Presented by:

For more on emission monitoring technology check out Curbing Methane featured in the March 2022 issue of Oil and Gas Investor Magazine.

Carbon capture and storage (CCS or CCUS, with utilization) is a critical part of a worldwide effort to control greenhouse gases (GHG) emitted into the atmosphere. Without putting away massive amounts of CO₂ while awaiting renewable energy to mature commercially, there is no hope in stopping global temperature from rising beyond 1.5 C by the end of the century.

Despite the U.S.’ federal 45Q tax credit near-record carbon price above $80 euro/ tonne in Europe, and a new emissions trading scheme in China, CCS in general still lacks a sound business model in the west and political will in the east. In the U.S., the Build Back Better Act would have increased the incentives beyond the current $50/tonne and $35/tonne for geologic storage and utilization, respectively.

“Carbon capture technologies are generally mature with recent improvements promising to bring costs down significantly.”

The value proposition of a CCS project is twofold: environmental and commercial. In a sense, it is a waste disposal/recycling business. For the private sector to construct a business model, value has to be derived from the improved production of goods or sales revenue from utilizing the captured CO₂. Due to the lack of “green” premium in products and immature carbon markets, governments worldwide have had to step in to provide support in the form of penalties (e.g. carbon tax, emissions permit) or incentives (e.g. tax credit, direct grant) to kick start CCS/CCUS programs.

In the U.S., large quantities of CO₂ have traditionally been utilized for EOR, though this CO₂ almost entirely comes from naturally occurring underground reservoirs. CCS/CCUS comprises three components:

- Capture of CO₂ from anthropogenic or natural sources such as an industrial facility or the atmosphere;

- Transport of CO₂ from sources to sinks where it can be stored or utilized; and

- Secure and permanent storage, monitoring and verification of CO₂ underground in saline aquifers, oil and gas reservoirs, mineralized rocks or in products such as cement.

Cost comparison across sectors

The biggest cost in a typical project is the capture component. Given that most point sources are small, emission volumes need to be aggregated so that transportation and storage costs can be spread across a network, resulting in lower unit costs. Emission sources ranging from coal/gas power plants, chemicals and refineries to steel mills, cement plants and fertilizer plants have wildly different capture costs due to many factors. Other than a few project-specific studies for the likes of Boundary Dam and Petra Nova power plants, industry and government researchers have published many studies on the macro-level economics.

