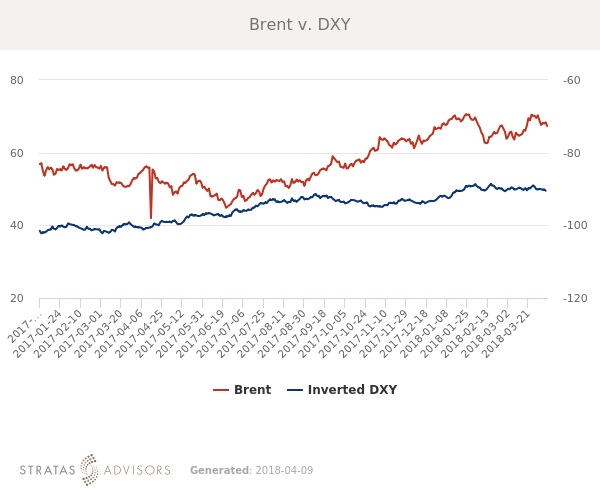

In the week since our last edition of What’s Affecting Oil Prices, Brent prices averaged $67.83/bbl last week, down $2.17/bbl from the week before.

West Texas Intermediate (WTI) suffered a similar fate, falling $1.95/bbl last week to average $63.08/bbl. This came about despite a surprise draw in U.S. crude stocks and market concerns about the evolving trade dispute between the U.S. and China. This week could see prices stabilize with Brent averaging $68/bbl.

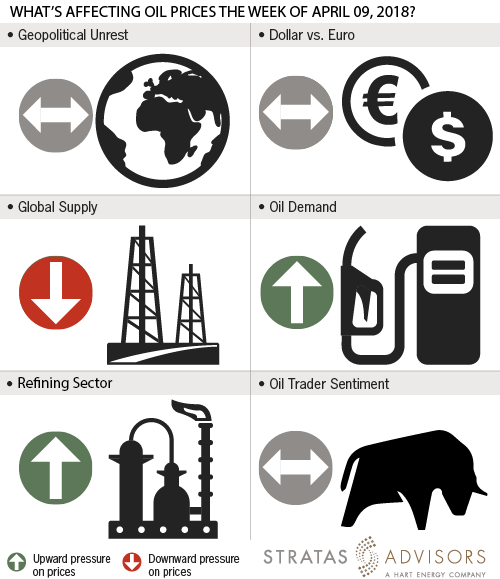

Geopolitical: Neutral

There is minimal news on the geopolitical front that is likely to influence prices this week. While perennial issues such as the decline in Venezuela and unrest in Libya remain, analysts do not expect them to become more impactful in the short term.

Dollar: Neutral

Fundamental and sentiment-related drivers continue to have more impact on crude oil prices. The dollar rose slightly last week while Brent and WTI both fell.

Trader Sentiment: Neutral

Nymex WTI and ICE Brent managed money net long positioning decreased slightly last week. Overall market sentiment remains supportive, but positioning has been moderating on both a lack of new bullish indicators and increasing concerns about the evolving U.S. and China trade dispute.

Supply: Negative

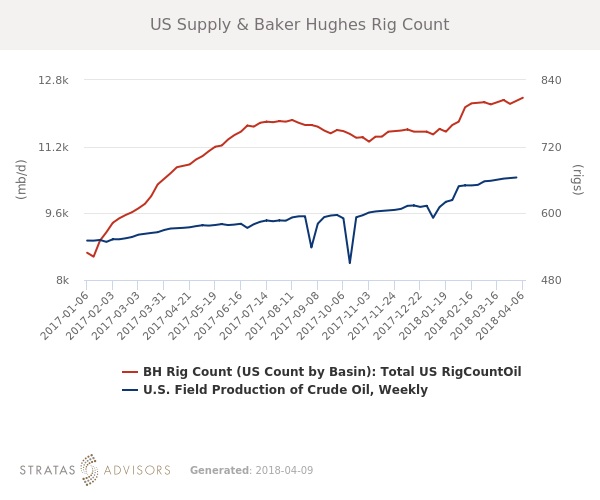

According to Baker Hughes, the number of U.S. oil rigs rose by 11 last week. U.S. oil rigs now stand at 808, compared with 672 a year ago. Evidence of renewed global oversupply continues to pose the greatest threat to prices.

