(Illustration by Rovert D. Avila)

[Editor's note: A version of this story appears in the October 2020 issue of Oil and Gas Investor magazine. Subscribe to the magazine here.]

A numismatist walks into Nymex and buys 10 contracts—each for 1,000 barrels—for May delivery of WTI to Cushing. At settlement on April 20, it loses $92,490.

Okay, futures aren’t bought by actually walking into Nymex. But Robert Mish and his firm—he’s president; Susan Mish is office manager—are among the many who lost that day when holding contracts for May delivery of WTI.

One trader reported being unable to sell his contracts—the brokerage app couldn’t comprehend a sub-$0 trade.

Harold Hamm, founder of Continental Resources Inc., estimates producers alone lost $500 million, factoring for the “calendar month average” used in their contracts. The month’s average fell $3/bbl.

Bloomberg and other media estimate traders lost $500 million.

Looking over Nymex trading activity for April 20 to April 21, the Mishes, who are coin dealers (physical, not Bit), found peculiar trading by London-based Vega Capital London Ltd.

Their firm, Menlo Park, Calif.-based Mish International Monetary Inc., filed a civil suit in federal court in Chicago—where Nymex owner CME Group is headquartered—in August against Vega and John Does 1-100, alleging a scheme to manipulate the WTI market.

The Mishes didn’t name the other members of the class action, stating “the class is so numerous” it’s impractical. The members are, essentially, everyone holding May WTI paper on April 20— that is, themselves “and all others similarly situated.”

Except, of course, the defendants, they state.

‘A lawful market’

Trading of WTI for May delivery closed on April 20 at a negative $37.63/bbl. The price had plummeted $58.17 during the day.

The Mishes allege Vega et al., beginning April 20 and into April 21, “acted to intentionally manipulate” the May contract price. On April 20, they “worked together to aggressively sell” May-delivery barrels to depress the price.

But why? Before April 20, Vega traders had purchased trading at settlement (TAS) contracts to buy the May oil at whatever the April 20 closing price would be.

“In other words, Defendant Vega had a large financial incentive for the May 2020 contract to trade and ultimately settle at the lowest possible price on April 20, 2020,” the Mishes state.

In the last minutes of trading, the price declined more than $25 a barrel. Meanwhile, on April 21, the contract closed at $10.01/bbl—“a more than $47-a-barrel increase from” the Monday close.

They posited that, because of Vega et al., they “were deprived of a lawful market.” Vega’s sole director, Adrian Spires, et al. “intended to affect or acted recklessly with regards to affecting the [May contract price] and engaged in overt acts in furtherance of such intent.”

They added that Vega’s work “was spectacularly successful.”

‘A huge profit’

Except for an admin email address, Vega did not provide contact information at its website; there is only the message “Website Currently In Development.” It did not respond to Investor’s email request for an interview.

The Illinois court docket didn’t show in early September any activity yet on the case since it was filed.

According to the Australian Financial Review (AFR), Spires went to work in 1994 after high school—Latymer Upper School on King Street along the Thames and tucked between Kensington Palace and Wimbledon.

His job was trading futures—back while it was still done as public outcry in pits—at the London International Financial Futures and Options Exchange (LIFFE). (LIFFE became part of Intercontinental Exchange ICE in 2014 and is now ICE Futures Europe.)

In 2016, Spires and a colleague he had met at a subsequent job at Tower Trading Group formed Vega. The partner, Tommy Gaunt, quit in 2019, according to AFR.

Vega didn’t respond to AFR’s emails for comment either. The journal added that the Vega “website has remained under construction since Vega was founded.”

“Vega’s selling collided with an exodus of buyers,” AFR reported. “… Oil’s dive into negative territory meant that Vega ended up being paid for many of the contracts it sold as the market was falling—and for all those it bought at the -US$37 settlement price via TAS, locking in a huge profit.”

The windfall to Vega is unusual, AFR added: “In a trillion-dollar energy ecosystem dominated by the likes of BP [Plc], Glencore [Plc] and Royal Dutch Shell [Plc], prop firms [like Vega] are bit players.”

‘Teeth gnashing’

Leah McGrath Goodman wrote for Institutional Investor on May 6, “Inside the Biggest Oil Meltdown in History,” that the first $0 trade was at 2:08 p.m. Eastern.

