(Source: Hart Energy)

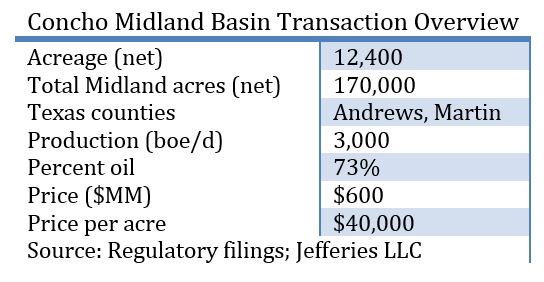

Concho Resources Inc. (NYSE: CXO) folded 12,400-net acres in Andrews and Martin counties, Texas, into its expansive Midland Basin position to end July in a deal that expands its long-lateral inventory.

Concho paid $600 million for leasehold contiguous with its Mabee Ranch at a price of about $40,000 per acre, Michael Hsu, an analyst at Jefferies LLC, said. The transaction was funded with cash on hand.

The July 31 acquisition includes average volumes of about 3,000 barrels of oil equivalent per day (boe/d), 73% oil, which Concho described as “legacy production.”

The deal came with some inflation on land prices. Concho bought the Mabee Ranch as part of $1.62 billion purchase of 40,000 acres from Reliance Energy in October 2016. That acreage cost roughly $25,000 per acre.

The deal adds to Concho’s 170,000 net acre position in the Midland Basin, where it has an estimated gross inventory of 4,000 horizontal drilling locations.

Tim Leach, Concho’s chairman and CEO, said the strategic deal complements its Midland Basin leasehold and is “consistent with our focus on high-grading our portfolio through trades, acquisitions and divestitures.”

“We believe one of the best ways to create value is by owning large, contiguous positions with high ownership in the Permian,” Leach said.

While the quarter wasn’t particularly unkind to Concho, the company’s production guidance faltered compared to analysts’ models. The company said production would range from 186 Mboe/d to 190 Mboe/d, slightly below the 193 Mboe/d modeled by RBC Capital Markets LLC.

However, second quarter production guidance increased with a “good part … related to an acquisition,” RBC analyst Scott Hanold said.

Year-over-year, Concho’s crude oil production has grown 27%.

“Capital spending was $383 million, below our $418 million estimate,” Hanold said. “Concho produced $35 million of free-cash-flow and marks the eighth straight quarter it did so.”

Tudor, Pickering, Holt and Co. said Concho remains its top overall pick as “update reveals material upside to fourth-quarter 2017 consensus expectations.”

Concho’s capex for the year remained at $1.6 billion to 1.8 billion.

Gibson, Dunn & Crutcher LLP advised Concho on the deal.

Darren Barbee can be reached at dbarbee@hartenergy.com.

Recommended Reading

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.