Presented by:

This article appears in the E&P newsletter. Subscribe to the E&P newsletter here.

The Midcontinent region contains hundreds of fields that have produced more oil than any other area in the U.S., according to IHS.

"Driven by increased drilling activity in the SCOOP and STACK, the Anadarko Basin started seeing growth in live DUCs as early as May [2021], with the total inventory swelling from 48 wells in April to 87 wells in September," according to an October 2021 Rystad Energy report.

With the increase in drilling activity, comes the greater need for technological innovations. Service companies are stepping up to provide operators with the tools they need to optimize production and increase revenue.

In this exclusive interview, SMEs and executives with Baker Hughes, Schlumberger and Well Data Labs shared their insights with E&P about the latest tech challenges, advances and R&D taking place in the SCOOP/STACK, Merge and other Oklahoma plays in the Midcontinent.

The speakers:

- Ruben DeVelasco, vice president sales and commercial, North America Land Oilfield Services, Baker Hughes

- Chad Peterson, U.S. land managing director, Schlumberger

-

Morris Hasting, vice president of sales, Well Data Labs

Attend Hart Energy's DUG Midcontinent conference March 1-3 in Oklahoma City!

E&P: What's next for the Midcontinent region? What upstream tech challenges still need to be addressed and/or improved?

Schlumberger

Peterson: Most of the Midcontinent region falls under the unconventional category where challenges related to producing horizontal wells are always present. One of the most important challenges to address is the prevalence of volatile hydrocarbons that lead to rapid production flow rate declines, which in turn lead to wells with low flow rates that are on the borderline of ESP [electric submersible pumps] applications or transitioning to rod pumps.

As flow rate decreases due to depletion in unconventional reservoirs, it is common to see a well change to a lower flow rate artificial lift system, such as rod pumps or gas lift. Results from one of our joint customer studies revealed that the production loss due to change of artificial lift from ESP to rod pumps is about 17%. Therefore, there is a need to extend the life of the ESP installed on the well as much as possible to decrease the production loss from a transition to a lower flow method.

Well Data Labs

Hasting: We're seeing an interest in real-time monitoring to improve operational awareness. Operators want reliable real-time data; they want to know what's happening in the field as it happens so they can respond accordingly.

Moving to more remote operations, especially in a post-COVID environment, has also become a priority for a number of operators. With limited staff and needing to accommodate remote workers, companies need to leverage technology to ramp up remote operations quickly and efficiently. I think this dovetails into the technical challenges that need to be addressed or improved including data integration, streamlining data and time synchronization between all the data streams. Having a single vendor or enabling platform will be key. I believe Well Data Labs is well positioned in that regard with our ability to ingest technical field data into our cloud-based platform, making it accessible to anyone who needs it, when they need it and wherever they may be located.

E&P: In the last two years, what has been the greatest improvement to a single upstream tool used in the Midcon?

Peterson: Some of the biggest improvements we have seen the last few years are in drilling. Not only are wells being drilled faster but also more precisely, enabling operators to place the wellbore exactly where they want it. Operators have been able to achieve this with the use of rotary steerable systems that provide enhanced directional control and a better wellbore, faster. Another improvement is the use of Schlumberger's MWD xBolt G2 accelerated drilling service and our LWD PeriScope HD multilayer bed boundary detection service, which help with the challenges of the reservoir, allowing the operators to map thin layers, and even multiple layers, while sustaining trajectory.

