Multiple rigs are shown in the Permian Basin. (Source: GB Hart/Shutterstock.com)

EOG Resources Inc. said May 7 its shift to so-called “double-premium” wells is contributing to improved results as the Houston-based oil producer increases productivity and picks up exploration efforts.

The target, which focuses on wells that yield a 60% direct after-tax rate of return (ATROR) at $40/bbl WTI and $2.50 Henry Hub, is double the previous minimal sought-after return.

EOG’s chairman and CEO, Bill Thomas, said the shift helped drive the company to record returns during first-quarter 2021. Notable achievements include an adjusted net income of $946 million, up from $318 million a year earlier, plus a quarterly record of more than $1 billion in free cash flow and an indicated annual total cash return to shareholders of $1.5 billion.

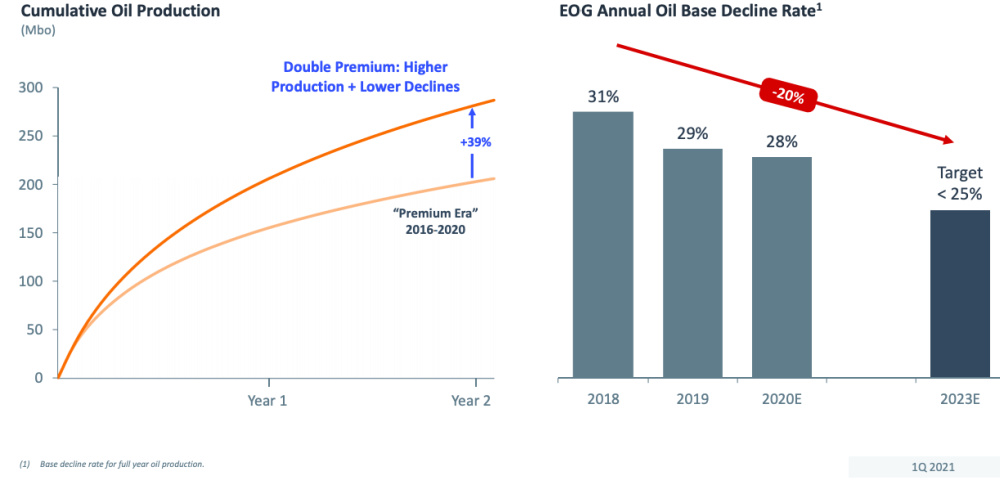

“As we drill more double premium wells, we expect our performance will continue to improve, our decline rate will flatten, our breakeven oil price will decline, our margins will expand, and the potential for free cash flow will increase substantially,” Thomas said during an earnings call on May 7.

With assets spanning the U.S., including the Permian Basin and Eagle Ford, EOG said it has more than 5,700 double premium locations, which it equates to over 10 years of drilling inventory.

In 2020, EOG completed 290 double premium net wells. The company said it plans to complete about 375 this year, lowering WTI breakeven for more than 10% return on capital employed.

Prior to the shift, an oil price of about $80 was required to reach that level, but that has since fallen, said Ezra Yacob, EOG’s president.

“That price is just $50 and we’re not stopping there. We expect it will continue to fall as our well level returns improve,” he said. “The impact of reinvesting at higher returns is also showing up in our free cash flow performance. We more than doubled the dividend over the last four years and improved our balance sheet, reducing net debt by nearly $3 billion.”

CFO Tim Driggers added that since the shift to premium, EOG has retired bond maturities totaling about $2 billion. The company’s plans are to retire another $1.25 billion in 2023 when the bond matures.

The focus on higher-quality assets comes as oil and gas prices improve following a dismal 2020 with pandemic-driven demand loss and oversupply.

RELATED

EOG Resources First-quarter Profit Surges as Oil Prices Rebound

Marathon Oil, Apache First-quarter Profit Beats Estimates

Continental Resources Posts First Profit Since Pandemic

Diamondback Energy Tops Profit Estimates on Higher Crude Prices

Pioneer Natural Resources More than Doubles Profit in First Quarter

EOG’s average crude prices, for example, rose to $58.02/bbl in the first quarter, up from $41.81 in fourth-quarter 2020, contributing about 60% of the $1.40 earnings per share increase.

Total production, however, dropped to about 778,900 boe/d—courtesy of downtime related to Winter Storm Uri—from the prior quarter’s 801,500 boe/d, though still above the guidance midpoint.

Quarterly oil production of 431,000 bbl/d was above guidance. Going forward, EOG said it plans to maintain oil production at about 440,000 bbl/d as it continues efforts to lower the base decline rate, reduce well costs by 5% and test across high-impact oil plays among other goals.

The double-premium strategy is also rooted in innovation, exploration and drilling teams focused on adding value by driving enhanced efficiencies.

