The Latin America and Caribbean (LAC) region is primarily geared up to import LNG, not export it. The two exceptions are Peru with its Peru LNG facility and twin-island Trinidad and Tobago with its Atlantic LNG facility. But, in theory, proposed liquefaction projects could revert the LAC region’s import reality. To what extent it materializes in practice is another question.

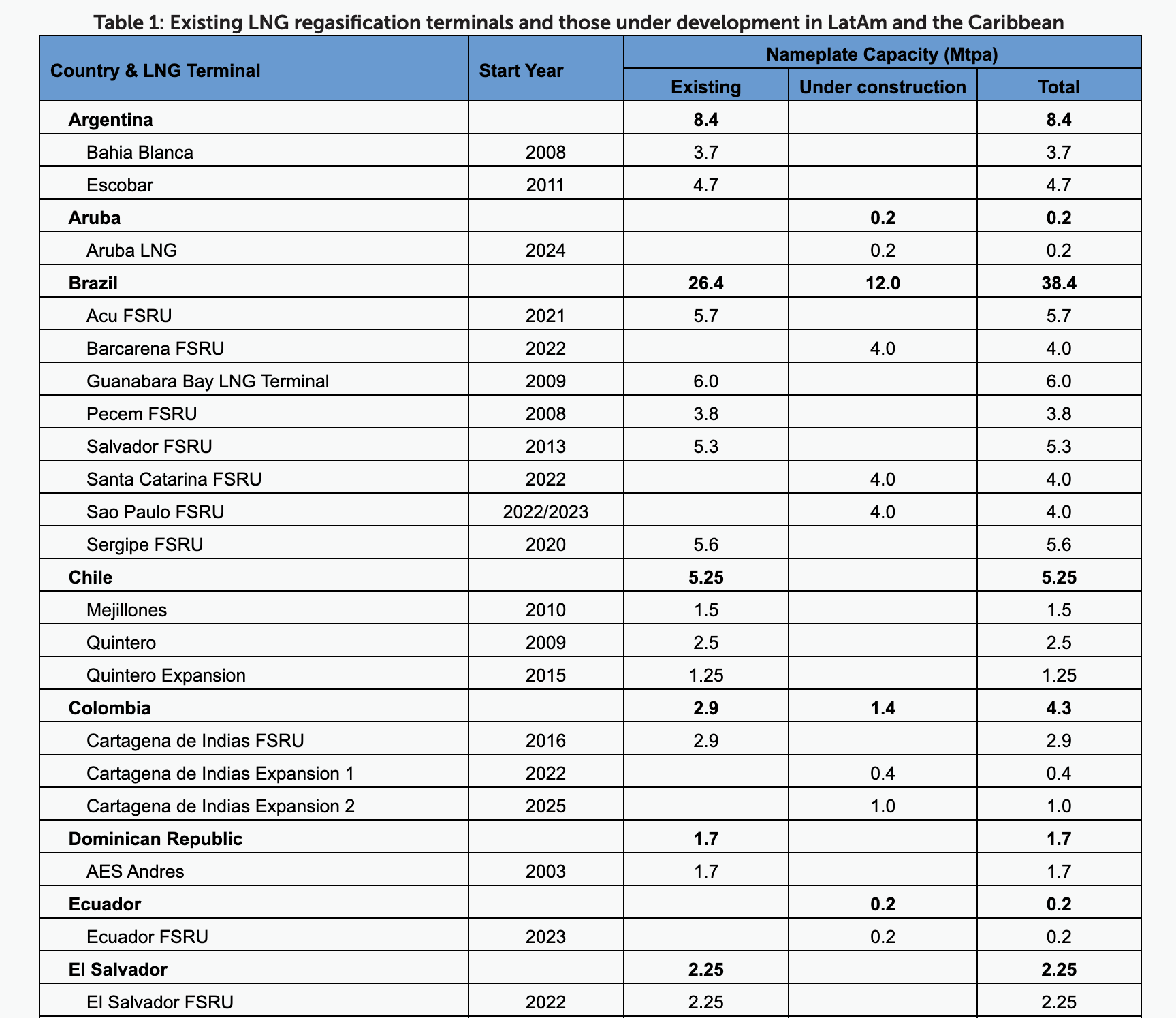