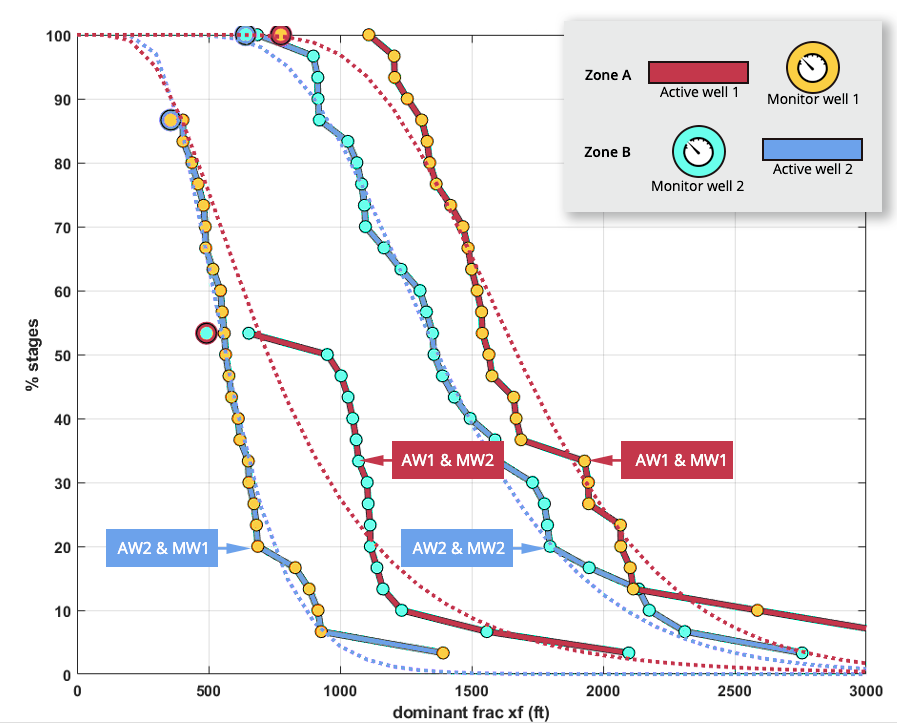

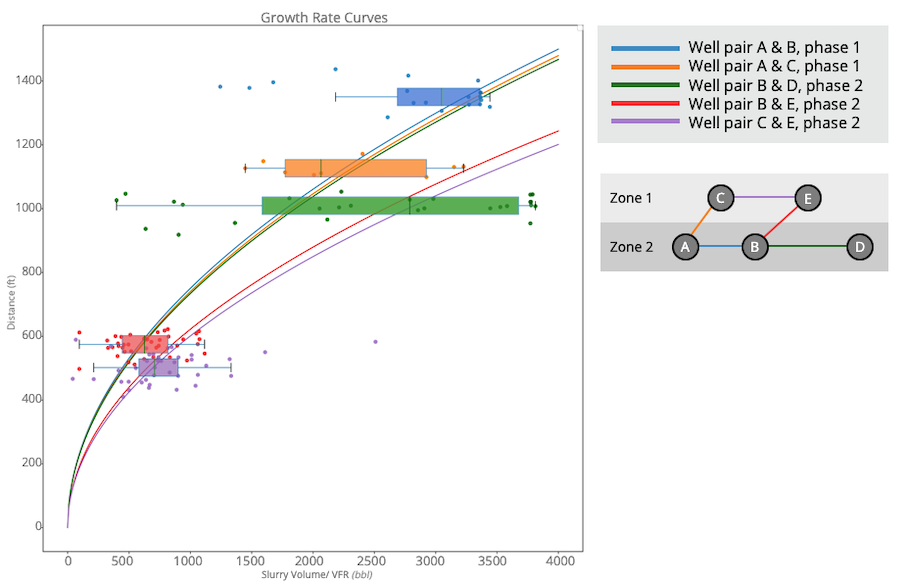

Hasting: What comes to mind is Devon Energy's patented Sealed Wellbore Pressure Monitoring, initially developed in the SCOOP/STACK for fracture diagnostics. In an exclusive partnership with Devon, Well Data Labs brought SWPM to market in 2020. Since then, over 13,000 stages have been analyzed in 16 unconventional basins in North and South America. SWPM has dramatically improved how operators analyze fracture-driven interactions, and it's a very cost-effective option compared to other fracture diagnostics. Another benefit is SWPM can be deployed broadly because the impact on operations is minimal. A sealed wellbore filled with low-compressibility fluid acts as a monitor well. Gauges on the well respond to pressure changes that occur when hydraulic fractures interact with the sealed wellbore. The pressure and fracturing data are collected and transmitted to Well Data Labs' cloud-based platform, where the fracture-driven interactions between the active and monitor wells are analyzed. Operators have used SWPM to optimize frac design, understand the connectivity between zones in stacked formations and improve cluster efficiency, among other objectives.

E&P: Do you have any R&D projects in the works that apply and/or are being implemented in the Midcontinent region?