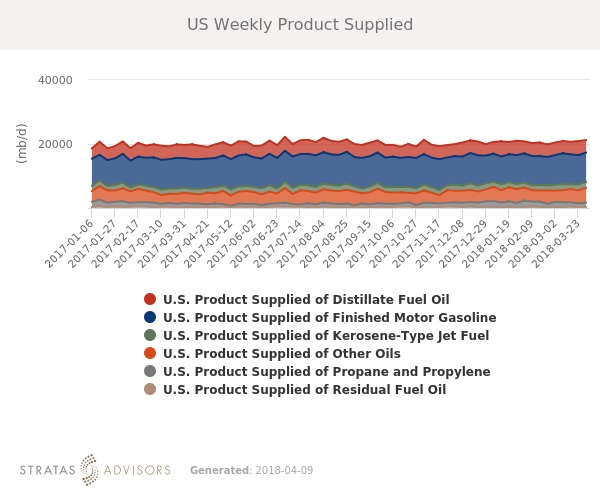

Demand: Positive

U.S. consumption of petroleum products remains generally at or above seasonal averages in all products, including fuel oil. Economic indicators so far presage strong consumer spending through the summer demand season, and refined product demand is likely to remain a supportive factor in the short-term.

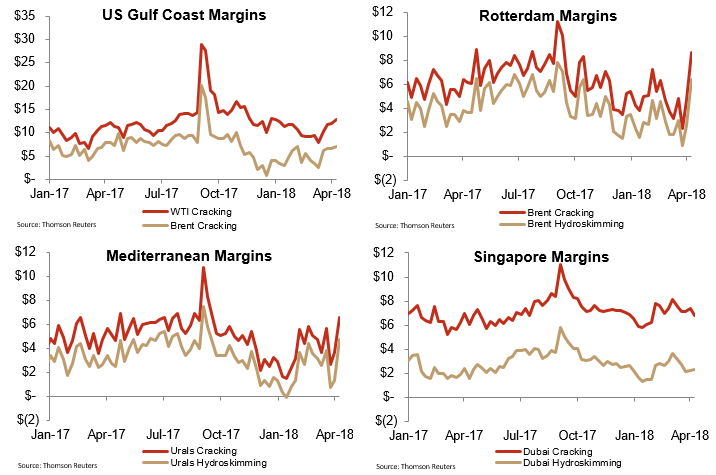

Refining: Positive

Margins rose in almost every enclave last week, due in large part to crude prices falling. Brent fell $2.17/bbl. Brent cracking and hydroskimming in Rotterdam both increased nearly $4/bbl. Margins remain at or above the five-year average in all enclaves, a boon for crude oil demand.

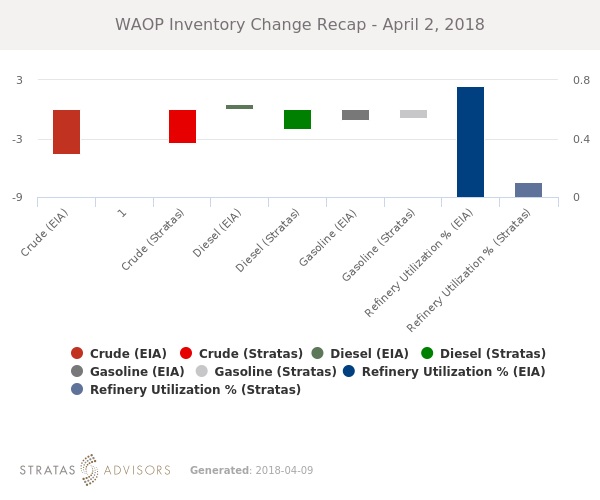

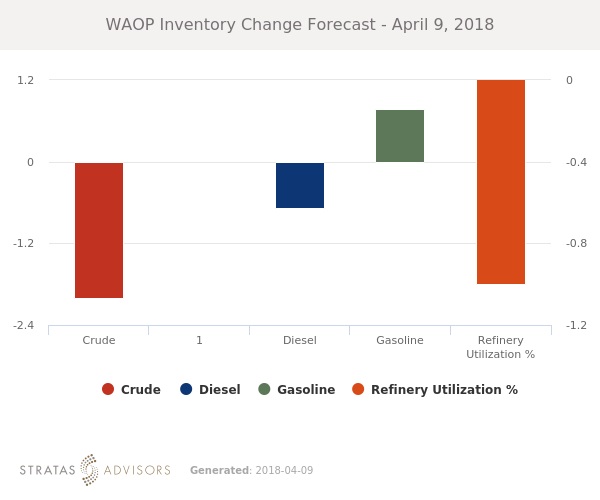

How We Did