That was about the time oil producers based in Houston, Dallas, Oklahoma City, North Dakota and West Texas were wrapping up lunch.

In that minute, 83 contracts traded at $0, “touching off an unprecedented freefall into negative territory,” she wrote.

“What took place instead [of a typical Nymex afternoon] was 20 minutes of unalloyed chaos, followed by another 24 hours of teeth gnashing, confusion and bewilderment as the market collapsed… .”

This had never happened “in a standardized, exchange-traded contract,” she added, “let alone the most heavily traded benchmark crude oil contract in the world, representing the lifeblood of the world’s industrialized nations.”

Many Oil and Gas Investor sources had considered in early April—many had even expected—that May oil could trade at $0. None spoke aloud of the possibility of less than zero—as if speaking the words was akin to saying “Voldemort.”

Goodman reported in early May, though, that energy economist Ed Morse, Citigroup’s global head of commodities research, had said the words out loud in early April, projecting sub-$0 WTI trading was a possibility.

And CME Group itself provided notice to traders on April 8 that “if major energy prices continue to fall towards zero in the coming months,” it wrote, it had a plan “to support the possibility” of sub-$0 trading to “enable markets to continue to function normally.”

This plan CME had for handling sub-$0 trading was to allow the May WTI contract to fail, based on the April 8 statement. If WTI declined to average between $8 and $11, it would switch to the Bachelier model.

It usually uses the Geometric Brownian Motion and Black-Scholes models, each of which is derived from Louis Bachelier’s “The Theory of Speculation” PhD thesis (1900).

An awkward description of the Bachelier model is “animal spirits on a random walk.” Or “market-price changes gone wild.” That was Nymex on April 20.

‘The system failed’

Continental’s Hamm wrote to the CFTC on April 21 that there wasn’t anything normal about that plan. “Not only did WTI crude futures trade negative, they settled at a bizarre -$37.63.” In effect, “The system failed.”

(On April 8, CME had added in its statement that it would send one-day notice before implementing the Bachelier model. It gave that notice on April 21, stating it would go into effect at the close of trading April 22 “and will remain in place until further notice.”)

In its April 8 notice, CME Group had emphasized—it used the all caps in “not”—that “negative strike prices will NOT be listed in any [WTI or other] energy markets until this model change is made per the plan above and may not occur even if the modelling changes do happen.”

The plan it referenced as being “above” was that it would provide one-day notice of the model change.

‘Somebody knew something’

Just before noon on April 20, CME Group reminded WTI traders that sub-$0 was a possibility. Well, that “sent the May contract plummeting to approximately $4 a barrel,” Hamm wrote to the CFTC.

In the last 22 minutes of trading that day, the price fell nearly $40/bbl. In three minutes alone—from 1:24 p.m. to 1:27 p.m. CDT—it fell some $25.

Hamm wrote to the CFTC that the combination of the odd CME announcement the morning of April 20, the CME’s “sudden change in computer models during a time of increased volatility” and the rapid price drop “strongly raises the suspicion of market manipulation or a flawed new computer model.

“The sanctity and trust in the oil- and all commodity-futures markets are at issue as the system failed miserably and an immediate investigation is requested and, we submit, is required,” he concluded.

He told Investor in August, “Was there insider dealing? Somebody knew something that allowed them to create that [pricing failure].”

He welcomed the Mishes’ lawsuit. “Seeing this play out, this is going to be a real eye opener into exactly what happened and how [Vega et al.] took that much money from U.S. producers in one day.”

(Editor’s note: In the interview, which is part of Hart Energy’s DUG Midcontinent virtual-conference proceedings, Hamm stated “$500 billion.” His office clarified to Investor that he meant $500 million.)

‘Dysfunctional farmers market’

Hamm’s use of “bizarre” isn’t the first time that descriptive was attached to a Nymex event. Nymex itself was virtually destroyed in 1976 by the Great Potato Scandal. Goodman wrote a book about it, “The Asylum: The Renegades Who Hijacked the World’s Oil Market” (2011).

Nymex didn’t trade energy futures at the time. It traded butter, cheese, eggs and such, including potatoes.

The story is that McDonald’s had picked Idaho potatoes for its fries and McDonald’s was becoming a behemoth potato buyer. J.R. Simplot was the “Idaho potato king” and wanted Nymex to trade potatoes based on the large Idaho market and not the small Maine-potato market.