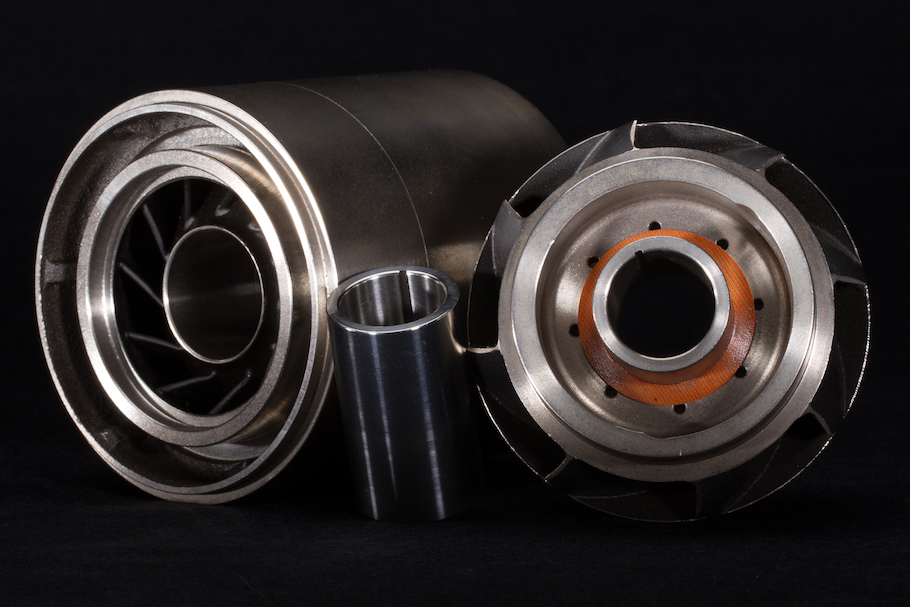

Peterson: To address the prevalence of low-flow wells and the need to extend the duration of ESP pumps before switching to rod pump systems, Schlumberger developed a new pump stage called the REDA Continuum LF low-flow, extended-life ESP pump. This stage includes all the latest development from our REDA Continuum extended-life ESP pump family with our proprietary enhanced compression design and tackles the low-flow applications, with an extended recommended operating range that covers from as low as 50 to 1,000 bbl/d.

In conjunction with pumps, we recently introduced our REDA Maximus Eon extended-life, install-ready ESP motor, which has the highest efficiency among any induction motor in the market. With the new Eon motor, power per section has increased by 33%, meaning overall shorter motors.

REDA Continuum LF pumps and Eon motors are the latest technology offerings to a basin such as Midcon where cost and production of low-flow wells go hand to hand, reducing opex and carbon emissions while maximizing oil production.

Hasting: We have several R&D projects, but one that is timely to this discussion is our real-time solution for fracturing operations. As an industry, we're trying to bring in key activities on the pad under one platform in real time. One complexity of real time is tying in various data types such as wireline, pump down and time synchronizing all the data channels. Platforms that capture data in real time and do it consistently will give operators a leg-up on real-time awareness and decision-making. The ability to offer this technology seamlessly while increasing operational efficiency will drive a data revolution in the field. We are seeing well over 95% uptime for our real-time solution, which is impressive knowing there are a number of variables not in our control and the remoteness of many locations we serve. Our goal is uptime approaching what we take for granted with cloud-based systems used at home or the office.

E&P: Digitalization and ESG are still hot topics in 2022. So what is your company's top technology focus in the Midcon this year?

Baker Hughes

DeVelasco: In recent years, Baker Hughes has invested heavily in remote operations, and it’s really paying off in terms of operational and environmental benefits. At the beginning of 2019, approximately 15% of our drilling operations in North America Land were executed remotely, and by the end of 2021 that number was more than 90%. This has helped us save rig days for our customers with a faster, more consistent drilling performance and lower each rig’s carbon footprint by reducing personnel on location and cutting job-related travel.

We’ve also made significant investments in automation, and these are also delivering both environmental benefits and performance improvements. For example, our ProductionLink Edge automation solution uses advanced analytics and “smart” edge technology to boost production while reducing associated methane emissions from oil and gas wells on artificial lift. During a 10-well pilot project in the Haynesville Shale, this technology helped one customer increase their gas production by 5% while decreasing the number of methane unloading events by 94%.

Peterson: We want to help operators unlock business impact via cutting-edge technology that can be deployed across operations. One of the ways in which we’re doing this is through our INNOVATION FACTORI, which is a dedicated resource that combines Schlumberger’s domain and artificial intelligence (AI) and machine learning (ML) expertise to help customers accelerate their digital transformation and realize economic gains at every stage of the well life cycle. Working with operators in the Midcontinent region, we can help them achieve better performance over a broad range of technology applications to improve allocation accuracy, optimize production performance and mitigate flow assurance issues through automation.

For ESG, our Cameron business has an extensive portfolio of certified low-emission (low-E) valves. In fact, more than 95% of our valves are now low-E certified. Over the past several years, we have developed new sealing technologies to meet the most demanding applications and certified our existing valve designs to meet the API 641 certification and ISO 15848 standard, which are generally considered the gold standards for low-E certification for valves. As the industry seeks ways to reduce its environmental impact, particularly from methane emissions, we expect to see growing interest for low-E certified valves in the Midcon region and in other areas across the globe.

