Baker Hughes office in Houston, TX. (Source: Shutterstock)

Baker Hughes reported record orders of $8 billion in fourth-quarter 2022 in its Jan. 23 earnings call. The oilfield services company also reported earnings per share (EPS) that surpassed the previous quarter by 46% and by fourth-quarter 2021 by 52%.

The company cited strong performance related to LNG contracts and service work for its financial success in the quarter. However, the results disappointed analysts. Baker Hughes’ EPS of $0.38 fell shy of the aggregate forecast of $0.40. Quarterly revenue of $5.91 billion surpassed the previous quarter by 10% and year-over-year by 7.7%, but came up short of the Goldman Sachs estimate by 3% and of Zack’s by 2.6%.

“This quarterly report represents an earnings surprise of -7.32%,” Zack’s said in its assessment. “Over the last four quarters, the company has surpassed consensus EPS estimates just once.” Baker Hughes’ stock price closed at $30.58, down 2.1%.

The company recorded adjusted net income of $182 million in the quarter, which was 44% higher than the previous quarter and up 70% year-over-year.

“We were very pleased to end 2022 with solid momentum across our two business segments,” said Lorenzo Simonelli, Baker Hughes chairman and CEO, in announcing the results. “In the fourth quarter, we saw continued margin improvement in our OFSE (oilfield services and equipment) business and an extremely strong level of orders for IET (industrial and energy technology), which was driven by multiple awards across different end markets.”

Adjusted fourth-quarter EBITDA of $947 million was up 25% over the previous quarter and 12% year-over-year, beating analyst expectations of $924 million.

Free cash flow of $657 million was 57% above the third-quarter figure and up 2% year-over-year. However, it fell short of Wall Street’s $686 million estimate.

Baker Hughes attributed its growth to volume in both of its business segments and higher pricing in oilfield services and equipment. Year-over-year hikes were driven by volume and pricing in both segments and productivity in oilfield services and equipment.

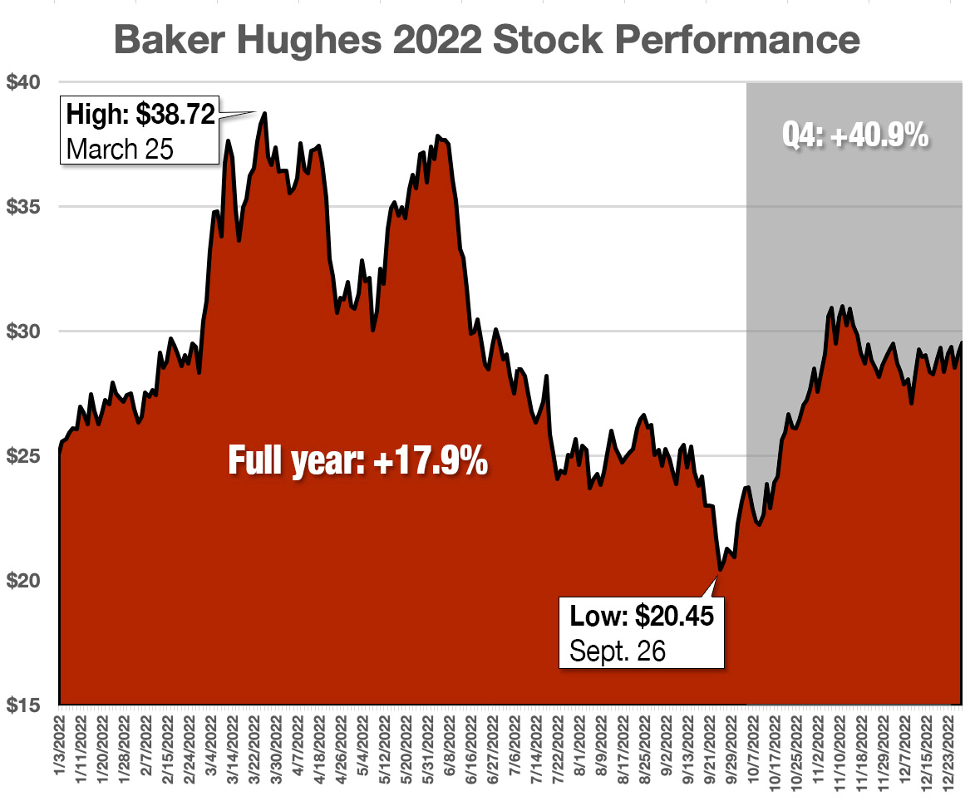

Baker Hughes stock performance

The company’s market performance can be seen in relative terms. Compared to the stock market as a whole, Baker Hughes lodged an exceptional year. For all of 2022, the stock price rose 18%. In the fourth quarter alone, the stock gained 41% in value. By comparison, the Dow Jones industrial average sank about 9% and the S&P 500 fell 20%.

Baker Hughes did not fare as well compared to the oil and gas industry as a whole. The S&P 500 Energy Index rose 59% in 2022.

The company’s guidance for first-quarter 2023 revenue is $5.3 billion to $5.7 billion, above the Goldman Sachs estimate of $5.2 billion. Full-year revenue guidance is $24 billion to $26 billion, compared to Goldman Sachs’s $24.3 billion. The Wall Street aggregate estimate is $24.23 billion.

First-quarter adjusted EBIDTA is guided to $700 million to $760 million, compared to Goldman Sachs’ forecast of $711 million and the analyst consensus of $761 million. Full-year EBIDTA guidance is $3.6 billion to $3.8 billion, compared to $3.7 billion for Goldman Sachs and the $3.72 billion Wall Street consensus.

LNG, service contracts

Growth in global demand for LNG was one of the drivers for the Baker Hughes IET segment. Venture Global LNG awarded the company a contract to provide 12 modularize compression trains for the Plaquemines LNG II project in Louisiana, similar to a gas technology contract for the Plaquemines I project that was announced in March. Venture Global LNG also contracted with Baker Hughes for eight years of maintenance services for its Calcasieu Pass LNG facility in Louisiana.

Internationally, IET gained a contract with Iraq’s Basrah Gas Co. to provide in-country field services, a resident team, a provision of local spares and repair for multiple facilities. Several contracts were signed to service FPSOs for five projects in Latin America and Sub-Saharan Africa.

The OFSE business segment secured well services and solutions agreements with a national oil company in the Middle East and with a major Latin American national oil company for shallow water exploration and land development.

OFSE also signed contracts with a Louisiana project designed to store 10 million tonnes per annum (mtpa) of CO2, as well as a separate Louisiana project for front-end engineering well design. A similar contract involves a North Dakota facility designed to store 5 mtpa of captured CO2.

Recommended Reading

Dividends Declared Week of Nov. 4

2024-11-08 - Here is a compilation of dividends declared from select upstream and midstream companies in the week of Nov. 4.

TC Energy Appoints Two Independent Directors to Board

2024-11-07 - TC Energy Corp. appointed Independent Directors Scott Bonham and Dawn Madahbee Leach to its board, the company announced Nov. 7 in a press release.

OMS Energy Files for IPO, Reports Revenue Growth

2024-11-06 - Singapore-based OMS Energy, a wellhead system manufacturer, has not yet determined its price range and number of shares.

Record NGL Volumes Earn Targa $1.07B in Profits in 3Q

2024-11-06 - Targa Resources reported record NGL transportation and fractionation volumes in the Permian Basin, where associated natural gas production continues to rise.

Twenty Years Ago, Range Jumpstarted the Marcellus Boom

2024-11-06 - Range Resources launched the Appalachia shale rush, and rising domestic power and LNG demand can trigger it to boom again.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.