The proposed plan, which could include zero to 11 offshore oil and gas lease sales, reflects President Joe Biden’s and Interior Secretary Deb Haaland’s “commitment to transition to a clean energy economy,” according to a press release. (Source: Hart Energy, Shutterstock.com)

The Biden administration recently unveiled a new proposed offshore oil and gas leasing plan, which could include anywhere from zero to 11 lease sales.

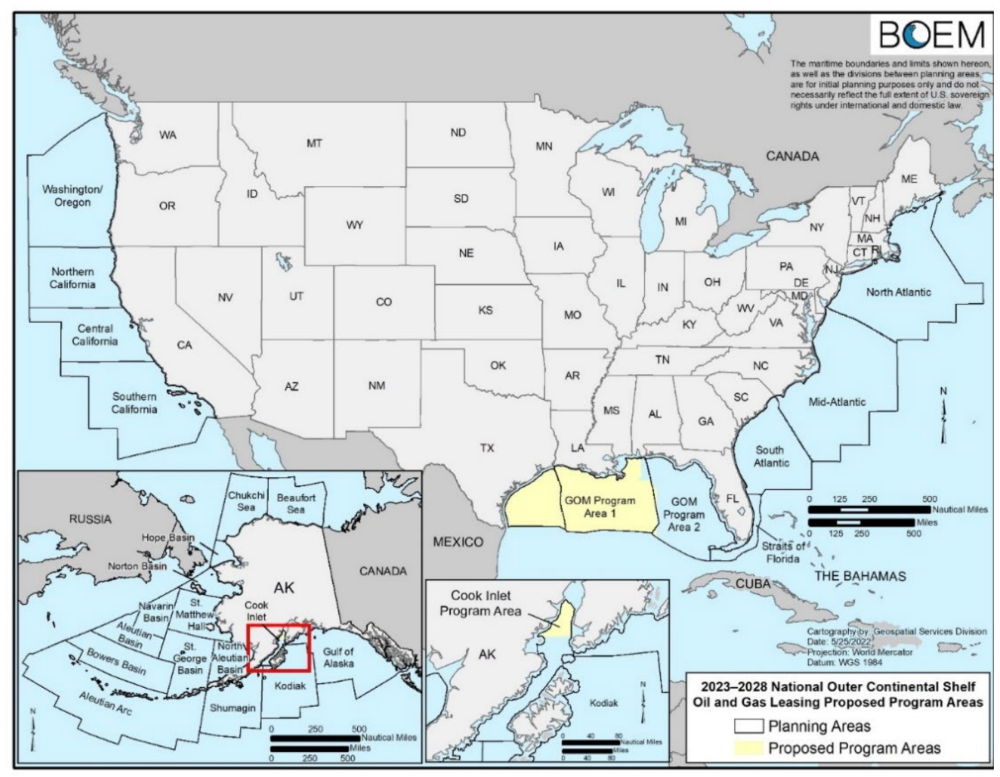

Consistent with the recently expired leasing program, only acreage in the Gulf of Mexico (GoM) and the Cook Inlet of Alaska is included in the latest proposed program for the U.S. Outer Continental Shelf (OCS). The proposed plan, for years 2023-2028, reflects President Joe Biden’s and U.S. Department of the Interior (DOI) Secretary Deb Haaland’s “commitment to transition to a clean energy economy,” according to a press release.

“This is the second step in a three-step planning process to determine whether or how many offshore oil and gas lease sales to hold over the next five years. The proposed plan puts forward several options from no lease sales up to 11 lease sales over the next five years,” Haaland said in the press release.

The proposed program was released by the DOI on July 1, a day after the previous five-year OCS leasing plan expired. The Bureau of Ocean Energy Management (BOEM) also released its U.S. Outer Continental Shelf Gulf of Mexico Region Oil and Gas Production Forecast: 2022–2031.

In the DOI release, Haaland invited comment on the proposed plan, which includes up to 10 potential lease sales in the Gulf of Mexico and one potential lease sale in the northern portion of the Cook Inlet of Alaska. No lease sales are proposed for the other Alaska planning areas, nor for the Atlantic or Pacific planning areas.

The DOI declined further comment.

The proposed sales include:

- 262 in 2023, Gulf of Mexico;

- 263 in 2024, Gulf of Mexico;

- 264 in 2024, Gulf of Mexico;

- 265 in 2025, Gulf of Mexico;

- 266 in 2025, Gulf of Mexico;

- 267 in 2026, Cook Inlet, Alaska;

- 268 in 2026, Gulf of Mexico;

- 269 in 2026, Gulf of Mexico;

- 270 in 2027, Gulf of Mexico;

- 271 in 2027, Gulf of Mexico; and

- 272 in 2028, Gulf of Mexico.