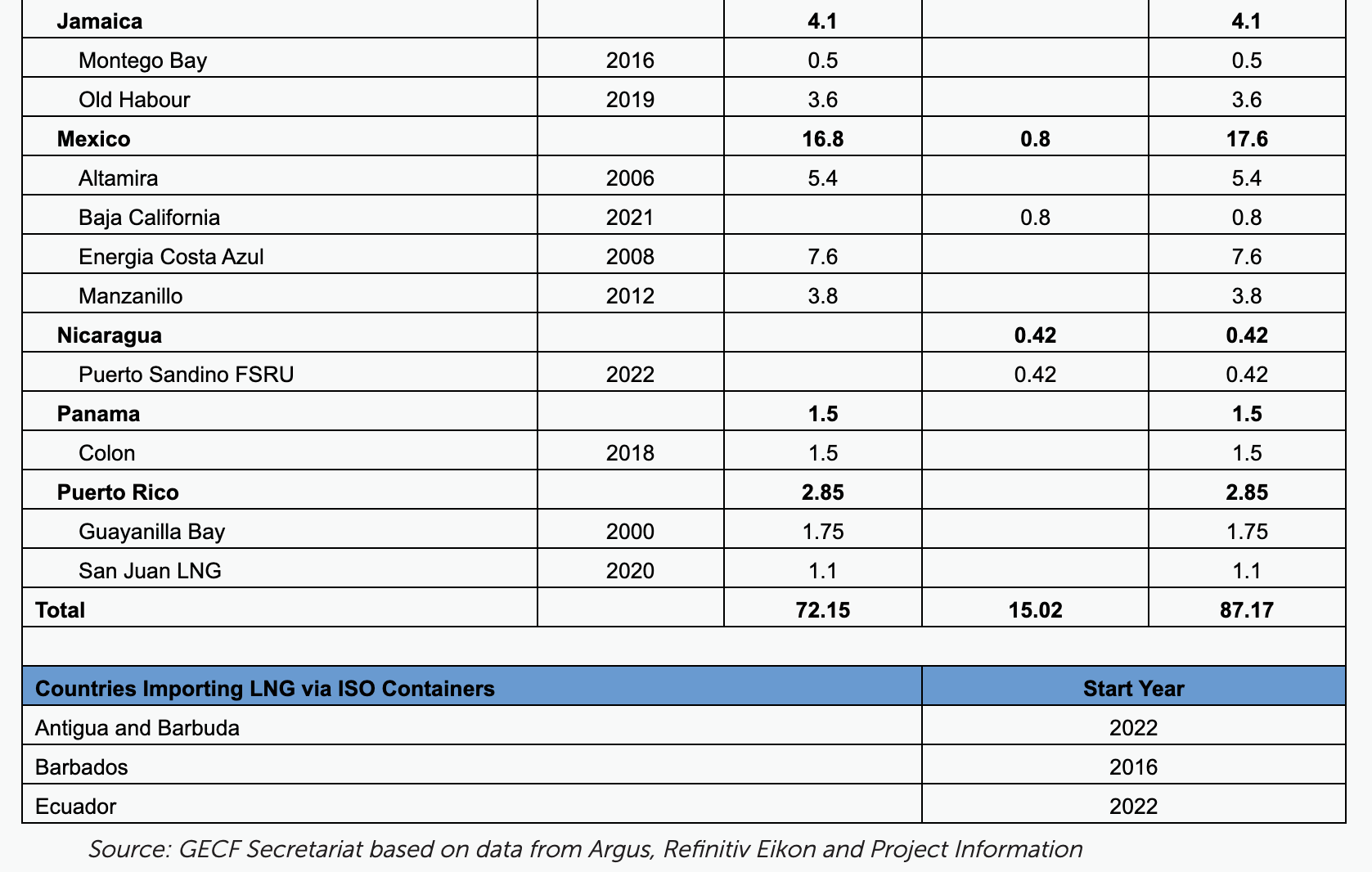

Currently, the LAC region has regasification capacity of around 72 million tonnes per annum (mtpa), according to the Gas Exporting Countries Forum (GECF). And the countries with the largest populations and economies are home to the bulk of the LAC region’s regasification capacity. Brazil accounts for around 40% of this capacity; Mexico, 24%; and Argentina, 12%.

