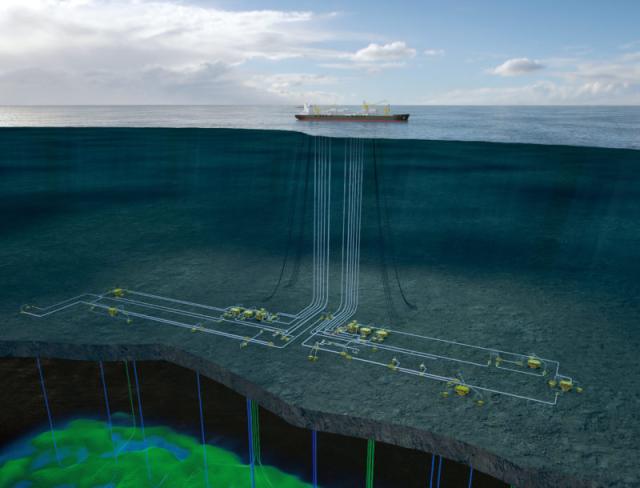

Plans call for a subsea production system with 26 subsea wells and an FPSO to process and export crude from the field. (Source: Aker Energy)

Fresh off marking successful drilling results from its latest Pecan Field well offshore Ghana, Aker Energy and partners have submitted to Ghanaian authorities a $4.4 billion development plan for the Deepwater Tano/Cape Three Points Block.

Taking a phased development concept route, the operator—Aker—will first tackle development of the Pecan Field, which is the largest of several discoveries on the offshore block. Plans call for a subsea production system with 26 subsea wells and an FPSO to process and export crude from the field, the company said in a news release.

If Ghana gives the development a green light, partners will begin the final investment decision (FID) process with first oil from the Pecan Field coming about 35 months after FID, the company said.

“The plan will, once approved, ensure an efficient development and production of the Pecan Field and further optimization of the DWT/CTP petroleum resources in a way that will deliver value to the people of Ghana and to us and our partners,” Aker Energy CEP Jan Arve Haugan said in a company statement.

Planned investment for the ultradeepwater development, which has a water depth of up to 2,700 m, does not include the charter rate for the FPSO.

Aker and partners Ghana National Petroleum Corp., Lukoil Overseas Ghana Tano Ltd. and Fueltrade Ltd. are targeting an estimated 334 million barrels of reserves at the Pecan Field.

Of the planned 26 subsea wells, 14 will be advanced horizontal oil producers and the rest will be injectors with alternating water and gas injection, the company said. Plans also include using multiphase pumps to help maximize oil production throughout the fields, which have a life expectancy of more than 25 years.

If all goes as planned, plateau production is expected to be about 110,000 barrels per day.

The Pecan Field area is believed to hold between 110-210 million barrels of oil equivalent (MMboe) in contingent resources, which could be developed in additional phases. But more appraisal drilling could lift the current estimated volume base of about 450-550 MMboe to between 600 MMboe and 1 billion barrels of oil equivalent, the company said.

“In addition to the FPSO for the Pecan Field development, Aker Energy has entered into an option agreement with Ocean Yield ASA for a second FPSO, Dhirubai-1,” Haugan said in the release. “If the option is exercised, Dhirubai-1 could either be used to accelerate production or for other, potential developments dependent on volumes and geographical distribution of these.”

Earlier this month, Aker Energy said the company hit oil in the Pecan South-1A well, which was drilled south of the main Pecan Field. At the time, the company planned to drill a sidetrack well in Pecan South and drill a third well in Pecan South East.

The Oslo-listed investment firm Aker, owned by Norwegian billionaire Kjell Inge Roekke, has also said Aker Energy could launch an IPO offering after summer 2019, Reuters reported.

Velda Addison can be reached at vaddison@hartenergy.com.

Recommended Reading

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.