NGL transport led the way as Energy Transfer enjoyed a strong Q4 earnings report. (Source: Shutterstock)

Energy Transfer reported higher volumes across all segments in fourth-quarter 2022, while notching records in NGL fractionation and transportation and midstream throughput.

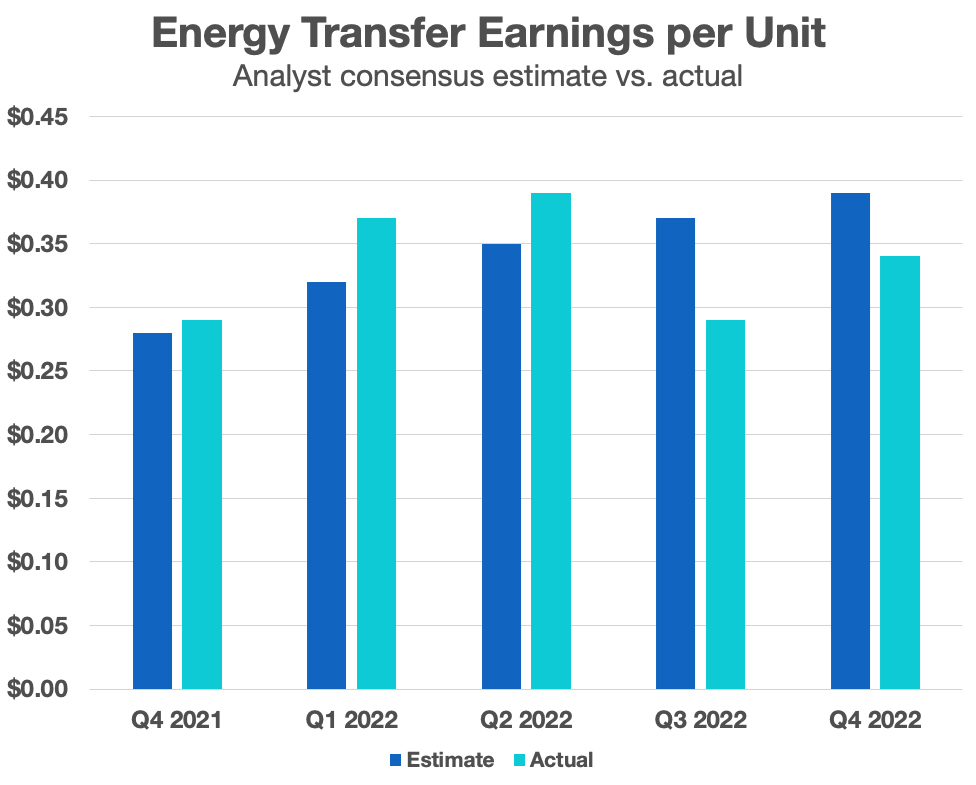

Net income for the quarter was $1.16 billion, or 34 cents/unit, which was up 25.4% year-over-year (yoy), but came up short of analysts’ consensus estimate of 39 cents/unit. Net income for the year totaled $4.76 billion, down 13.1% yoy.

Quarterly revenues totaled $20.5 billion, up 9.9% yoy, but also below the consensus estimate of $24.8 billion. Full-year revenue jumped 33.2% yoy to $89.88 billion.

The company’s stock price was $13.19 at midday on Feb. 16, up 24 cents from its open.

Energy Transfer’s full-year 2022 EBITDA of $13.1 billion set a record for the company. Fourth-quarter EBITDA of $3.44 billion surpassed the same period in 2021 by 22.3%.

Business segments

The company’s NGL and refined products transportation and services unit led the way in the quarter with EBITDA of $928 million, up 25.6% yoy, on revenues of $5.75 billion.

NGL transportation volumes set a record of 1.97 MMbbl in the quarter, up 5.3% yoy. Higher volumes from the Permian Basin and Eagle Ford shale accounted for the increase. NGL exports from the Nederland, Texas terminal set a record in 2022 and higher volumes are expected in 2023, co-CEO Tom Long told analysts during the earnings call on Feb. 15.

Ethane shipments alone totaled 43 MMbbl in 2022 and are expected to reach 60 MMbbl in 2023.

“In total, we continue to export more NGL than any other company or country with our percentage of worldwide NGL exports remaining at approximately 20% of the world market,” Long said.

Midstream EBITDA totaled $632 million in the quarter, up 15.5% yoy. Gathered natural gas volumes soared 31.6% yoy to 19.43 MMBtu/d. Long said there was increased throughput across operating regions, and the acquisitions of the Enable Oklahoma Intrastate Transmission system assets and the Woodford Express pipeline contributed to that total.

Quarterly EBIDTA rose sharply yoy in the transportation and storage segments for intrastate (58%) and interstate (24.4%). Crude oil transportation was up 7.1% yoy.

Energy Transfer has a number of projects in the works. Among them:

- Lake Charles LNG in Louisiana, which has taken longer to get to final investment decision than expected but is buttressed by growing global gas demand;

- Optimization at the Marcus Hook, Pa. terminal to add ethane refrigeration and storage capacity;

- Additional fractionation capacity at Mont Belvieu, Texas to bring the total to 1.15 MMbbl/d;

- The Bear Gas Processing Plant in the Permian Basin, a 200 MMcf/d facility expected to come online in second-quarter 2023; and

- The Gulf Run pipeline, which will boast a capacity of 1.65 Bcf/d and move gas to the Golden Pass LNG plant on the Gulf Coast.

- Long also made it clear that Energy Transfer would continue to grow.

“We don’t know when the next project will be announced coming out of the Permian Basin,” he told analysts. “We do believe it will be ours when it happens.”

Recommended Reading

Patterson-UTI Boosts Bottom Line with OFS Acquisitions

2024-08-06 - Less than a year out from the closing of its merger with NexTier and its acquisition of Ulterra Drilling Technologies, Patterson-UTI is taking strides not to be the latest has-been.

Patterson-UTI Updates Drilling Rig Status

2024-09-10 - Patterson-UTI’s monthly announcements represent the company’s average number of revenue-earning drilling rigs in the U.S.

Wood Mackenzie: OFS Costs Expected to Decline 10% in 2024

2024-07-30 - As service companies anticipate a slowdown in Lower 48 activity, analysts at Wood Mackenzie say efficiency gains, not price reductions, will drive down well costs and equipment demand.

Seadrill to Adopt Oil States’ Offshore MPD Technology

2024-09-17 - As part of their collaboration, Seadrill will be adopting Oil States International’s managed pressure drilling integrated riser joints in its offshore drilling operations.

E&P Highlights: Aug. 12, 2024

2024-08-12 - Here’s a roundup of the latest E&P headlines, with a major project starting production in the Gulf of Mexico and the latest BLM proposal for oil and gas leases in North Dakota.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.