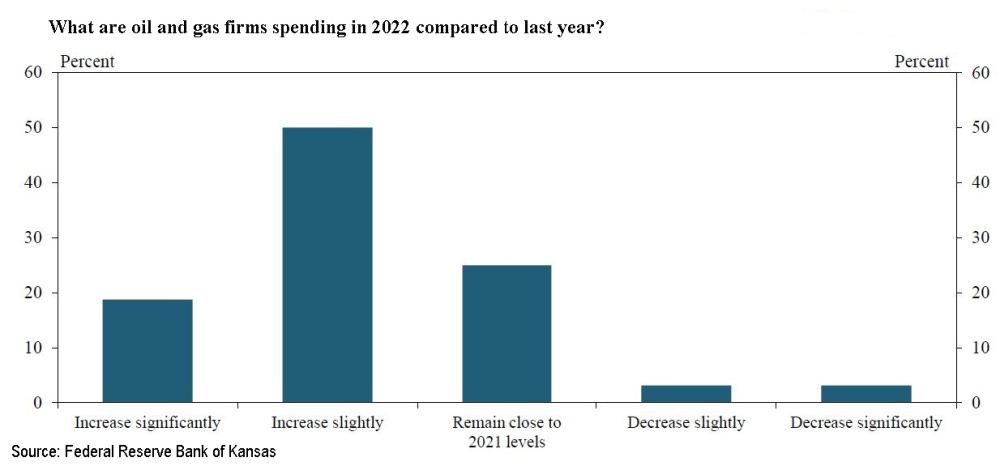

Oil and gas companies also reported feeling the effects of inflation, with about 50% of firms in a survey by the Federal Reserve Bank of Kansas expecting a slight increase in spending and another 20% a significant increase. (Source: Shutterstock.com)

Suddenly E&Ps are seeing variables that go up and not just down.

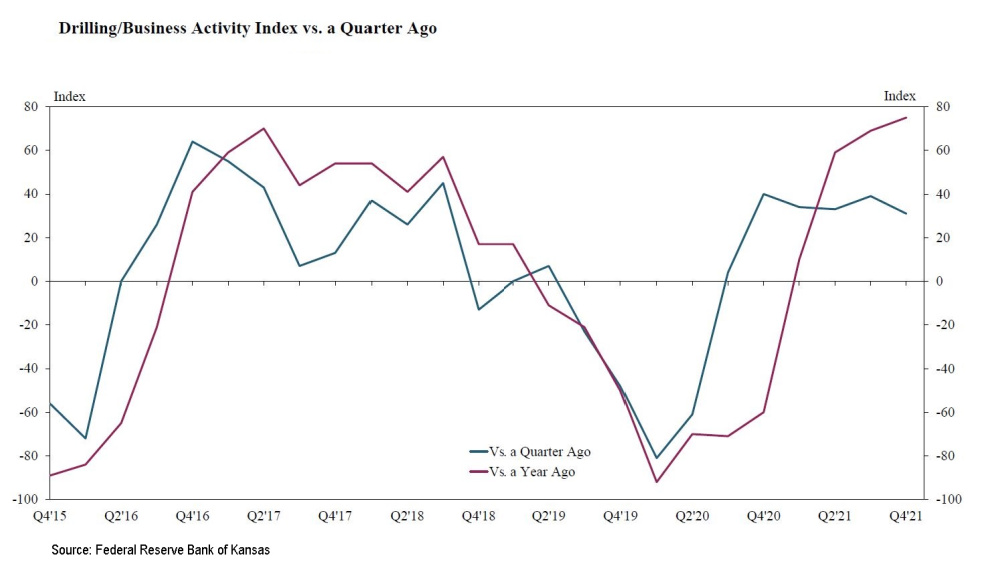

E&Ps are facing inflation, management teams expect oil prices to rise and overall the oil and gas industry saw a moderate expansion of activity to close out fourth-quarter 2021, according to a newly released survey of producers in several states including Colorado, Oklahoma, Wyoming and northern New Mexico.

Results of the survey by the Federal Reserve Bank of Kansas released Jan. 7 also show activity continued to outpace levels from a year ago.

“District drilling and business activity continued to grow through the end of 2021,” said Chad Wilkerson, Oklahoma City Branch executive and economist at the Kansa Fed. He added in the release that oil and gas companies’ revenues have risen along with higher wages and benefits for workers.

Survey respondents also said they plan to spend more in 2022 than they did last year, citing inflation and possible increased activity.

Oil and gas firms reported that oil prices needed to average $73/bbl for a substantial increase in drilling to occur, and natural gas prices at $4.27 per million Btu.

In December, WTI prices were forecast to average $66.42/bbl in 2022, according to the U.S. Energy Information Administration. As of Friday morning, 2022 prices for the remainder of the year were averaging about $75.40.

