In the Oct. 21 release, Apache said it believes that Alpine High offers attractive returns in the current environment and is currently assessing the addition of drilling and completion activity in its 2022 capital budget. (Source: Apache Corp.)

Altus Midstream Co. agreed to an all-stock business combination with Midland, Texas-based EagleClaw Midstream on Oct. 21.

The combination creates the largest pure-play midstream company in the Permian Basin—one of the world’s most prolific hydrocarbon basins, providing the scale, operational capabilities and fully integrated service offerings necessary for long-term success, according to Jamie Welch, president and CEO of EagleClaw.

“This transaction is a transformative event for all parties and their respective stakeholders,” Welch commented in the release.

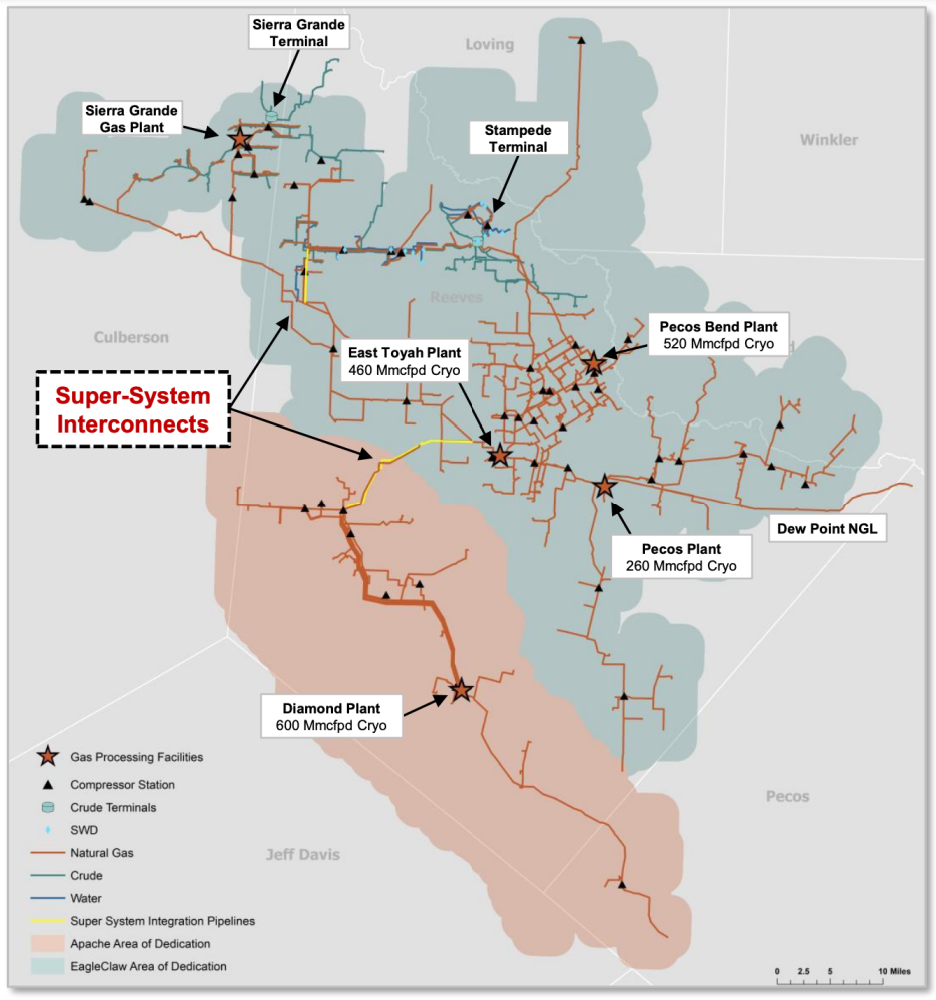

Independent and financially backed by Blackstone and I Squared Capital, EagleClaw Midstream is the largest private gathering and processing pure-play business strictly focused within the Permian’s southern Delaware Basin.

Meanwhile, Altus Midstream was formed in 2018 through the business combination of a Kayne Anderson special purpose acquisition company and Apache Corp.’s midstream business that included gathering, processing and transmission assets serving the U.S. shale producer’s operations in the Delaware Basin. Altus also currently owns equity interests in four Permian-to-Gulf Coast pipelines.

