Calgary-based midstream giant Enbridge is investing billions to grow its oil and gas pipeline network and storage capacity, President and CEO Greg Ebel told Hart Energy. (Source: CERAWeek by S&P Global)

Enbridge Inc. is investing billions to grow its transportation and storage capabilities around North America, including several projects on the Gulf Coast.

The Calgary-based midstream company – among North America’s largest pipeline operators – has recently announced billions of investments, including deploying $2.4 billion on crude oil and natural gas pipeline transmission, storage, liquids terminals and renewable natural gas production.

Enbridge also earmarked $1.75 billion for investment in new gas transmission modernization.

“We’re creating that nice super system on the heavy side, on the light side, on the terminalling side,” Ebel told Hart Energy. “On the LNG side we’ve got gas pipelines, we’ve got LNG terminals that obviously lead to LNG exports. Last but not least, we’ve got stuff on the sustainability side.”

The company is expanding its gas storage capacity on the Texas Gulf Coast through acquisition. Enbridge recently agreed to purchased Tres Palacios gas storage, a 35-Bcf salt cavern gas storage facility in Matagorda County, Texas, for $335 million.

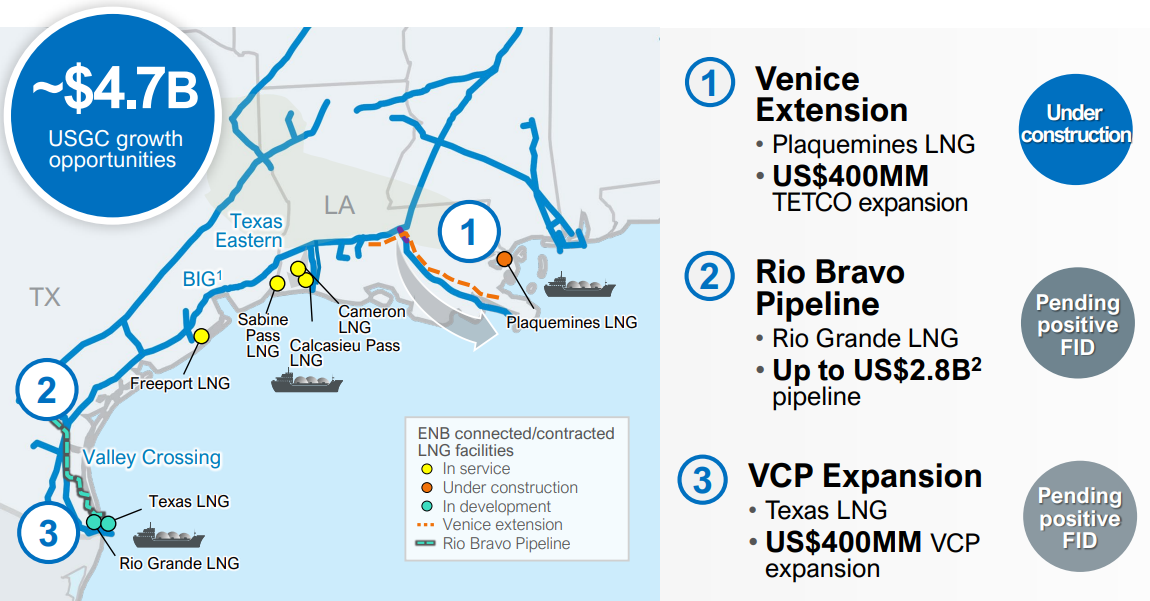

One of the drivers of gas demand on the Gulf Coast is an increase in liquefied natural gas export volumes, Enbridge said in regulatory filings. The company already connects with four Gulf Coast LNG facilities, and the company anticipates supplying two to three more in the future.

Enbridge is also making moves in LNG on the western coast of Canada. The company acquired a 30% stake in Woodfibre LNG LP for $392 million in November 2022. Woodfibre will operate a 2.1 million tonnes per annum (mtpa) LNG export complex in Squamish, British Columbia.

The company is moving forward on a $2.65 billion expansion of the southern segment of its British Columbia gas pipeline system to serve Woodfibre LNG and other customers in western Canada.

