Crescent brought four new Uinta wells online in the first quarter and 20 in its other play, the Eagle Ford Shale. (Source: Shutterstock)

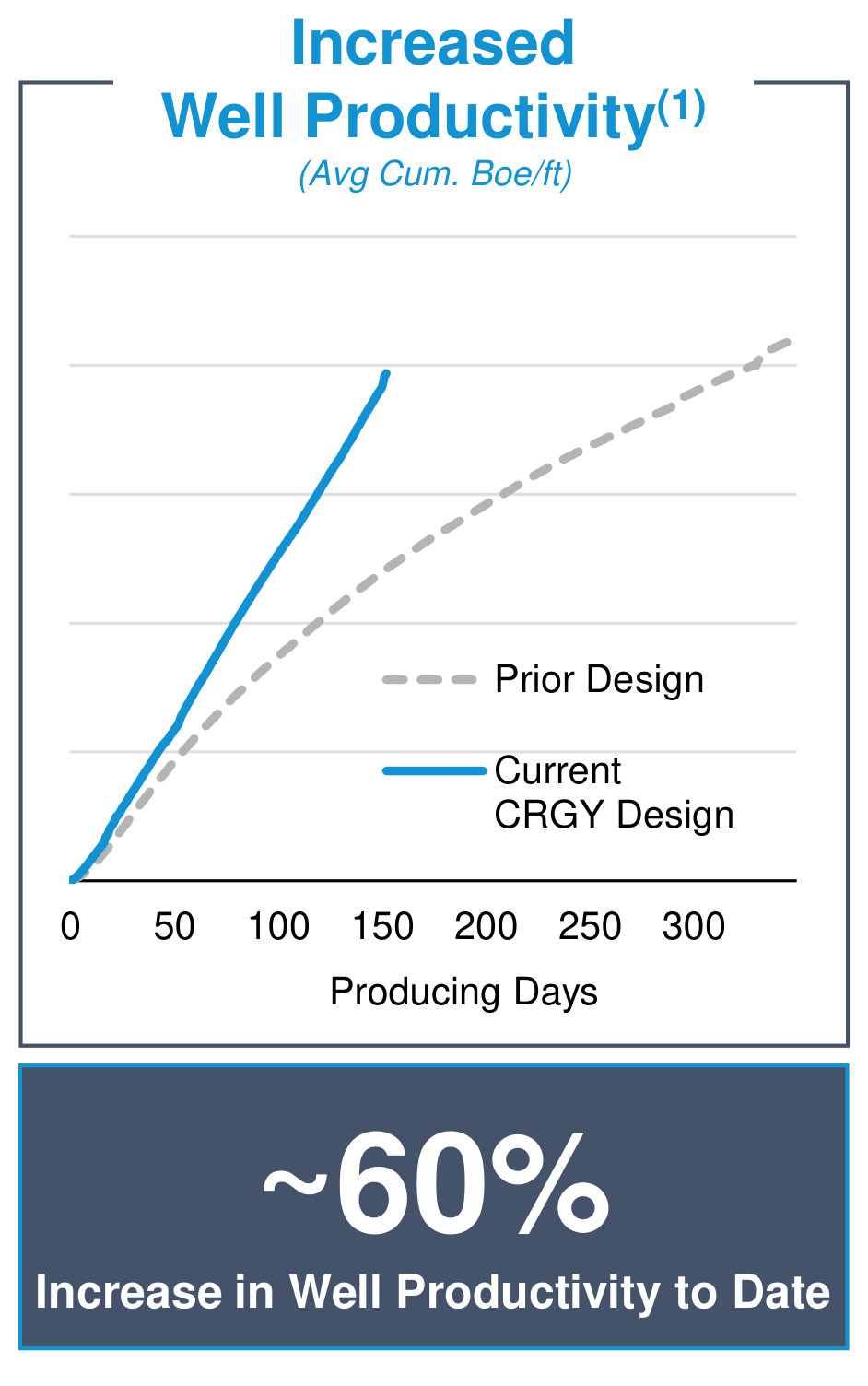

Crescent Energy’s new Uinta Basin completions are showing 60% greater production now that the new-design wells have been online 150 days, the E&P reported May 7.

