(Source: Hart Energy; Shutterstock.com)

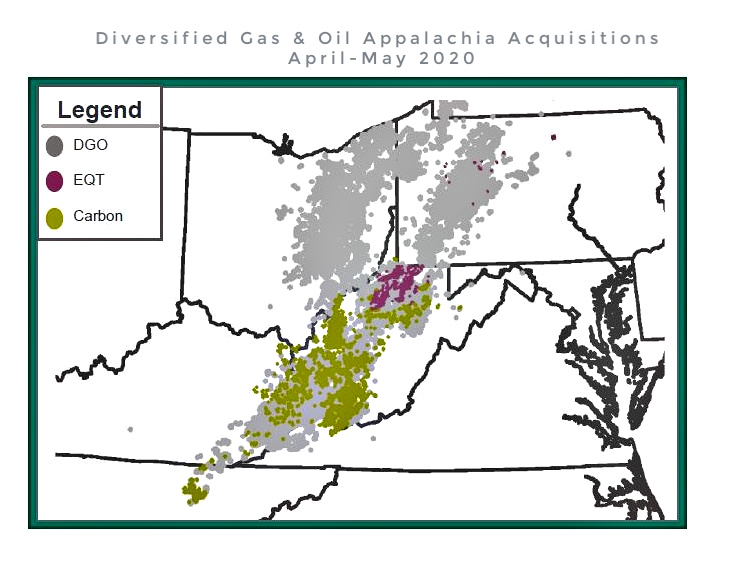

Operator Diversified Gas & Oil Plc (DGO), with its love of code names for transactions, disclosed May 11 what it dubbed “Project Teaberry”—a previously announced acquisition of assets from Carbon Energy Corp. and a second deal with EQT Corp. totaling $235 million.

Diversified, which previously has used “Project 007” to discuss its acquisitions, agreed to purchase upstream and midstream Appalachia assets from EQT for initial consideration of $125 million. The deal includes contingency payments of up to $20 million to EQT.

In April, Diversified said it had reached an agreement with Carbon Energy to buy Appalachian assets for $110 million, not including potential contingency payments.

Much of the Carbon Energy assets overlap geographically, primarily in West Virginia and Pennsylvania. Diversified also added that the Carbon Energy assets are in proximity to its existing footprint and can be managed by the company’s existing personnel without need for additional general and administrative expenses.

The EQT assets will add about 8,500 net acres and include an estimated 48 million boe of reserves with a PV-10 value of $185 million. Primarily a conventional asset operator, DGO also noted about 10% of the wells included in the EQT deal are unconventional and prospective for the Marcellus and Utica shales.

Overall, the two deals will also add about 7,000 net operated wells and an average 18,100 boe/d in production the company.

Additionally, the deals are set to expand Diversified’s midstream network with the acquisition of 4,900 miles of midstream infrastructure from Carbon plus EQT and its affiliate Nytis LLC. Gathering and pipeline services along the Cranberry Pipeline, included in the Carbon transaction, generate about $12 million of third-party revenue. Diversified will also add two operational gas storage fields in West Virginia with 3.5 Bcf of capacity.

Diversified, which trades on the London-based AIM stock exchange, plans to pay for the two deals with an $85.8 million equity issuance and $162.5 million in debt. The company added that excess cash proceeds from its debt and equity issuances would either fund future acquisitions or be used to reduce debt.

Diversified said the transactions pay about 3.4x of adjusted EBIDTA, within its criteria of paying less than 4x EBITDA. One such past acquisition includes a deal with EQT in 2018 where Diversified purchased about 2.5 million net acres for $575 million.

The EQT and Carbon deals would have an effective date of Jan. 1.

Recommended Reading

AI & Generative AI Now Standard in Oil & Gas Solutions

2024-07-25 - From predictive maintenance to production optimization, AI is ushering in a new era for oil and gas.

ProFrac, IWS Taking the Garbage Out of Oilfield Data Transfer

2024-07-16 - ProFrac and Intelligent Wellhead Systems’ MQTT protocol promises to speed up communications at the frac site, not only by saving costs but laying the foundation for future technological innovations and efficiencies in the field, the companies tell Hart Energy.

Give Us a Signal: Tech Firm Ups E&P Coverage in Remote Plays

2024-07-02 - As E&Ps struggle to transmit information over public networks in out-of-the-way oil and gas basins, tech firm Digi is working to improve its reception.

Safety First, Efficiency Follows: Unconventional Completions Go Automated

2024-07-18 - The unconventional completions sector has seen a tremendous growth in daily stage capacity and operation efficiencies, primarily driven by process and product innovations in the plug and perf space.

SLB Collaborates with Aker BP on AI-driven Digital Platform

2024-07-24 - SLB and Aker BP’s partnership will build a digital platform that will benefit Aker BP’s subsurface workflows to lower costs, shorten planning cycles and increase crude production.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.