RELATED: Enbridge to Invest $1.5 Billion in Pacific Energy’s Woodfibre LNG Project

Making moves to move crude

Enbridge is also investing in its liquids footprint. The company said it is in negotiations with shippers for up to 95,000 bbl/d of incremental capacity on Enbridge’s Flanagan South Pipeline system, which transports crude oil from Enbridge’s terminal in Flanagan, Illinois, to Cushing, Oklahoma.

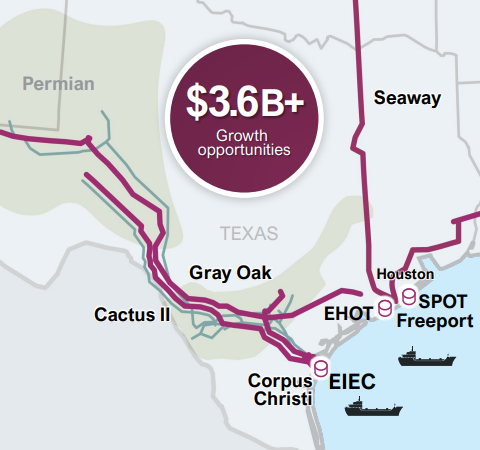

In connection with the Flanagan South Pipeline open season, Enbridge decided to move forward with building the Enbridge Houston Oil Terminal (EHOT) to handle the incremental commitments.

The $240 million EHOT project will be built at the terminus of the Seaway Pipeline, which originates in Cushing and moves crude to the Gulf Coast refining hub near Houston.

With an expected capacity of 2.5 MMbbl, EHOT will have export opportunities through docks at Freeport, Texas, and Texas City. EHOT will also have future access to Enterprise Product Partners’ offshore export terminal, the Sea Port Oil Terminal (SPOT).

Expansion through transactions

Enbridge also sees opportunity to increase its footprint in key onshore regions like the Permian Basin. In January, the company acquired Diamondback Energy Inc.’s 10% interest in the Gray Oak Pipeline for $180 million. The line connects the Permian Basin and the Eagle Ford Shale to market hubs in Corpus Christi and Freeport.

Last year, Enbridge grew its stake in Gray Oak from 22.8% to 58.5% as a result of a joint venture merger transaction with Phillips 66. After buying the 10% stake from Diamondback, Enbridge’s interest in Gray Oak Pipeline grew to 68.5%.

In November 202, Enbridge boosted its stake in the Cactus II Pipeline up to 30% through a $177 million deal with Western Midstream Partners.

And Enbridge picked up a 20% interest in the Cactus II Pipeline, which runs from the Delaware Basin to Corpus Christi, as part of the company’s $3 billion acquisition of Moda Midstream LLC in 2021. The deal also included the massive Ingleside Energy Center, one of the largest crude oil export complexes in the U.S.

“We have storage facilities in place that’ll allow our customers to utilize that storage, whether it’s for use in Gulf Coast refineries or, ultimately, for export out of Ingleside,” Ebel said.

RELATED: Enbridge Buying Gulf Coast Gas Storage Facility for $335 Million

Food waste to energy

In addition to investments in its core gas and liquids segments, Enbridge continues to develop its low-carbon portfolio. At the beginning of March, Enbridge bought a 10% equity stake in Massachusetts-based Divert Inc., which converts food waste into renewable natural gas (RNG), for $80 million.

RNG, biogas that has been upgraded to pipeline quality, has attracted investments from other large players such as BP and Shell.

RELATED: Enbridge, Divert Partner in $1 Billion Plan to Scale Up RNG

But to blend the pipeline-ready biogas with natural gas to move to buyers requires pipeline infrastructure. As one of North America’s largest pipeline operators, investing in RNG was a perfect fit for Enbridge, Ebel said.

“As these RNG projects get located in and around where our pipelines are, and as we’re able to structure them with long-term contracts like our pipelines, we’re able to make some progress on the sustainability front. That’s a win-win-win scenario,” Ebel said.

Recommended Reading

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.