And at least 15 mtpa of regasification capacity is under construction, with 12 mtpa alone located in Brazil, according to the GECF, despite exploration successes in recent years in the prolific pre-salt region offshore. At most, Brazil needs to hedge its bets until it can build-up its domestic gas infrastructure. In the meantime, it needs assurance it can import gas if need be.

Despite this massive regasification capacity, actual and planned, the LAC region’s utilization capacity averaged around 25% in 2021, according to the GECF. The reasons vary across the LAC region’s big economies.

Argentina is boosting oil and gas production from its Vaca Muerta (“Dead Cow”) shale formation, albeit slowly due to infrastructure bottlenecks. Likewise, Brazil’s import dependency falls drastically when the country doesn’t experience drought conditions and its dams are sufficient to produce energy and reduce the need to import LNG. Brazil also still has access to piped-gas from Bolivia and potentially Argentina. Mexico is better located geographically, which affords it the easy access to cheap piped-gas from the U.S. Permian Basin.

Major headwinds

All told, LNG exporters face the threat of losing market share as LAC transitions from an LNG importing region to an exporting region.

But getting there will not be easy. Investors across Argentina, Brazil and Mexico will face political headwinds with changing governments and ideology-driven priorities, as well as economic and financial headwinds that encompass subsidies, overvalued currencies and repatriation of funds.

Another major consideration: international oil companies active in the LAC region are also changing priorities in response to the energy transition and the push to net-zero emissions.

Enter Argentina and Mexico with plans that could, in theory, anchor the LAC region’s emergence as an LNG exporter over the near-to-medium term.

Plans floated by Argentina’s state oil company YPF, in partnership with Malaysia’s Petronas, to move forward an LNG export project that could see the country add 25 mtpa of liquefaction capacity. Beyond the political, economic and financial constraints that confront Argentina’s national oil companies, the biggest below-surface headwind is a lack of infrastructure to move the country’s massive shale production to the coast for export.

Plans in Mexico to export LNG could see the country add 32 mtpa of liquefaction capacity, according to Rystad Energy, or up to 45 mtpa, according to BTU Analytics.

But unlike Argentina, Mexico has an advantage on two fronts.

First, the planned liquefaction projects have been proposed by private companies with foreign capital, a factor that boosts the potential of many of them to get across the finish line, since that would reduce the burden of state-owned Petroleos Mexicanos (Pemex) to fund infrastructure projects.

Second, the planned projects will source gas from the prolific U.S. Permian Basin, thus further reducing Pemex-related funding pressures to increase production to feed the projects.

But lurking in the region are Guyana and Suriname, neighboring countries in northern South America with plans to add significant liquefaction capacity in the future.

The potential to add liquefaction capacity in the LAC region is real. While Argentina and Mexico are seemingly moving the fastest with mega liquefaction potential, Brazil is not far behind. Then, there’s always the sleeping giant in the region, Venezuela, home to massive non-associated gas reserves but hampered by political stalemate, U.S. sanctions and all-around investor uncertainties.

So, what’s the likelihood that Argentina and Mexico achieve their goals?

It depends on the risk factor applied. My risk adjusted figures: 50% for Mexico and 30% for Argentina.

Recommended Reading

Trump Prepares Withdrawing From Paris Climate Agreement, NYT Reports

2024-11-08 - U.S. President-elect Donald Trump's transition team is preparing announcements that would withdraw the U.S. from the Paris Climate Agreement, the New York Times reported.

Utica’s Encino Boasts Four Pillars to Claim Top Appalachian Oil Producer

2024-11-08 - Encino’s aggressive expansion in the Utica shale has not only reshaped its business, but also set new benchmarks for operational excellence in the sector.

NextDecade Advances FID Talks for Rio Grande Train 4

2024-11-08 - NextDecade also reported updates to Phase 1 development , which is currently underway for the facility’s Trains 1, 2 and 3.

Houston Natural Resources to Rebrand to Cunningham Natural Resources

2024-11-08 - Now rebranded as Cunningham Natural Resources Corp., the company will continue its focus on traditional oil and gas opportunities and energy transition materials.

Trafigura Signs NatGas Supply Agreement with NuVista

2024-11-08 - Under the agreement, NuVista Energy will supply Trafigura with 21,000 MMBtu/d of natural gas for up to thirteen years, starting Jan. 1, 2027.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.