A farmer and grade-school dropout, self-made billionaire Simplot saw Nymex as a back-alley type of operation fraught with market manipulation. Meeting with impasse through normal channels to achieve change, he shorted the over-sold Maine potatoes and didn’t deliver them.

The litigation notes around it are summarized as “when the sellers of almost 1,000 contracts failed to deliver approximately 50 million pounds of potatoes, resulting in the largest default in the history of commodities futures trading in this country.”

(The newly formed CFTC fined Simplot $50,000 and forbade him from trading for six years.)

Lots became of that—a whole book worth of events as Goodman documented in hers—but Nymex was forbidden by the CFTC from trading in any other futures unless it was something it had traded before.

The exchange’s newly named, 27-year-old chairman—in her book, Goodman described him as the “unlikely savior of a dysfunctional farmers market”—found it had once traded a heating-oil contract. So it had that.

In the 1980s, President Reagan deregulated crude oil and, then, natural gas. Nymex became papered in energy futures. It IPOed in 2006 and, eventually, CME Group, its long-time rival over in Chicago, came to own it.

‘Every single barrel’

Goodman wrote in her May article, “In all, 14,913 crude oil contracts exchanged hands at negative prices on April 20, according to CME data.”

She got in touch with Michel Marks, “the father of the Nymex crude oil futures contract” that was born in 1983 and who was the 27-year-old who became chairman of Nymex in 1977.

“Black swans are hard to anticipate,” Marks told her. “The bottom line is to maintain a fair and orderly market.”

CME Group Chairman and CEO Terry Duffy told CNBC on April 22 that “The futures market worked to perfection.”

He added that it had announced two weeks earlier that it was “going to allow negative price trading. So this was no secret that this was coming at us.

“We have to do things to allow the market to go to a price that is reflecting the fundamentals of the product.”

As for Hamm’s complaint with the CFTC, Duffy told CNBC that Hamm and others should have “stood in there and taken every single barrel of oil if it was worth something more” and he questioned why they didn’t.

“The true answer is it wasn’t at that point in time,” he said.

‘No convergence with reality’

But what happened on April 20 on Nymex didn’t actually represent “the fundamentals of the product” in the real market, others have pointed out.

AFR wrote that, “Whether Vega’s windfall was a result of savvy trading, blind luck or something else, the idea that a relative minnow could have such a profound impact calls into question [Duffy’s] declaration that the futures market had ‘worked to perfection.’”

Michael Lynch, president, Strategic Energy and Economic Research, wrote in a Forbes blog the morning of April 21, “The oil industry faces a serious challenge, but this bizarre occurrence does not reflect the reality of the physical market.

“Storage is filling but still available, and the crisis is on the paper market, not the ‘real’ world.”

Goodman wrote that a former exchange official told her “The futures market demonstrated no convergence with the physical market that day. It demonstrated no convergence with reality.”

CFTC Commissioner Dan Berkovitz stated on May 7, “The CFTC must determine the causes of this unprecedented price movement and divergence from physical markets...

“A critical question that both the [CFTC] and the CME must answer is the extent to which trading in WTI on that date resulted from unique circumstances or actions or [if it] reflects structural issues with the contract that may persist or recur in the future.”

‘Oversupply of paper’

Berkovitz noted that TAS contracts were among “trades that settled on the penultimate day of trading.”

April 20 came off like having two aces in the hole and seeing three more on the flop. The divergence in the real, versus the paper, market was glaring.