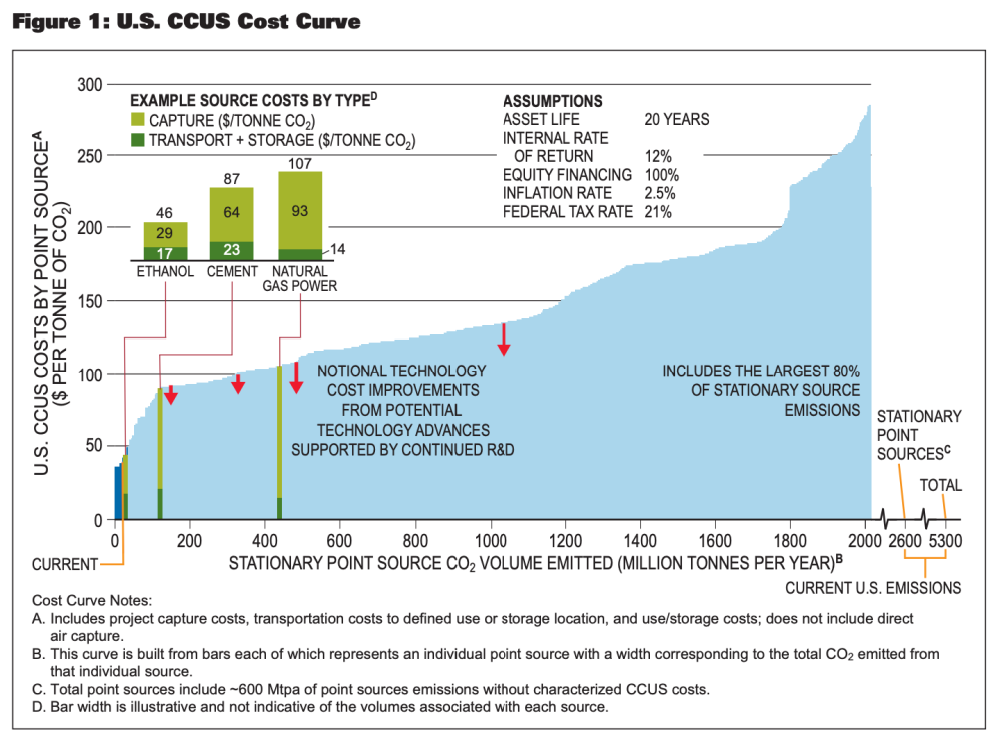

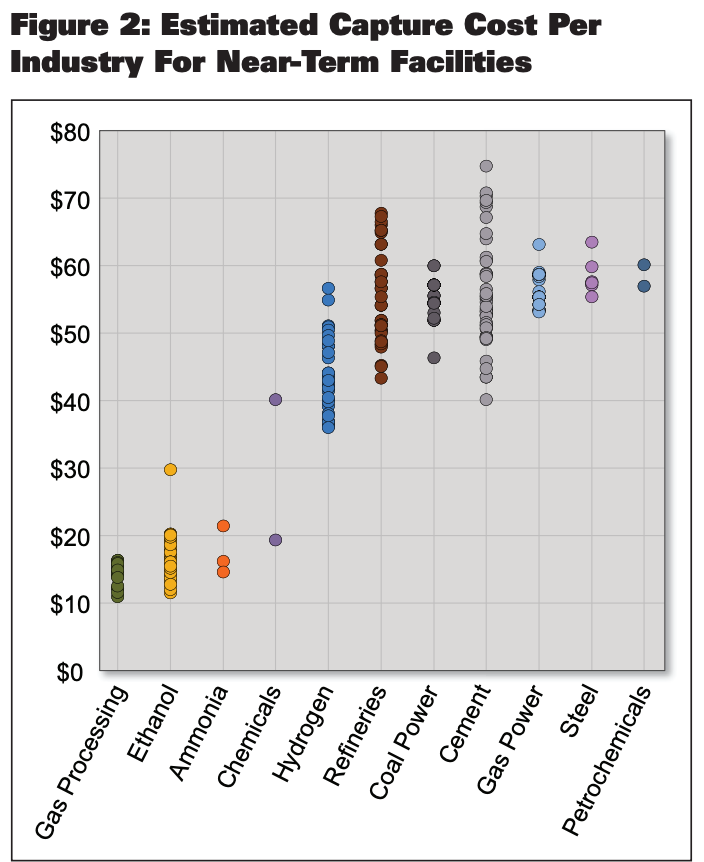

Figures 1 and 2 by the National Petroleum Council in 2019 and Great Plains Institute in 2020 outline the range of levelized costs of a reference plant across and within sectors with current technologies. These benchmarks are suitable for policy discussion and high-level project screening purposes, especially when compared to a carbon price or a government incentive such as the 45Q tax credit. However, they are difficult to apply to specific projects due to myriad factors such as capture scale, technology selection, project life, cost of capital, recency of study, etc. Project developers or financiers will need to conduct their own due diligence.

Carbon capture technologies are generally mature with recent improvements promising to bring costs down significantly. Capture methods depend on plant processes but are generally divided into chemical/physical solvent (e.g. amine, selexol), solid adsorbent, membrane and other up-and-comers such as direct air capture.

In a 2021 study, the Global CCS Institute rated these according to technology readiness and their applicability to different industries. Methods based on chemical processes require large heat input and result in higher costs but can separate low-concentration CO₂ in the flue gas. Physical processes are cheaper but require much higher CO₂ concentration and pressure.

The most important capture cost drivers are the properties of the source gas. As a general rule, lower partial pressure or concentration, smaller scale (<1 Mtpa) and more contaminants in the source gas result in higher costs. As in most industrial applications, economy of scale matters, and contaminants require more complicated gas treating. Lower CO₂ concentration requires more source gas to be processed and a higher solvent/sorbent utilization rate, resulting in larger equipment and higher energy penalty. It also limits the technology selection to higher-cost chemical solutions.

Ethanol and natural gas processing plants are the lowest-hanging fruits in the world of carbon capture due to their high-concentration CO₂ process gas of > 90%. Recently announced projects from Summit Carbon Solutions and Navigator Energy Services both aim to serve ethanol plants. Due to the typically small emission volumes (0.2 Mtpa to 0.3 Mtpa), both projects need to aggregate a large number of facilities to achieve commercial viability.

The next tranche of facilities likely to be retrofitted are chemicals, hydrogen and refineries with modest CO₂ volumes and concentration (15% to 40%) but conveniently packed in the Gulf Coast region with a large CO₂ trunk line owned by Denbury Inc. and a lot of geologic storage that enables low transportation and sequestration costs.

“The short 12-year asset useful life and limited pool of large investors with sufficient tax liability are additional hurdles to CCS projects.

Coal-fired power plants, more so than natural gas-fired ones, are a major current focus of Department of Energy studies despite their low CO₂ concentration (3% to 15%) because of their large emissions (1 to 3 Mtpa). Steel and cement plants tend to have low-to-moderate CO₂ concentrations and large volumes but are hampered by technological challenges.

Business model and structure

There are a few CCS/CCUS business models employed around the world with varying degrees of success. A vertical integration model is common in the U.S. for CO₂-EOR operators that produce/capture, transport and inject CO₂ for oil production. The aforementioned Navigator and Summit are pursuing a CCS operator model whereby a business provides the capture and maybe transport and storage services for a fee. There are also existing joint ventures and CO₂ transporter models.

