Roustabouts work on a drilling rig in Kern County, Calif., where California Resources’s flagship Elk Hills Field is located. (Source: Richard Thornton/Shutterstock.com)

California’s largest oil and gas producer could receive up to $500 million as part of a new joint venture (JV) to develop one of the most historically productive fields in the U.S.

California Resources Corp. (CRC) formed the JV with Colony HB2 Energy, an investment firm which agreed to fund the development of CRC’s flagship Elk Hills Field, the Los Angeles-based company said July 23 in a press release.

The partnership follows a strategy by CRC to pursue JVs that CFO Mark Smith told attendees of the Bank of America Merrill Lynch Energy Credit Conference last month allows the company to fund exploration and development capital despite reducing its budget to stay within cash flow.

“Another key aspect of our strategy is the thoughtful use of relationships, particularly joint ventures,” Smith said, according to a transcript of the presentation provided by CRC. “They allow us to accelerate our value and participate in the growth wedge, to de-risk our inventory.”

CRC currently has ongoing JV partnerships with Benefit Street Partners LLC, Ares Management LP and Macquarie Infrastructure and Real Assets.

(Source: California Resources Corp.

Conference Presentation June 2019)

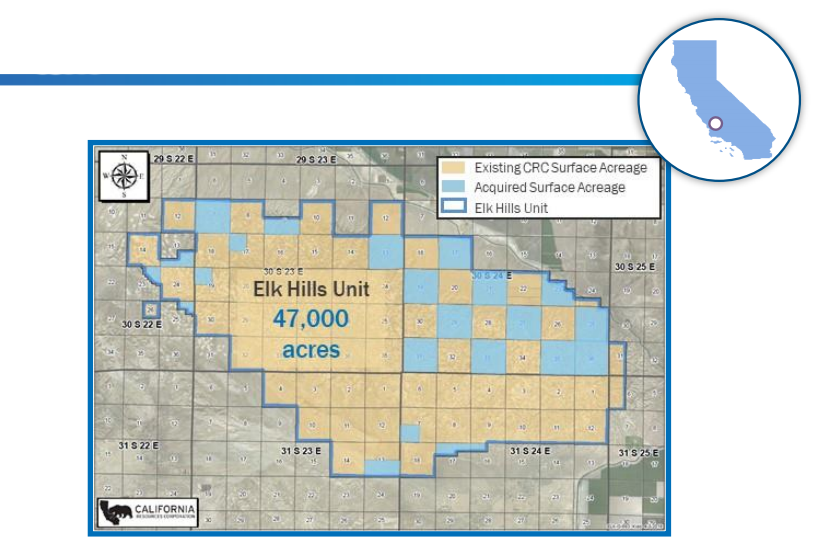

As part of a pre-approved development plan for the Elk Hills Field, CRC will drill about 275 wells, of which Colony has agreed to fund 100%. Located within the San Joaquin Basin, 20 miles west of Bakersfield in Kern County, Calif., Elk Hills is the largest natural gas and NGL field in California, generating over half of the state’s natural gas production, according to CRC’s website.

Colony has initially committed to invest $320 million, which could be increased to $500 million. The capital will be invested over about three years to cover multiple development opportunities throughout the Elk Hills Field.

“This is the largest joint venture capital commitment to date for CRC, and the terms reflect the sizable project inventory we have established at Elk Hills,” Todd Stevens, president and CEO of CRC, said in a statement on July 23. “This partnership also provides additional flexibility to aid in our deleveraging efforts through growing our production and cash flow.”

In exchange for funding 100% of the development wells, Colony will earn a 90% working interest. CRC said its working interest will revert to 82.5% from the initial 10% upon Colony achieving an undisclosed, agreed-upon return.

Lastly, Colony will also receive warrants to purchase up to 1.25 million shares of CRC stock with a $40 strike price upon funding its capital obligations.

Tom Barrack, chairman and CEO of Colony Capital Inc., noted that the CRC investment is a milestone event for Colony in the establishment and growth of the firm’s new energy investment management platform.

Colony HB2 Energy is the energy investment management platform of Colony Capital, a Los Angeles-based firm with significant holdings in the healthcare, industrial and hospitality property sectors.

Peter Eichler, managing director of Colony Capital, also added, “CRC’s operational expertise, technical understanding and substantial infrastructure in the San Joaquin Basin are unparalleled, and we look forward to building upon decades of profitable investment by CRC in the Elk Hills Field over the long-term.”

Elk Hills, formerly known as the Naval Petroleum Reserve No. 1, was first discovered in 1911 and has produced over 2 billion barrels of oil equivalent, according to the CRC website.

CRC has operated the field for over 20 years after purchasing interest from the U.S. government. The company acquired the remaining Elk Hills interest from Chevron Corp. last year for about $513.3 million.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

Halliburton Working to Assess Cause, Impacts of Cyberattack

2024-08-22 - A Halliburton spokesperson said the company had activated a response plan and was working internally and with external experts to remediate the “issue.”

Solaris Stock Jumps 40% On $200MM Acquisition of Distributed Power Provider

2024-07-11 - With the acquisition of distributed power provider Mobile Energy Rentals, oilfield services player Solaris sees opportunity to grow in industries outside of the oil patch—data centers, in particular.

Liberty Energy Warns of ‘Softer’ E&P Activity to Finish 2024

2024-07-18 - Service company Liberty Energy Inc. upped its EBITDA 12% quarter over quarter but sees signs of slowing drilling activity and completions in the second half of the year.

Offshore, Middle East Buoys SLB’s 2Q as US Land Revenue Falls

2024-07-19 - Driven by a strong offshore market and bolstered by strategic acquisitions and digital innovation, SLB saw a robust second quarter offset by lower drilling revenue in the U.S.

Halliburton Sees NAM Activity Rebound in ‘25 After M&A Dust Settles

2024-07-19 - Halliburton said a softer North American market was affected by E&Ps integrating assets from recent M&A as the company continues to see international markets boosting the company’s bottom line.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.