Venezuela’s Orinoco heavy oil belt, also known as the Faja, is home to around 1.4 Tbbl of original oil in place. (Source: Shutterstock.com)

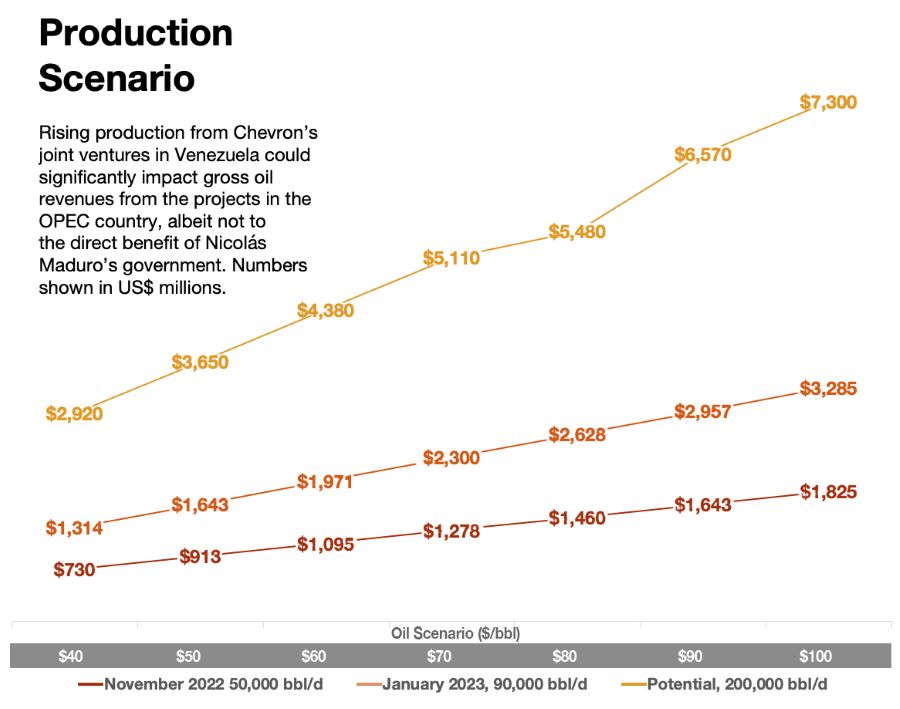

Efforts by Chevron Corp. to boost oil production in Venezuela this year will see the U.S. oil giant generate more revenues to pay outstanding debt in the OPEC country.

Just how much revenue Chevron will generate will depend on the ultimate price it gets for its heavy oil production after upgrades, transport and other discounts are applied to get the oil to market.

In late January, Chevron chairman and CEO Mike Wirth said the company’s four joint ventures (JV) in Venezuela were producing around 90,000 bb/d, up from around 50,000 bbl/d in November 2022 when the company was still prohibited by the U.S. Office of Assets Control (OFAC) from engaging in efforts to expand production.

RELATED

Chevron Says Venezuela Production Up Nearly 80%

Column: Much Ado About Venezuelan Sanctions

Now with OFAC’s approval, the Chevron JVs will continue to encounter headwinds as they try to reach a prior 200,000 bbl/d potential. This has been a largely evasive pursuit since early 2019 when the U.S. initially imposed sanctions on Venezuela’s oil sector to promote “free and fair” elections in 2024 and a potential democratic change to a leader that is more to the U.S.’ liking.

Regardless of the price point, Chevron’s JVs will generate more income for the company, but not necessarily to the benefit of the government of President Nicolas Maduro.

Just how long the U.S. will allow Chevron to operate will depend on Maduro’s actions ahead of elections next year and whether it can deal with the outcome amid an opposition faction that remains widely divided and, hence, less of a threat to defeat the ruling party.

Amid the certain uncertainties, one thing is clear: The U.S. will not likely get the election result it wants next year, according to Datanalisis president Luis Vicente Leon.

“Elections in Venezuela will not be transparent and competitive, considering the desired parameters of liberal democracy,” Leon wrote Feb. 19 in a Twitter post. “But neither were they in most of the experiences of transition from autocracy to democracy in the last century of world political history.”

Recommended Reading

RWE Slashes Investment Upon Uncertainties in US Market

2025-03-20 - RWE introduced stricter investment criteria in the U.S. and cut planned investments by about 25% through 2030, citing regulatory uncertainties and supply chain constraints as some of the reason for the pullback.

Stonepeak Backs Longview for Electric Transmission Projects

2025-03-24 - Newly formed Longview Infrastructure will partner with Stonepeak as electric demand increases from data centers and U.S. electrification efforts.

BlackRock CEO: US Headed for More Inflation in Short Term

2025-03-11 - AI is likely to cause a period of deflation, Larry Fink, founder and CEO of the investment giant BlackRock, said at CERAWeek.

Michael Hillebrand Appointed Chairman of IPAA

2025-01-28 - Oil and gas executive Michael Hillebrand has been appointed chairman of the Independent Petroleum Association of America’s board of directors for a two-year term.

Baker Hughes Appoints Ahmed Moghal to CFO

2025-02-24 - Ahmed Moghal is taking over as CFO of Baker Hughes following Nancy Buese’s departure from the position.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.