After closing of the acquisition from Devon Energy, Kalnin Ventures will take over as the largest natural gas producer in the Barnett Shale. (Source: Shutterstock.com)

[Editor’s note: This story was updated at 4:25 a.m. CT Aug. 11 to include comment from Kalnin Ventures CEO.]

Devon Energy Corp. has again fiddled with the timing of its Barnett Shale exit, saying on Aug. 4 that it will complete its deal with Kalnin Ventures LLC and backer Banpu Pcl of Thailand earlier than expected.

The deal, potentially worth up to $830 million, will now close at the beginning of October rather than the end of the year. The Oklahoma City-based E&P company said it expects to receive a net cash payment of $300 million at closing on Oct. 1, which will coincide with a special dividend to shareholders worth $100 million.

The companies had most recently postponed finalizing the deal until Dec. 31. The transaction, first announced in December 2019, was originally meant to close in the second quarter before a destructive oil price war and global pandemic threw the industry off-kilter.

Christopher Kalnin, CEO of BKV Corp. and Kalnin Ventures, told Hart Energy his company wanted to move up the timetable for closing with Devon.

“The main rationale for the timing change is that we have become more bullish on the gas markets for Q4 2020 and FY 2021,” Kalnin said.

Devon said it has already collected a $170 million deposit. However, Banpu’s costs at closing will be adjusted based on Devon’s cash flow from the Barnett Shale asset since Sept. 1. The company may also have to pay contingency fees of up to $260 million based on future commodity prices.

Devon would receive the contingency payments at either a $2.75 Henry Hub natural gas price or a $50 WTI oil price. The payment period has a term of four years beginning Jan. 1, 2021. Payments are earned and paid on an annual basis.

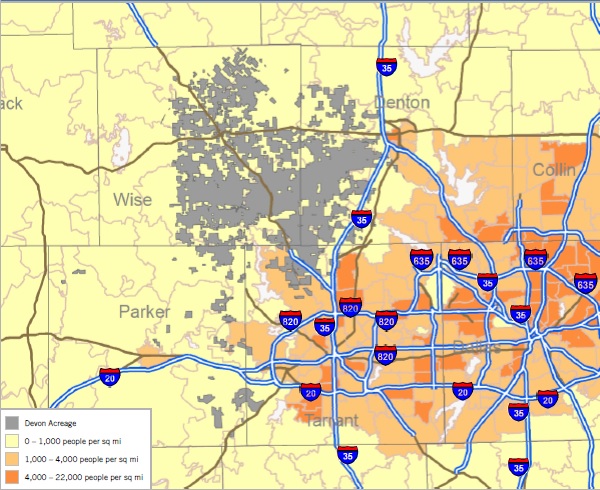

Devon’s footprint in the Barnett Shale includes more 320,000 gross acres and 4,200 producing wells. After closing, Kalnin Ventures will take over as the largest natural gas producer in the Barnett Shale.

Net production from the Barnett properties averaged 597 MMcfe/d in third-quarter 2019. At year-end 2018, proved reserves associated with the properties amounted to about 4 Tcfe. The transaction has an effective date of Sept. 1, 2019.

Devon’s presence in the Barnett over the past 18 years began with the acquisition of Mitchell Energy & Development Corp. for $3.5 billion in cash and stock. The original deal included 2.5 Tcfe of proved reserves plus midstream assets valued at $800 million to $1 billion.

Devon also said Aug. 4 that it’s moving forward with cost reductions of $300 million by the end of the year. Key to its plans is the repurchase of $1.5 billion of its outstanding debt, which will save about $75 million on an annual run-rate basis. The company plans to evaluate various transaction structures to achieve its targeted debt reduction, including open-market purchases and tender offers.

“As we navigate through the challenges presented by COVID-19, Devon continues to transform how it operates. The next phase of our strategic plan is to take meaningful and decisive steps to sustainably improve our cost structure and reduce debt,” Devon CFO Jeff Ritenour said in a statement. “The aggressive reduction of cash costs across our organization is expected to drive down per-unit expenses by an incremental 10% versus our second-quarter 2020 results.”

The company also announced a special dividend of $0.26 per share of Devon common stock resulting in a payment of $100 million to shareholders. The dividend, payable on Oct. 1, is a supplement of the company’s regular quarterly dividend of $0.11 per share.

“With the visibility, we have on the early closing of the Barnett transaction, I am excited to announce that we are returning a portion of the proceeds to our shareholders in the form of a $100 million special dividend,” Dave Hager, president and CEO, said in a statement. “The decision to issue a special dividend is consistent with our disciplined strategy and demonstrates our firm commitment to return increasing amounts of cash directly to our shareholders.”

Recommended Reading

Diversified, Partners to Supply Electricity to Data Centers

2025-03-10 - Diversified Energy Co., FuelCell Energy Inc. and TESIAC will create an acquisition and development company focused on delivering reliable, cost efficient net-zero power from natural gas and captured coal mine methane.

Winter Storm Snarls Gulf Coast LNG Traffic, Boosts NatGas Use

2025-01-22 - A winter storm along the Gulf Coast had ERCOT under strain and ports waiting out freezing temperatures before reopening.

US Oil, Gas Rig Count Unchanged This Week

2025-03-14 - The oil and gas rig count was steady at 592 in the week to March 14. Baker Hughes said that puts the total rig count down 37, or about 6% below this time last year.

BKV Positions Itself to Meet Growing Power, CCS Demand

2025-02-26 - Electricity needs across the U.S. are expected to soar as industrial and manufacturing facilities, data centers and other consumers crave more power. BKV is exploring ways to bridge the gap between demand and energy supply.

Huddleston: Haynesville E&P Aethon Ready for LNG, AI and Even an IPO

2025-01-22 - Gordon Huddleston, president and partner of Aethon Energy, talks about well costs in the western Haynesville, prepping for LNG and AI power demand and the company’s readiness for an IPO— if the conditions are right.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.