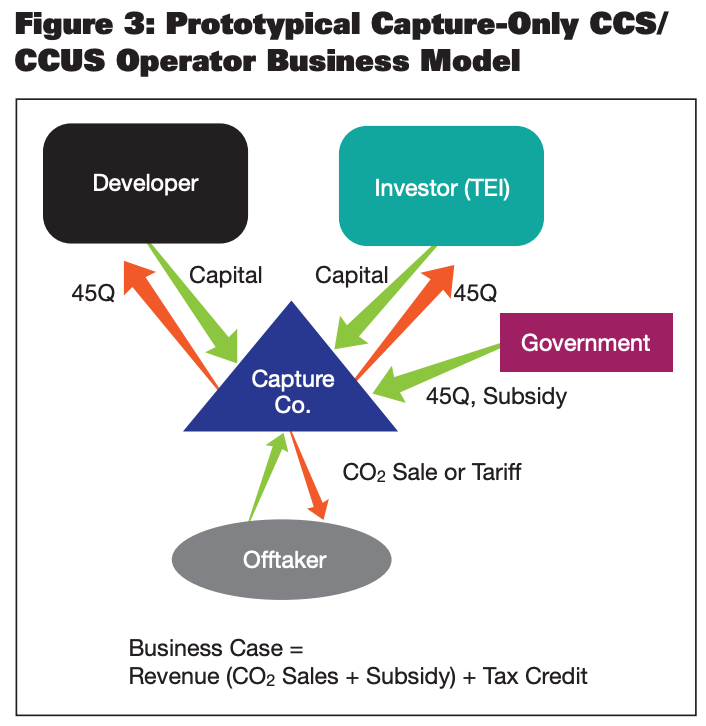

Since CO₂ disposal has no intrinsic market value, most business models rely heavily on government incentives. The current 45Q CCUS and CO₂ program can generate about $400 million to $600 million of tax credit for a 1 Mtpa during a 12-year period. Since a typical project will not generate sufficient income to utilize the entire credit, a developer is likely to partner with a tax equity investor with a large appetite for tax credit. A simplified business model is presented in Figure 3. Revenues for this structure come from the sale of the captured CO₂ and possibly fees for transport and storage. They are offset by fixed and variable plant operating costs, electricity, fuel, taxes, financing cost and overhead.

Capex for carbon capture facilities can run into hundreds of millions of dollars. The short 12-year asset useful life and limited pool of large investors with sufficient tax liability are additional hurdles to CCS projects. Economics is challenging in this environment. Therefore, Congress, with bipartisan support, is considering a variety of revisions to this scheme, including direct-pay (refundable tax) and expanding storage credit from the current $50/tonne to $85 to $175/tonne, and utilization credit from the current $35/tonne to $60 to $150/tonne.

“Issues related to risk allocation and mitigation have added headwinds to attracting capital to CCS/CCUS worldwide.”

Risk and allocation

In addition to policy risk and the traditional financing risk for capital-intensive industrial projects, there are specific risks related to CCS/CCUS projects. The above mentioned short useful life creates an aggressive schedule for return on investment and heightened stranded asset risk. Long-term CO₂ leakage risk is not easily mitigated by insurance. Pore space ownership issue can potentially be a litigation risk. The complex components create cross-chain risk in that one party’s failure to perform can ripple through the entire value chain. If the captured CO₂ is used for EOR, commodity price exposure can also be problematic. The Petra Nova CCUS project cited weak oil prices as the reason for its suspension of operations.

Issues related to risk allocation and mitigation have added headwinds to attracting capital to CCS/CCUS worldwide. Similar to the solar and wind industries, although acute in the initial stages of development, risks are slowly being addressed by government support, technology improvement and evolving business models.

CCS/CCUS is an exciting multidecade trend, and the oil and gas industry is wellplaced to ride the wave. We are experienced and well-positioned to help investors and developers navigate the economic, technical and policy landscape in this area.

About the author: Jeff Lee is the principal consultant for Kronos Management, a boutique consulting firm that caters to the oil and gas midstream sector. Seasoned engineers and commercial specialists work with oil and gas operators, banks, private equity companies and law firms to deliver transaction advisory, expert witness and capital project development/management services. Lee can be contacted at LeeJeff@ engineer.com.

Recommended Reading

Safety First, Efficiency Follows: Unconventional Completions Go Automated

2024-07-18 - The unconventional completions sector has seen a tremendous growth in daily stage capacity and operation efficiencies, primarily driven by process and product innovations in the plug and perf space.

E-wireline: NexTier Taps Oilfield Grid, Automation for Completions

2024-07-23 - NexTier Completion Solutions is using advanced electric-drive equipment, automation-enabled pump down technology and digital connectivity to optimize wellsite operations during shale completions.

TGS Releases Illinois Basin Carbon Storage Assessment

2024-09-03 - TGS’ assessment is intended to help energy companies and environmental stakeholders make informed, data-driven decisions for carbon storage projects.

STRYDE Awarded Seismic Supply Contracts in Mexico

2024-09-03 - STRYDE was awarded two seismic node supply contracts in Mexico, the company’s first projects in the country.

PakEnergy Plows Ahead with New SCADA Solution

2024-09-17 - After acquiring Plow Technologies, home of the OnPing SCADA platform, PakEnergy looks to enhance its remote monitoring solutions.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.