The combined operations of Altus and EagleClaw include approximately 2 Bcf/d of state-of-the-art natural gas processing capacity strategically located near the Waha Hub in West Texas. As measured by processing capacity, Altus will become the largest natural gas processor in the Delaware Basin and third largest across the entire Permian Basin, according to the company release.

“The pro forma enterprise is well positioned to capitalize on accelerating activity in the Delaware Basin with expanded processing and transportation capabilities for all three streams from the wellhead to end markets,” Welch continued.

The new management team of the combined company will be led by Welch. The pro forma enterprise will also maintain its headquarters in Midland with corporate leadership in Houston and operate under a new name, which will be finalized prior to closing.

Additionally, Apache will continue as a natural gas gathering and processing customer of the combined company and recently executed an amendment to its commercial agreements with Altus that incentivizes activity in the Delaware Basin.

“This transaction builds scale and liquidity, which will be important for Altus’ evolution as a publicly-traded entity,” commented John Christmann, president and CEO of APA Corp., parent company of Apache Corp.

Apache currently owns approximately 79% of Altus. The company, along with Blackstone and I Squared, have agreed to customary lock-up provisions of their respective holdings for 12 months post-closing. However, a limited exception will permit Apache to sell up to 4 million shares until three-months post-closing provided it invests the first $75 million of proceeds in its Alpine High development activity in the Delaware Basin over 18 months.

“The reduction of APA’s ownership in Altus is a logical continuation of our ongoing work to streamline our portfolio and unlock the value of our midstream infrastructure,” Christmann continued.

“We have great confidence in the new management team and look forward to remaining a key customer of Altus for many years to come,” he added.

As part of the transaction, Altus said it will combine with BCP Raptor Holdco LP, the parent company of EagleClaw Midstream, which includes EagleClaw Midstream Ventures, the Caprock Midstream and Pinnacle Midstream businesses, and a 26.7% interest in the Permian Highway Pipeline.

Apache field personnel working at Altus Midstream facilities will also be offered employment with the pro forma enterprise, the release said.

The pro forma company will operate in two segments: Midstream Logistics (formerly the Gathering and Processing business) and Pipeline Transportation. The expected 2022 EBITDA split between the two segments is approximately 65% Midstream Logistics and 35% Pipeline Transportation.

The company expects to achieve at least $50 million of annual EBITDA synergies, with total integration spend of less than $100 million spread over the next three years.

The transaction is expected to close during first-quarter 2022, following completion of customary closing conditions, including Altus shareholder approval and regulatory reviews. Apache agreed to vote in favor of the transaction, according to the release.

Credit Suisse Securities (USA) LLC is financial adviser to Altus Midstream and Bracewell LLP is serving as its legal adviser. Goldman Sachs is serving as financial adviser to Apache. Barclays, Citi, Greenhill, Intrepid and Jefferies are financial advisers to BCP, Blackstone and I Squared, and Vinson & Elkins LLP and Sidley Austin are legal advisers to the three companies.

Recommended Reading

Lake Charles LNG Selects Technip Energies, KBR for Export Terminal

2024-09-20 - Lake Charles LNG has selected KTJV, the joint venture between Technip Energies and KBR, for the engineering, procurement, fabrication and construction of an LNG export terminal project on the Gulf Coast.

Entergy Picks Cresent Midstream to Develop $1B CCS for Gas-fired Power Plant

2024-09-20 - Crescent will work with SAMSUNG E&A and Honeywell on the project.

FERC Chair: DC Court ‘Erred’ by Vacating LNG Permits

2024-09-20 - Throwing out the permit for Williams’ operational REA project in the mid-Atlantic region was a mistake that could cost people “desperately” reliant on it, Chairman Willie Phillips said.

Diamondback to Sell $2.2B in Shares Held by Endeavor Stockholders

2024-09-20 - Diamondback Energy, which closed its $26 billion merger with Endeavor Energy Resources on Sept. 13, said the gross proceeds from the share’s sale will be approximately $2.2 billion.

Optimizing Direct Air Capture Similar to Recovering Spilled Wine

2024-09-20 - Direct air capture technologies are technically and financially challenging, but efforts are underway to change that.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.