Among 33 respondents, the average price for WTI predicted: $73/bbl.

Confidence in WTI pricing increased despite perceived late-year setbacks amid fears of the Omicron variant of COVID.

“Oil price expectations increased to the highest levels since the survey began this question in 2017,” the Kansas Fed reported. However, natural gas price expectations declined.

Price Expectations Rise for Oil, Flatten for Natural Gas |

||||

| 4Q 2018 | 4Q 2019 | 4Q 2020 | 4Q 2021 | |

WTI Price Expecations |

||||

| Six months | $54 | $60 | $48 | $75 |

| One year | $59 | $62 | $52 | $78 |

| Two years | $61 | $65 | $56 | $78 |

Natural Gas Price Expectations (MMBtu) |

||||

| Six months | $3.23 | $2.69 | $3.03 | $3.97 |

| One year | $3.06 | $2.38 | $2.68 | $3.66 |

| Two years | $3.12 | $2.49 | $2.88 | $3.92 |

Some producers predicted that the scarcity of investment would lead to shrinking supply, echoing comments made by Hess Corp. CEO John Hess in December.

“Investment is the greatest challenge the oil industry faces today,” Hess said at the World Petroleum Congress.

One executive told the Fed survey, similarly, that “there is not enough investment for replacement barrels [of oil]. Supply may shrink and demand will stay similar or even grow.”

Robert Yawger, director of Energy Futures at Mizuho Securities USA LLC, said in a Jan. 7 report that crude oil storage has dipped lower for six consecutive weeks. The U.S. also sold off about 18 million barrels of oil from the Strategic Petroleum Reserve in December.

“In the U.S., EIA crude oil storage slipped to 417.9 million [barrels] in the report as of Wednesday, the lowest level since 413.9 million in the week to September 17, and dangerously close to the three year low of 409.9 million,” Yawger wrote.

Other respondents, who were surveyed between Dec. 15 and Jan. 3, said that capital discipline will continue to moderate activity.

“Pressure to moderate spending from investors,” an executive said.

Firms also said they were feeling the effects of inflation, with about 50% of firms expecting a slight increase in spending and another 20% a significant increase. About one-quarter of firms expected 2022 capital spending to remain close to 2021 levels.

“Several firms reported that inflation has driven higher capital spending costs from services and materials,” according to the survey. “Other [respondents] reported increased capital spending plans to expand drilling and production.”

“Inflation is hitting the equipment purchases for new wells,” an executive surveyed told the Fed.

The survey also reaches out to producers in Nebraska and western Missouri.

Other selected comments from energy executives:

Demand

- “If demand picks up from drop in COVID cases, I think oil prices [will increase] within a few months. Then demand destruction kicks in and more EVs are sold and by mid to end of decade we see gasoline demand actually start to plateau and even drop.”

- “Expect prices to remain steady due to supply constraints resulting from underinvestment coupled with disproportionate demand increase.”

- “OPEC + overhang and demand uncertainties suggest neutral to moderate approach to growth.”

Natural gas

- “Plenty of gas in the USA; European and Asian demand will fall off significantly.”

- “Inability to permit enough LNG to balance the market in the U.S. Persistent disparity between U.S. and global spot prices.”

- “Gas will be favored internationally for its cleaner footprint. Underspending will keep prices up.”

Supply

- “Not enough new reserves are being drilled to replace existing production.”

- “There is not enough investment for replacement barrels [of oil]. Supply may shrink and demand will stay similar or even grow.”

Recommended Reading

Worley CEO: Combative Politics Complicating Regulations, Incentives

2024-09-20 - From LNG to direct air capture, Chris Ashton, CEO of Worley, said economic incentives aren’t “on a pace and scale that are necessary for us to move things forward.”

RNG Producer OPAL Recovers 25% of Capex from Tax Credits Sale

2024-09-19 - OPAL Fuels, which sold tax credits for $11.1 million, indicated that its capex for the Emerald RNG facility is approximately $45 million, according TPH & Co.

New FERC Commissioner Calls Slow Permitting Process ‘Huge Problem’

2024-09-17 - FERC Commissioner David Rosner said the commission is aware that the permitting process is too slow overall at Gastech Houston 2024.

Industry Warns Ruling Could Disrupt GoM Oil, Gas Production

2024-09-12 - The energy industry slammed a reversal on a 2020 biological opinion that may potentially put an indefinite stop to oil and gas operations in the Gulf of Mexico—by December.

What's Affecting Oil Prices This Week? (Sept. 9, 2024)

2024-09-09 - Within the context of lower oil prices and disappointing economic data, members of OPEC+ have decided to delay the unwinding of voluntary cuts, which were expected at the end of September.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.