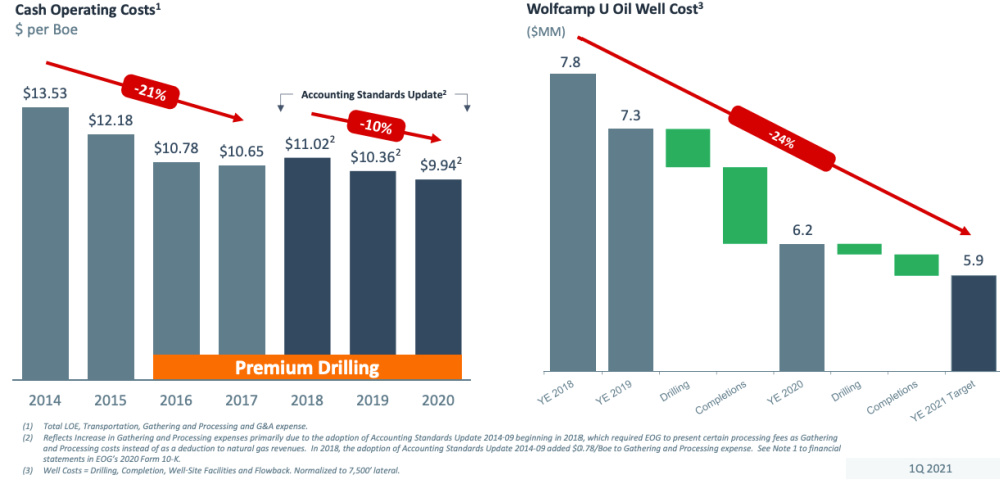

COO Billy Helms highlighted some of the company’s efforts. These included moving to larger wellpads and using “super-zippers,” a completion technique crews began experimenting with in 2019 that has lowered well costs.

“This practice involves using a single spread of pressure pumping equipment to complete four or more wells on a single pad. We split the equipment’s capacity in half, simultaneously pumping on two wells while conducting wireline operations on the remaining wells,” Helms explained. “We piloted and perfected super-zipper logistics in our Eagle Ford play and the collaboration between operating areas has accelerated its adoption throughout the company.”

In instances where four wells aren’t feasible for a single pad, engineering teams are devising new ways to put the technique into practice, he added.

Sustainable well cost reductions combined with technology applications not only lead to well productivity gains but also enable EOG to move some existing inventory into the double-premium category, Yacob said.

So, what does the shift mean for the remaining non-premium inventory?

“We’re always high-grading our portfolio and divesting of those properties with minimal double premium potential remaining,” said Ken Boedeker, executive vice president of E&P for EOG. “We’ve actually sold about 7 billion in assets over the last 10 years, and we will continue to high-grade our assets as we see the market giving them fair value.”

On the growth side, bolt-on acquisitions near existing developments and exploration efforts also provide opportunity. Such efforts are underway in the U.S. and abroad.

EOG has allocated about $300 million for exploration this year following a 2020 pullback due to the COVID-19 pandemic and the price downturn. The company’s executives said they are drilling exploration wells at some prospects and appraisal wells at others.

The company is also looking to replicate shallow-water success offshore Trinidad and Tobago in Australian waters, where EOG recently acquired a stake in the Beehive oil prospect.

“The attractive thing about Australia is not only does it fit into our experience level from operations and a technical perspective,” Yacob said, “but it has many offtake and oilfield service availability there and of course, the low cost of entry and an exciting amount of upside in the prospect.”

RELATED: EOG Resources Strikes Deal for First Australian Venture

EOG said it remains focused on adding low decline, high impact plays to increase returns, regardless of growth rate.

“When you’re reinvesting in higher return opportunities and adding lower-cost reserves, you’re driving down the cost base of the company year after year,” he said, “and that’s essentially what translates into our corporate financials and allows us to lower that price required for a double-digit ROCE every year.”

Recommended Reading

VTX Energy Quickly Ramps to 42,000 bbl/d in Southern Delaware Basin

2024-09-24 - VTX Energy’s founder was previously among the leadership that built and sold an adjacent southern Delaware operator, Brigham Resources, for $2.6 billion.

E&P Highlights: Sept. 23, 2024

2024-09-23 - Here's a roundup of the latest E&P headlines, including Turkey receiving its first floating LNG platform and a partnership between SLB and Aramco.

US Drillers Cut Oil, Gas Rigs for Fifth Week in Six, Baker Hughes Says

2024-09-20 - U.S. energy firms this week resumed cutting the number of oil and natural gas rigs after adding rigs last week.

Western Haynesville Wildcats’ Output Up as Comstock Loosens Chokes

2024-09-19 - Comstock Resources reported this summer that it is gaining a better understanding of the formations’ pressure regime and how best to produce its “Waynesville” wells.

August Well Permits Rebound in August, led by the Permian Basin

2024-09-18 - Analysis by Evercore ISI shows approved well permits in the Permian Basin, Marcellus and Eagle Ford shales and the Bakken were up month-over-month and compared to 2023.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.