And the extra oil is “with only minimal increases in our D&C costs,” David Rockecharlie, Crescent CEO, told investors in an earnings call.

A report earlier this year indicated 50% uplift, based on new wells’ output through that time.

“When we acquired this position [in 2022], the only horizontal development on the assets utilized a legacy, smaller completion design with roughly 1,500 pounds of proppant per foot,” Rockecharlie said on May 7.

“As we've implemented our operational approach, we are seeing significantly enhanced returns and improved capital efficiencies through larger completions, which we've doubled to roughly 3,000 pounds per foot.”

Crescent, which operates in Utah’s Uinta as Javelin Energy Partners, was the state’s No. 3 oil producer in January, putting into pipe some 21,000 bbl/d, according to state data.

Crescent brought four new Uinta wells online in the first quarter and 20 in its other play, the Eagle Ford Shale. Its 2024 capex is split 50-50 between the two plays.

Companywide drilling speed has grown 25% from 2022 to 2,000 ft per day, it reported, while completion speed has grown 40% since 2022 to 100,000 bbl/d of fluid pumped.

In full D&C cycle time, the results “save us a couple of days [per] well,” Rockecharlie said. “So a pretty meaningful improvement … over a year ago.”

Meanwhile, well costs have declined 10% to $900/ft per day from 2023, Crescent reported.

‘Supports our optimism’

Based on production growth from both areas, Crescent has increased its 2024 estimated production by 2,500 boe/d to average some 160,000 boe/d this year.

Rockecharlie said of the Uinta Basin results in particular, “Long-term implications for our asset are becoming clearer and clearer over time as productivity remains strong.”

He noted that the findings are still nascent, “but the data supports our optimism about the long-term value creation potential.”

Crescent has one rig drilling in Utah; two rigs, in the Eagle Ford.

It isn’t looking to add rigs or frac spreads, Rockecharlie said, and will return surplus earnings to shareholders instead.

“We would not look to accelerate activity …. I think our basic guidance of a two- to three-rig business today is going to remain intact.”

As for adding more Uinta or Eagle Ford leasehold, Rockecharlie said, “We are constantly in the market and looking for opportunities to invest at attractive risk-adjusted returns.”

Deal-making in the Uinta Basin has been a target of the Federal Trade Commission (FTC) beginning in 2022.

Crescent Energy neighbor XCL Resources has a deal underway to buy fellow operator Altamont Energy, but it is on hold as it awaits FTC approval.

Recommended Reading

Matterhorn Express Ramps Up Natural Gas Flow

2024-10-04 - The Matterhorn Express Pipeline flowed 317 MMcf of natural gas to customers on Oct. 1, according to East Daley Analytics.

Uinta Railroad Up for Review as Supreme Court Term Begins

2024-10-03 - Court analysts say a decision on the proposed Uinta Basin railway, coming next year, could have a major impact on the energy industry.

FERC Sides with Williams Over Energy Transfer in Pipeline Dispute

2024-09-30 - The Federal Energy Regulatory Commission has declared that Williams’ disputed Louisiana Energy Gateway project is a gathering network, not a transport line.

Energy Transfer Leads the Midstream Consolidation Flow

2024-09-30 - Energy Transfer co-CEOs discuss pipeline pain points, needed M&A, regulatory woes and much more in this Midstream Business exclusive.

Gulf Coast Midstream Sets Open Season for Natgas Storage Facility

2024-09-27 - Gulf Coast Midstream Partners, which aims to build the first salt cavern natural gas facility in the Houston area since 2008, will launch a non-binding open season on Oct. 1.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.