, which means the startup will be more responsive to commercial inquiries.

Conclusion

Universities, national laboratories, companies in other industries and startups represent a vibrant source of innovation. By following some basic guidelines, oil and gas producers and oil service companies of all sizes can access these external technologies. This type of technology outreach is particularly attractive now because of low oil and gas prices and constrained petroleum industry R&D budgets.

Recommended Reading

Dividends Declared in the Week of July 22

2024-07-25 - Second quarter earnings are underway, and companies are declaring dividends.

Endeavor Energy Founder Autry Stephens Dies at 86

2024-08-16 - Stephens created a legacy in the Permian Basin that Endeavor said will continue to shape the future of the company.

Viper Energy Offers 10MM Shares to Help Pay for Permian Basin Acquisition

2024-09-12 - Viper Energy Inc., a Diamondback Energy subsidiary, will use anticipated proceeds of up to $476 million to help fund a $1.1 billion Midland Basin deal.

Dividends Declared in the Week of July 15

2024-07-18 - Here is a selection of dividends declared in the week of July 15 for upstream, midstream and service and supply companies.

Dividends Declared Sept.16 through Sept. 26

2024-09-27 - Here is a compilation of dividends declared from select upstream, midstream and service and supply companies.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.