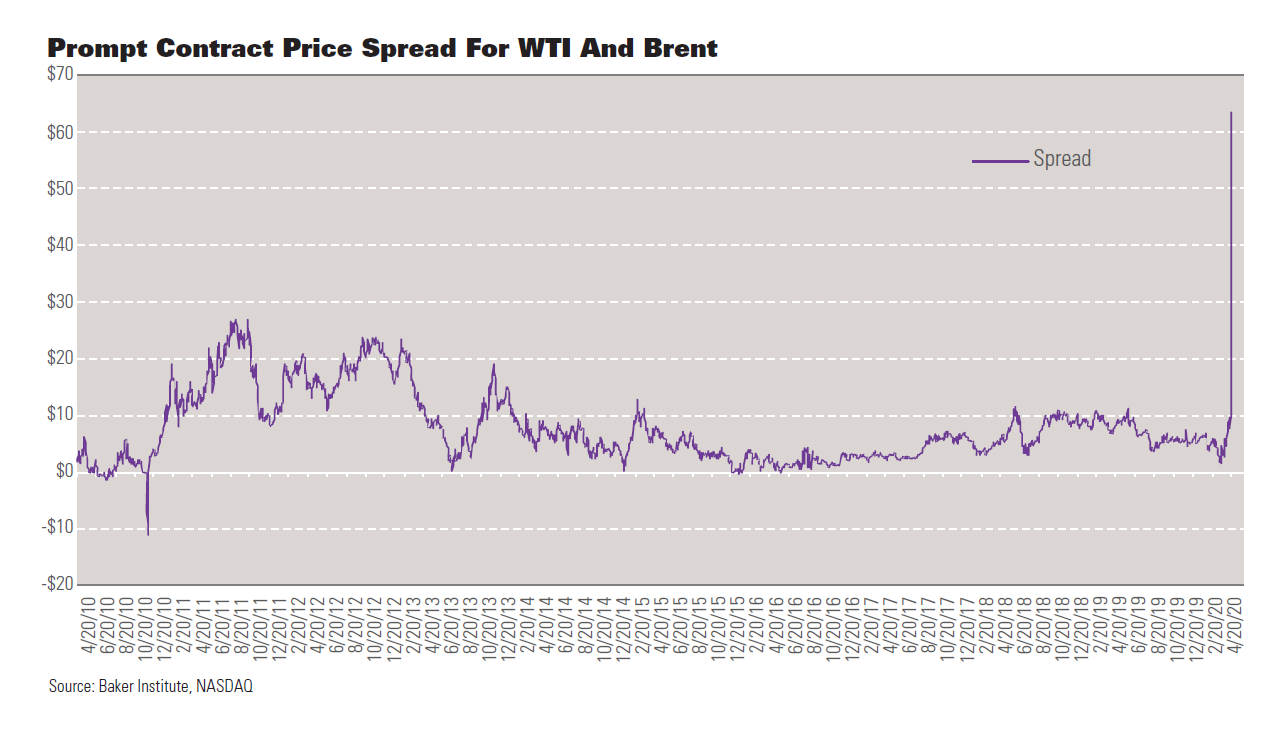

“April 20: WTI At -$37, Brent At $26! What Happened? What Comes Next? The Stories That Will Be Told.” That’s the headline of a Baker Institute blog by Ken Medlock, the James A. Baker III and Susan G. Baker Fellow in Energy and Resource Economics.

The paper market for crude oil is supposed to reflect the real market—the spot price—for crude oil, he wrote. “April 20 revealed something that many people found to be outright unbelievable; the price for May [WTI] collapsed by more than $50/bbl into previously uncharted, negative territory.

“Moreover, WTI disconnected from its typical relationship with Brent and petroleum product prices.”

Gasoline futures remained similar to the spot price but “not WTI. Why?” Everything suggests “a massive oversupply of paper, not physical, oil,” he wrote.

While what regulatory change will result is yet unknown, “The die has been cast for the status quo to, at the very least, be challenged.”

‘Price doesn’t conform’

Berkovitz noted in his May 7 statement that the difference in price between the May and June contracts was $58/bbl, a “mega-contango.” He cited Craig Pirrong, director, energy markets, at the University of Houston’s Global Energy Management Institute.

At Pirrong’s “Streetwise Professor” blog, he titled his April 20 entry “WTI—WTF?” He wrote, “Today was one of the most epochal days in the history of oil trading, which is saying something.”

One trader, “Darrin W.,” replied to Pirrong on April 22, “I can assure you that there was LOTS of manipulation going on. I’ll give you one example: Once the contract went negative, Interactive Brokers traders were trapped because their trading platform wasn’t supporting negative prices.”

Trade orders were getting a “price doesn’t conform” error message, Darrin W. wrote. “Essentially, we were therefore all trapped.” Everyone was “stuck for the open interest.”

He concluded, “That alone is robbery, and it’s just one way in which the markets were being manipulated that day.”

Another of Pirrong’s readers replied that “Cushing means ‘godforsaken place’” and that “I tell my students ‘I’ve been to Cushing, so you don’t have to.’”