The U.S. Gulf sales include acreage in the Western and Central GoM Planning Areas and a small portion of the Eastern GoM Planning Area, consistent with the Gulf of Mexico Energy Security Act, where more than 95% of current OCS production occurs.

The release of this proposed program follows the 2018 publication of the draft proposed program and is the second of three required steps before the Secretary of the Interior can approve a final program. Following publication in the Federal Register, the Interior Department will seek public comment on the proposed program and the accompanying draft programmatic environmental impact statement.

When public comment closes, the BOEM will prepare a proposed final program and final programmatic environmental impact statement, which will include analysis of the size, timing, location, and number of potential lease sales in the proposed program. The final program also may include fewer potential lease sales, or no lease sales. There is then a minimum 60-day period before the secretary can approve the program and finalize the record of decision.

The previous plan

The finalized 2017-2022 OCS Oil and Gas Leasing Program included the possibility of 11 lease sales, with a similar composition to the current proposed program. However, all three lease sales originally scheduled for 2022 under the previous five-year plan—259 and 261 in the Gulf of Mexico and 258 in the Cook Inlet—were canceled.

The DOI cited lack of industry interest when canceling the Cook Inlet sale. The cancellation of the other two followed court conflicts associated with the most recent Gulf of Mexico lease sale, number 257.

Sale 257, held in November 2021, generated $191 million in high bids, but a court vacated the sale.

Also in November 2021, the DOI released a report finding the federal oil and gas program “fails to provide a fair return to taxpayers, even before factoring in the resulting climate-related costs that must be borne by taxpayers; inadequately accounts for environmental harms to lands, waters, and other resources; fosters speculation by oil and gas companies to the detriment of competition and American consumers; extends leasing into low potential lands that may have competing higher value uses; and leaves communities out of important conversations about how they want their public lands and waters managed.”

That same report made two recommendations: designing leasing and development processes that prioritize the most suitable areas for development and ensure lessees and operators have the financial and technical capacity to comply with all applicable laws and regulations, and creating a more transparent, inclusive, and just approach to leasing and permitting.

Looking to the future

The 10-year forecast BOEM released earlier this month cited its 2021 Resource Assessment Fact Sheet in saying the GoM holds estimated undiscovered technically recoverable resources ranging from 23.3 billion barrels of oil to 36.3 billion barrels of oil and 46.9 Tcf to 62.6 tcf of gas, with expected recoverables of 29.6 billion barrels of oil and 54.8 Tcf of gas.

