(Source: Shutterstock.com)

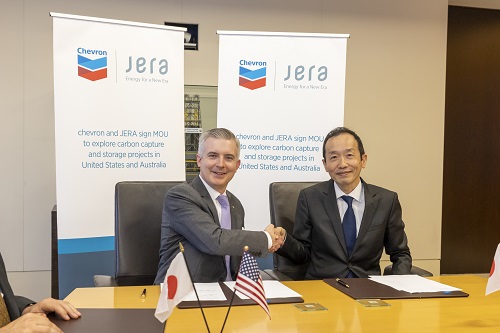

Chevron New Energies, a division of Chevron U.S.A. Inc., and Japan’s JERA Co. Inc. signed a memorandum of understanding (MOU) on March 7 outlining their planned collaboration on carbon capture and storage (CCS) projects in the U.S. and Australia.

The agreement demonstrates Chevron and JERA’s commitment to low-carbon solutions — and has the potential to deepen the two companies’ LNG relationship, according to a March 7 press release.

“We have a long-standing LNG relationship with JERA that continues to progress, with the intent of bringing affordable, reliable, and ever-cleaner solutions to our customers,” said Chris Powers, Chevron’s vice president of carbon capture utilization and storage. “We have deep experience and capability in subsurface and are actively developing CCS projects around the world. We understand that without long-term relationships like the one we have with JERA, we wouldn’t be able to develop these resources and move at the pace we have been moving to further our energy transition goals.”

Chevron and JERA previously announced in Nov. 2022 a joint study agreement to explore potential co-development of low-carbon fuel in Australia, with a feasibility study expected to be completed this year. Additionally, they also agreed to study liquid organic hydrogen carriers (LOHC) in the U.S.

LOHC could potentially enable efficient hydrogen transport and long-duration energy storage applications—essentially using hydrogen as a battery to deliver lower carbon energy on demand. Both companies invested in Hydrogenious LOHC technologies to further their focus on the possibilities of LOHC.

Of their low-carbon goals, Gaku Takagi, JERA’s executive officer and head of the resource procurement and investment division of JERA, touted their “JERA Zero CO2 Emissions 2050” objective.

“JERA has been working to reduce CO2 emissions from its domestic and overseas businesses to zero by 2050,” he said.

JERA and Chevron have also partnered to bring “stable and reliable LNG to our customers over the years, and this CCS collaboration further demonstrates our strong commitment to advance lower carbon solutions,” Takagi said. “Chevron brings significant expertise and experience in the CCS business, so we look forward to working together as we aim to transition to a decarbonized society.”

JERA is an equal joint venture of two major Japanese electric power companies, TEPCO Fuel & Power Incorporated and Chubu Electric Power Co., that produces about 30% of electricity in Japan.

Recommended Reading

Analyst: Is Jerry Jones Making a Run to Take Comstock Private?

2024-09-20 - After buying more than 13.4 million Comstock shares in August, analysts wonder if Dallas Cowboys owner Jerry Jones might split the tackles and run downhill toward a go-private buyout of the Haynesville Shale gas producer.

BP Profit Falls On Weak Oil Prices, May Slow Share Buybacks

2024-10-30 - Despite a drop in profit due to weak oil prices, BP reported strong results from its U.S. shale segment and new momentum in the Gulf of Mexico.

Private Producers Find Dry Powder to Reload

2024-09-04 - An E&P consolidation trend took out many of the biggest private producers inside of two years, but banks, private equity and other lenders are ready to fund a new crop of self-starters in oil and gas.

Utica Oil E&P Infinity Natural Resources Latest to File for IPO

2024-10-05 - Utica Shale E&P Infinity Natural Resources has not yet set a price or disclosed the number of shares it intends to offer.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.