Oryx Midstream owns and operates a crude oil gathering and transportation system comprising 2.1 million barrels of storage and about 1,200 miles of in-service and under-construction pipeline in the core of the Delaware Basin. (Source: Oryx Midstream Services LLC)

Upstream producers Concho Resources Inc. and WPX Energy Inc. are cashing in their stakes in the largest privately-held midstream crude operator in the Permian Basin as part of Stonepeak Infrastructure Partners’ multibillion-dollar takeout on April 2 of Oryx Midstream.

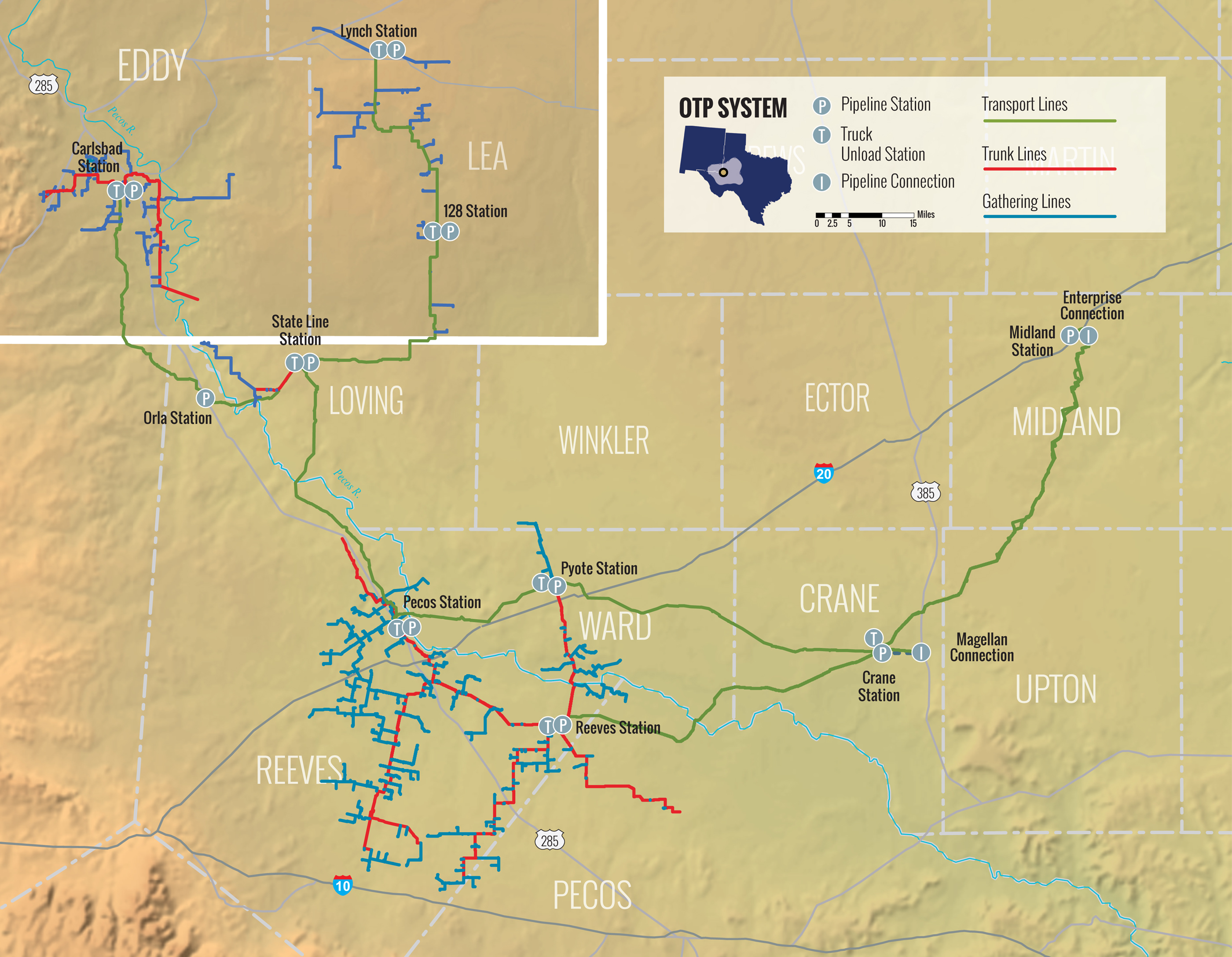

Midland, Texas-based Oryx Midstream owns and operates a crude oil gathering and transportation system—the Oryx I and Oryx II—comprising 2.1 million barrels of storage and about 1,200 miles of in-service and under-construction pipeline. The company’s system spans eight counties in Texas and two in New Mexico, representing a footprint across the core of the Delaware Basin.

Stonepeak, an infrastructure-focused private equity firm, said April 2 it had agreed to buy substantially all of the assets of Oryx for roughly $3.6 billion in cash. Investors in Oryx include affiliates of Quantum Energy Partners, Post Oak Energy Capital, Concho Resources and WPX Energy, according to the Stonepeak press release.