Berkovitz chaired a CFTC committee meeting the morning of May 7. The meeting was previously scheduled on another topic. He acknowledged that in his opening comments but added, “before we turn to that, I would like to address what I know is on many members’ minds … .”

The April 20 price decline from $17.73 at open to negative-ver$37.63/bbl at close was a “40 standard deviation event,” he said.

The physical price diverged from the paper price; essentially, the market failed.

‘Not Zoom’

Both Berkovitz and Goodman cited energy economist Phil Verleger, who wrote in an Energy Intelligence article in late April. In it, Verleger, principal, PK Verleger LLC, noted that some of the May WTI contract’s demise could be derived from United States Oil Fund LP (USO) and other ETFs.

Investment in USO shares had been pouring in much like buying “not Zoom” stock in March. In the latter, the ZOOM ticker was held by a virtually defunct company, Zoom Technologies Inc.; the Zoom stock people actually wanted was ZM for Zoom Video Communications Inc.

But the order errors pushed defunct ZOOM from a penny to $60 before the ZOOM ticker was shut down by the SEC on March 26.

Meanwhile, in the case of USO, buyers thought they were buying barrels for cheap and holding them in storage. Plans among those who didn’t understand the stock may have been to sit on the barrels (via the stock) until a better oil-price day.

But USO’s stated MO was to hold only paper barrels—and it was required in its model to buy and dump them each month. Its MO is a public GPS.

Buying the stock on March 10 was only a bet that a May barrel would be worth more on April 10. This past April, it wasn’t.

Before a 1-for-8 reverse split on April 28, USO shares began 2020 at about $12.75. They closed on April 21 at the equivalent of $2.75. Soon after trading the week of April 20, it announced that it would divvy up its funds to invest in more months of futures than in just the prompt month.

The ETF’s sponsor, United States Commodity Fund LLC, has received notices from the CFTC as well as from the SEC.

‘Happy to sell’

Verleger wrote that USO’s May WTI buying through April 10 is why prices for that contract didn’t fall sooner. In USO’s model, it was simply doing what it had told its investors it did—buy a month, then dump the month.

“Producers and traders holding inventories were happy to sell to the fund, no doubt welcoming the opportunity to lock in higher prices before a price collapse that they anticipated,” Verleger wrote.

As soon as April 13, USO was out. But “The USO effect was still there because it pulled in more shorts—that is, it allowed more producers to hedge, leaving the market more exposed to the risk of a squeeze by the shorts, which is what happened.”

Like Hamm and others, Verleger concluded that “The proper functioning of the futures market is critical not just to the oil industry’s future, but to the future of the banking and broader financial system.

“Negative prices cannot be allowed to occur again.”

‘Market was played’

Hamm told Investor, “It usually takes a crisis to show the fundamental good or bad of a market. Certainly that [May contract] did.”

Hamm co-led Platts’ and Argus’ launch this summer of American Gulf Coast Select crude. “It takes the inherent storage issue away,”

he said.

“As long as you have ships that can load with the waterborne barrel, you don’t have the [Cushing] storage overhang issue that these people [on Nymex] played off of.

“Incidentally, storage was never a problem,” he added. “The storage at Cushing was never filled.

“It all had to do with the way the market was played and the skepticism it created and the way they were able to buy all of those positions the day before.”

Recommended Reading

Exxon Surprises with Smaller FPSO for Guyana’s Hammerhead Project

2024-07-19 - Exxon Mobil Corp. announced plans for its seventh development offshore Guyana, Hammerhead, which will add 120,000 bbl/d to 180,000 bbl/d of production capacity starting in 2029.

Petrobras to Add Two FPSOs Offshore Brazil in Second-half 2024

2024-08-12 - Petrobras will bring online 280,000 bbl/d of production capacity in the second-half 2024 with the addition of two FPSOs offshore Brazil.

The EPC Market Keeps Its Head Above Water

2024-08-06 - While offshore investments are rising, particularly in deepwater fields, challenges persist due to project delays and inflation, according to Westwood analysis.

E&P Highlights: Aug. 5, 2024

2024-08-05 - Here’s a roundup of the latest E&P headlines, including new oil discoveries and an implementation of AI technology in operations offshore United Arab Emirates.

E&P Highlights: Sept. 16, 2024

2024-09-16 - Here’s a roundup of the latest E&P headlines, with an update on Hurricane Francine and a major contract between Saipem and QatarEnergy.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.