“We’ve found a way to kind of crack that code and really maybe extract the maximum benefits that we can from the ground in Ohio.” Rob Brundrett, president of the Ohio Oil & Gas Association. (Source: Hart Energy)

Buoyed by a decade of investment in the oil and gas industry, Ohio’s production is up and expectations are high that even better numbers are around the corner.

Even though Ohio has sometimes been “the forgotten child” in the region, the state has plenty to offer, including the “holy trinity of hydrocarbons,” Rob Brundrett, president of the Ohio Oil & Gas Association, said during an update on the state of the Utica Shale at Hart Energy’s DUG Appalachia Conference on Nov. 29. “We’ve got oil, natural gas, natural gas liquids and crude oil. So we have them all right here in the Utica and the state of Ohio.”

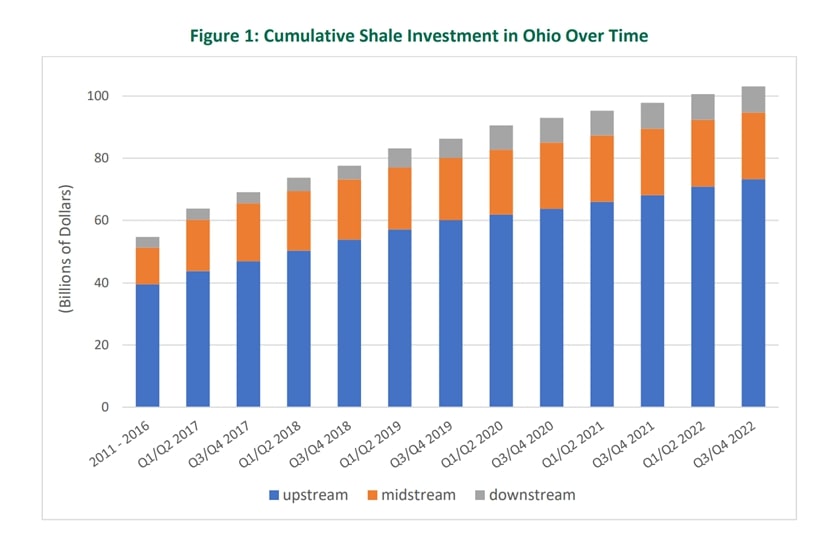

Those resources have drawn in more than $100 billion in investments over the past decade, with the lion’s share going to the upstream sector, he said.

“Most of this is private money. It’s not government subsidies. We’re very fortunate to have a strong thriving industry,” Brundrett said. “If you look at the producer side, about $70 billion of that is coming straight from the producers in the state of Ohio, and that money is going into eastern Ohio. And I can’t again overstate the importance of that kind of infrastructure and that kind of investment in really one of the poorest regions in our state.”

The state itself embraced its role as an energy producer during that time.

With no corporate income tax, the climate is favorable for businesses, he said, and the regulatory environment is straightforward.

More than 4,000 permits have been issued for lateral shale wells, and more than 3,000 horizontal shale wells are producing, he said.

“We’ve got a really good regulatory environment that’s allowed oil and gas to sort of thrive on the edge of this play,” he said.

Brundrett said the industry-friendly environment is one of the big draws Ohio offers.

“Just last year, the state of Ohio declared natural gas a green energy. It’s more of a declaratory statement than anything, but I think it doubles down on where the state’s elected officials are when it comes to the production and use of natural gas,” he said.

And Ohio has a fully integrated oil and gas industry with production, processing and refining in the state, he said.

“Little brother”

In 2012, he said, the industry was excited about the possibilities and potential across the Utica Shale, which stretches from New York state in the north to northeastern Kentucky and Tennessee in the south, according to the Energy Information Administration (EIA).

Ohio’s seemed to have potential even as neighboring states — and the Marcellus Shale — got most of the attention.

“Ohio is on the edge, so it’s kind of like the younger sibling of the other two. And so maybe the projections weren’t as great for Ohio as what they were for West Virginia and Pennsylvania,” Brundrett said.

But 10 years later, he said, investments in the state are paying off.

“We’ve always had a strong gas play and we’ve continued to have a strong gas play,” he said.

But the play’s oil production is also picking up.

Between first-quarter of 2022 and the second-quarter of 2023, oil output increased by 51%, he said.

Overall Ohio oil production is also up. In second-quarter 2023, the state produced a total of 6.9 MMbbl of oil. That compares with second-quarter 2022 production of 4.9 MMbbl — a 40% increase, according to Ohio Department of Natural Resources data.

Looking at expected future production, Brundrett believes Ohio’s contribution to the energy mix will continue to grow as the industry continues to improve its understanding of the source rocks and better parse data.

“I think we’ve all learned a ton over the last decade on how best to drill and how best to finish these wells to get the … maximum for your investment. And I think it’s starting to finally really pay off in the state of Ohio, especially with natural gas liquids,” he said. “We’ve found a way to kind of crack that code and really maybe extract the maximum benefits that we can from the ground in Ohio, which is really, really exciting. And we’re probably going to see, obviously, a lot more investment in Ohio based on these results.”

RELATED

EOG: Emerging Ohio Utica Combo Play Competes with Premium Portfolio

Recommended Reading

Hunt Oil Offloads LNG Interests Via Indirect Sale to Aramco

2024-09-16 - Hunt Oil is selling 15% interest in Peru LNG to MidOcean, an LNG company managed by EIG in which Aramco is an investor.

Kimmeridge Signs Natgas, LNG Agreement with Glencore

2024-09-19 - Under the terms of the agreement, set to be finalized later this year, Glencore will purchase 2 mtpa of LNG from Commonwealth LNG and source natural gas from Kimmeridge Texas Gas.

TotalEnergies Signs LNG Agreements in China, Turkey

2024-09-19 - TotalEnergies announced two separate long-term LNG sales in China and a non-binding agreement with Turkey’s BOTAŞ in an effort to grow its long-term LNG sales.

Woodside Reports $2.3B in Deals, Agreements for Scarborough Project

2024-08-27 - Woodside Energy said the Scarborough project was 67% complete at the end of first-half 2024, with first LNG cargo expected in 2026.

Exclusive: Aethon M&A Gambit Pays Off with Woodside-Tellurian Deal

2024-08-07 - Aethon Energy, already a large LNG feed-gas supplier, sees Woodside’s acquisition of Tellurian and the Driftwood LNG project as a validation of the natural gas industry’s prospects.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.