Oryx’s crude oil gathering and transportation system, which is underpinned by nearly one million acres under long-term dedications from more than 20 customers, will represent a platform for Stonepeak to capitalize on growing production in the Permian Basin, said Jack Howell, partner and head of the firm’s energy business.

“Oryx is the most attractive private Permian midstream asset Stonepeak has evaluated and we view it as a strategic platform and a core North American crude infrastructure asset,” Howell said in a statement.

and Eddy and Lea counties, N.M., Oryx is the largest private oil gathering and

transportation business in the Delaware Basin based on dedicated acreage

and gathered volumes. (Source: Oryx Midstream Services LLC)

Commenting on Concho and WPX’s announcement of the transaction, analysts of Tudor, Pickering, Holt & Co. (TPH) said it was positive to see both of the upstream operators bringing forward value from the monetization of midstream assets.

Concho, which owns a 23.75% equity interest in the Oryx I oil gathering and transportation system, will receive roughly $300 million in proceeds from the sale. The sale proceeds combined with the earlier distribution total of about $457 million, representing a 10 times multiple on invested capital of roughly $45 million since December 2015, Concho said.

“The transaction isn’t expected to impact oil realizations or transportation costs as the existing gathering agreement remains unchanged with proceeds expected to repay borrowings outstanding on the company’s credit facility,” TPH analysts said in an April 2 research note. “Equity remains a top pick in the upstream space given the combination of a best-in-class, large-cap company capable of generating material [free cash flow] allowing for accelerated shareholder returns in the future.”

Meanwhile, WPX will receive about $350 million for its 25% equity interest in the Oryx II pipeline, which is under construction in the Delaware Basin. The company is retaining its contractual rights as a shipper on Oryx and plans to deploy proceeds from the transaction to its balance sheet.

The Oryx II transaction is WPX’s second midstream divestiture this year. The company already closed on the previously announced sale of its 20% equity interest in WhiteWater Midstream’s Agua Blanca natural gas pipeline system, of which WPX remains a shipper as well.

Pending the close of the Oryx II sale, WPX said its investments in the Oryx and WhiteWater midstream systems generated about half of a billion dollars in net proceeds this year. The company invested about $125 million in its equity positions in the midstream systems, primarily in 2017 and 2018.

WPX is now reevaluating the timetable for its plan to return capital to shareholders, originally targeted for 2021. Projected free cash flow from WPX’s operations in 2019 may accelerate action, the company said.

“At [the] current strip, we see [the] company generating $450 million to $500 million over the next two years [of free cash flow],” TPH analysts said. “[WPX] remains a top pick in the SMID cap space.”

Upon completion of the remaining part of the Oryx II system under construction, Oryx’s total Delaware Basin transportation capacity will ultimately exceed 900,000 barrels per day and access multiple takeaway options.

According to Howell, Stonepeak’s critical focus will be to continue building Oryx’s service offerings to accommodate growing production through new commercial opportunities across the value chain.

“Our extensive experience in the Permian uniquely qualifies us to help transition Oryx into the next phase of its evolution,” Howell said.

Oryx will retain its name and continue to be headquartered in Midland. Its leadership team, led by Brett Wiggs and Karl Pfluger, will remain in their current roles and are investing alongside Stonepeak in this transaction, according to Stonepeak’s press release.

Barclays, acting through its investment bank, advised Stonepeak Infrastructure Partners on the transaction. A Barclays-led arranger group including Goldman Sachs, RBC Capital Markets and Jefferies LLC have provided a $1.5 billion Term Loan B in support of the transaction, which will include a refinancing of the existing Oryx Southern Delaware Holdings facility and consolidation of Oryx Southern Delaware Holdings and Oryx Delaware Holdings into a single borrower.

Jefferies and Citi were financial advisers to Oryx and its sellers.

Shearman and Sterling LLP and Vinson & Elkins LLP served as legal counsel to Oryx. Stonepeak was represented by Hunton Andrews Kurth LLP and Sidley Austin LLP with regards to the transaction, and Simpson Thatcher & Bartlett LLP its fund counsel. Latham & Watkins LLP represented the lender group.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

VTX Energy Quickly Ramps to 42,000 bbl/d in Southern Delaware Basin

2024-09-24 - VTX Energy’s founder was previously among the leadership that built and sold an adjacent southern Delaware operator, Brigham Resources, for $2.6 billion.

US Drillers Cut Oil, Gas Rigs for Third Week in a Row

2024-10-04 - The oil and gas rig count fell by two to 585 in the week to Oct. 4.

How Liberty Rolls: Making Electricity, Using NatGas to Fuel the Oilfield

2024-08-22 - Liberty Energy CEO Chris Wright said the company is investing in keeping its frac fleet steady as most competitors weather a downturn in oil and gas activity.

US Drillers Add Oil, Gas Rigs for First Time in Four Weeks

2024-10-11 - The oil and gas rig count rose by one to 586 in the week to Oct. 11. Baker Hughes said the total count was still down 36 rigs or 6% from this time last year.

From Exxon to APA, E&Ps Feel Need to Scratch Exploration Itch

2024-08-27 - Exxon Mobil is looking for its “next Permian,” which an executive said could be in Algeria.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.