Hasting: We’re excited about the impact SWPM is making. To this point, several operators have been able to tie operational adjustments identified by SWPM to enhanced production results, and the numbers have been quite impressive. We have been fortunate to work in almost every North American basin at this point, many of them multiple times, which gives our expert completions advisers the data to begin noticing interesting themes by basin that add additional value to clients. Adding the real-time and automated decision-making with SWPM will be a game changer and bring operators one step closer to making changes to their frac in near-real time.

E&P: How is your company implementing carbon management technologies in the Midcon, and/or what carbon management projects are you involved in within this region?

DeVelasco: We believe one of the most effective ways we can support carbon reduction is by working with our customers to design and deploy carbon capture, utilization and storage (CCUS) technology and solutions. That’s because, without effective and efficient CCUS technology, it will be nearly impossible to remove emissions from large parts of the global economy, and we expect much more interest in this area in 2022. In fact, we’re currently working with a couple of operators to determine the viability of re-injecting CO2 from industrial plants for enhanced oil recovery applications.

Peterson: In the Midcontinent region, Schlumberger is involved in carbon management projects ranging from supporting the Archer Daniels Midland’s Carbon Capture and Storage (CCS) Project in Illinois to working with numerous companies looking at the feasibility of CCS projects throughout the entire Midwest. Schlumberger’s ability to characterize site specific properties, reservoir simulations and provide regulatory permitting documentation has been a key enabler for project efficiency and success.

Hasting: During completions operations, operators are looking for ways to power their fleets, improve fuel usage while minimizing emissions, reduce time on the pad and lower overall environmental impact, all without negatively impacting frac operations. For example, we’ve had customers that want to compare and understand the impact that different fuels have on the quality and efficiency of their completions operations. By providing analytical tools and machine learning, we can help them analyze and understand the fuel that has the optimal impact on operations. Another example is the need for operators to reduce time on pad through operational efficiencies such as reduced NPT [nonproducive time] or simul-frac operations. We help them analyze that data in real time and post-job to ensure they are both efficient and effective in their operations.

E&P: Do you have anything else you'd like to share?

Peterson: We continue to maintain a strong technical community in Oklahoma City to support operators in the region to leverage a broad range of solutions to the basin. One way we are doing that is through a new business model called Extreme that allows operators to select any Schlumberger technology that fits their challenge regardless who they use as their primary service provider.

Hasting: AI and ML have definitely become a part of our everyday lives; think Siri and Alexa as examples. Well Data Labs has built one of the most extensive portfolios of deployed ML models in the industry. We’re leveraging AI to make our offerings more efficient and, in doing so, we make our customers, both operators and service providers, more efficient. What took a certain amount of time, effort and resources yesterday takes significantly less time, effort and resources today. By automating manual processes, we can help technical professionals devote more time to decision-making and less time spent managing data. For our customers, that takes cost out of the value chain and ultimately helps improve their margins.

RELATED CONTENT:

‘In the Money’ in Oklahoma

Margins are strong in the multistream SCOOP, STACK and Merge where operators are dialing up the hydrocarbon weighting they want from any given rig. Yet, any stream—oil, gas, NGL—will make the numbers these days.

Recommended Reading

E&P Highlights: Aug. 26, 2024

2024-08-26 - Here’s a roundup of the latest E&P headlines, with Ovintiv considering selling its Uinta assets and drilling operations beginning at the Anchois project offshore Morocco.

OMV Makes Gas Discovery in Norwegian Sea

2024-08-26 - OMV and partners Vår Energi and INPEX Idemitsu discovered gas located around 65 km southwest of the Aasta Hansteen field and 310 km off the Norwegian coast.

E&P Highlights: Sep. 2, 2024

2024-09-03 - Here's a roundup of the latest E&P headlines, with Valeura increasing production at their Nong Yao C development and Oceaneering securing several contracts in the U.K. North Sea.

Breakthroughs in the Energy Industry’s Contact Sport, Geophysics

2024-09-05 - At the 2024 IMAGE Conference, Shell’s Bill Langin showcased how industry advances in seismic technology has unlocked key areas in the Gulf of Mexico.

Devon Energy Expands Williston Footprint With $5B Grayson Mill Deal

2024-07-08 - Oklahoma City-based Devon Energy is growing its Williston Basin footprint with a $5 billion cash-and-stock acquisition from Grayson Mill Energy, an EnCap portfolio company.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.