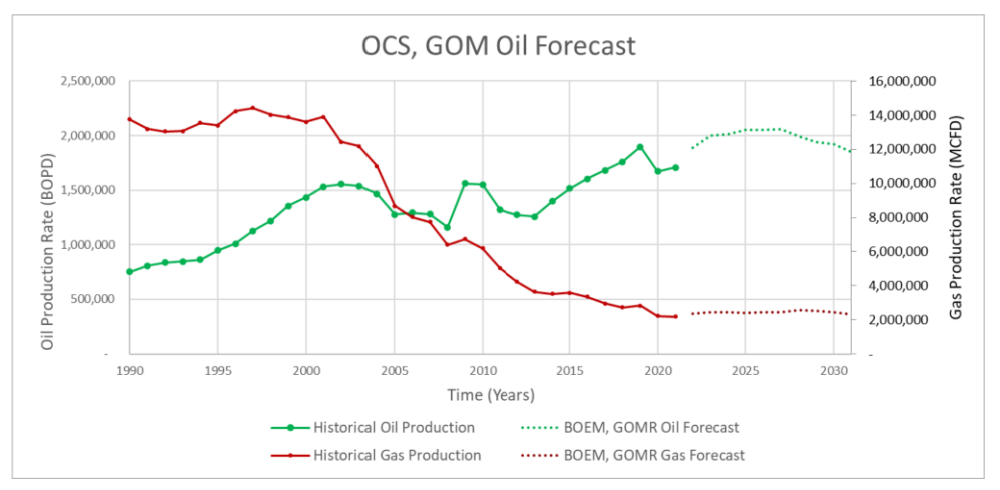

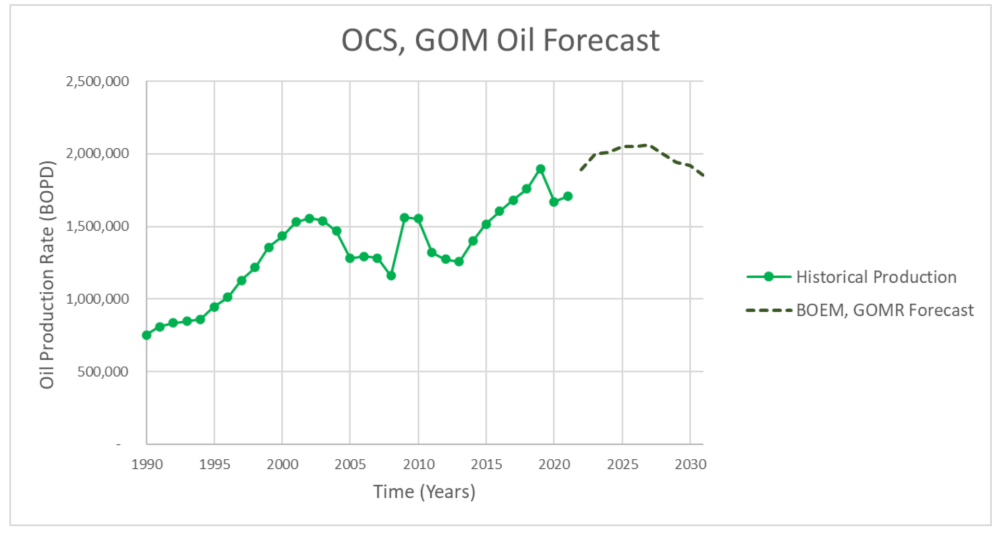

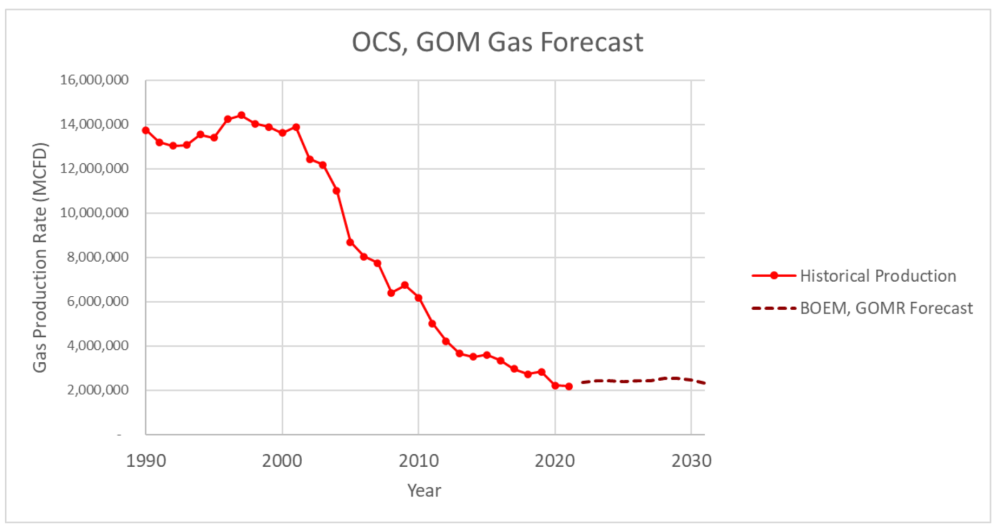

According to the forecast, GoM oil production is expected to continue to grow while gas production is expected to experience moderate increases but not expected to rebound near previous highs. The forecast notes that the energy transition has already begun to affect the region.

“Renewable energy sources and increases in energy efficiency have begun to decrease demand for oil production and this trend will continue,” the BOEM report said.

The forecast projects oil production from 2022 through 2024 to have strong growth, followed by a relative plateau until 2027 and a gradual decline through the end of the forecast period. On the other hand, the forecast noted that since 2001, gas production has declined significantly despite some periods of strong growth in oil production over the same timeframe.

Recommended Reading

Early Innings: Uinta’s Oily Stacked Pay Exploration Only Just Starting

2025-03-04 - Operators are testing horizontal wells in less developed Uinta Basin zones, including the Douglas Creek, Castle Peak, Wasatch and deeper benches.

Occidental to Up Drilling in Permian Secondary Benches in ‘25

2025-02-20 - Occidental Petroleum is exploring upside in the Permian’s secondary benches, including deeper Delaware Wolfcamp zones and the Barnett Shale in the Midland Basin.

Chord Drills First 4-Mile Bakken Well, Eyes Non-Op Marcellus Sale

2025-02-28 - Chord Energy drilled and completed its first 4-mile Bakken well and plans to drill more this year. Chord is also considering a sale of non-op Marcellus interests in northeast Pennsylvania.

Acquisitive Public Minerals, Royalty Firms Shift to Organic Growth

2025-04-04 - Building diverse streams of revenue is a key part of growth strategy, executives tell Oil and Gas Investor.

Improving Gas Macro Heightens M&A Interest in Haynesville, Midcon

2025-03-24 - Buyer interest for Haynesville gas inventory is strong, according to Jefferies and Stephens M&A experts. But with little running room left in the Haynesville, buyers are searching other gassy basins.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.