Though OPEC and its allies agreed to raise production by about 1 million bbl/d, the real output increase from the group’s agreement June 22 is expected to translate to roughly 600,000 bbl/d. (Source: Shutterstock.com)

[Editor's note: This story was updated at 2:55 p.m. CST June 22.]

OPEC and its allies led by Russia agreed on June 22 to raise oil production by about 1 million barrels per day (bbl/d) starting in July at the group’s 174th meeting in Vienna.

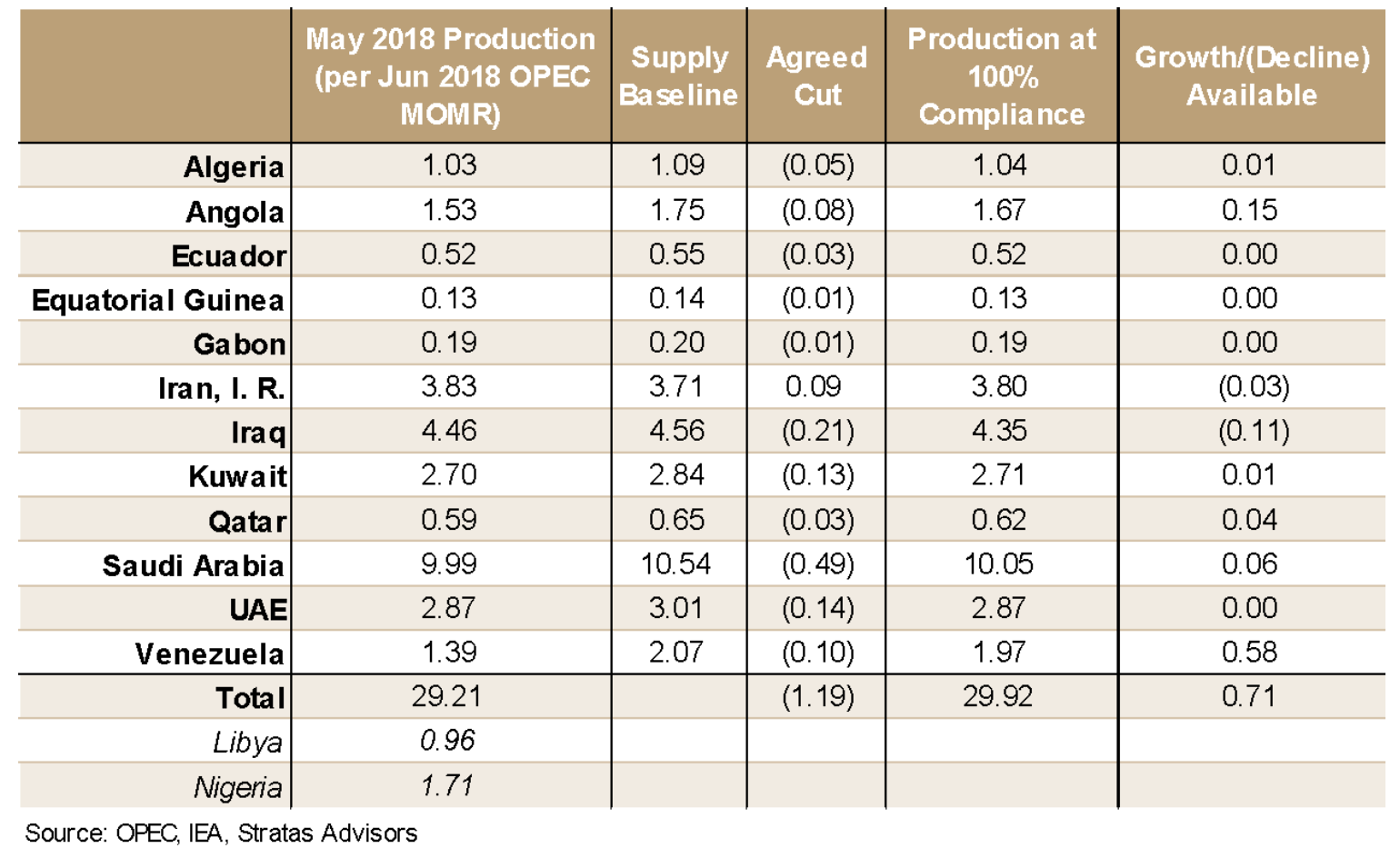

The increase is the result of OPEC and non-OPEC countries reaffirming their prior agreement to cut oil supply by 1.8 million bbl/d that started in 2017 with the collective pledge to boost production to 100% of the targeted cuts after recently exceeding compliance by 152%.

The June 22 decision will result in a nominal output gain to compensate for the group’s overcompliance as several countries such as Venezuela and Libya have been hit by production losses at a time of rising global demand. Further, the real output increase will translate to a minimum of roughly 600,000 bbl/d of crude because certain countries will still not be able to substantially ramp up production.

Despite global crude inventories dropping to the five-year average range and a recovery in crude oil prices, oil demand is growing, said Andrew Slaughter, executive director for the Deloitte Center for Energy Solutions.

Slaughter pointed to growing production declines from OPEC-member countries Venezuela and Iran driving the need for an output increase from the group.

For Venezuela, he said the country continues to report month-on-month production declines as a consequence of upstream capital constraints and growing export logistics issues. Meanwhile, Iran faces U.S. sanctions in November which are making its oil more difficult to sell. The country was reported as saying it would not support even a modest output increase ahead of the June 22 meeting.

“These factors, along with the lower inventory levels resulting from the agreements, might make the world more vulnerable to sharper upward price responses in the months ahead, legitimizing the discussion about whether to increase production,” Slaughter said in a statement on June 21.

Saudi Arabia and Russia had both been lobbying for a change to the production deal, with some proposals rumored to encourage production to be lifted by 1.5 million bbl/d but seemed to be running into unanticipated resistance including vocal opposition from Iran.

However, Saudi Arabia, OPEC’s de facto leader, reportedly persuaded Iran with a compromise in order to reach the June 22 agreement for a modest hike in oil supply.

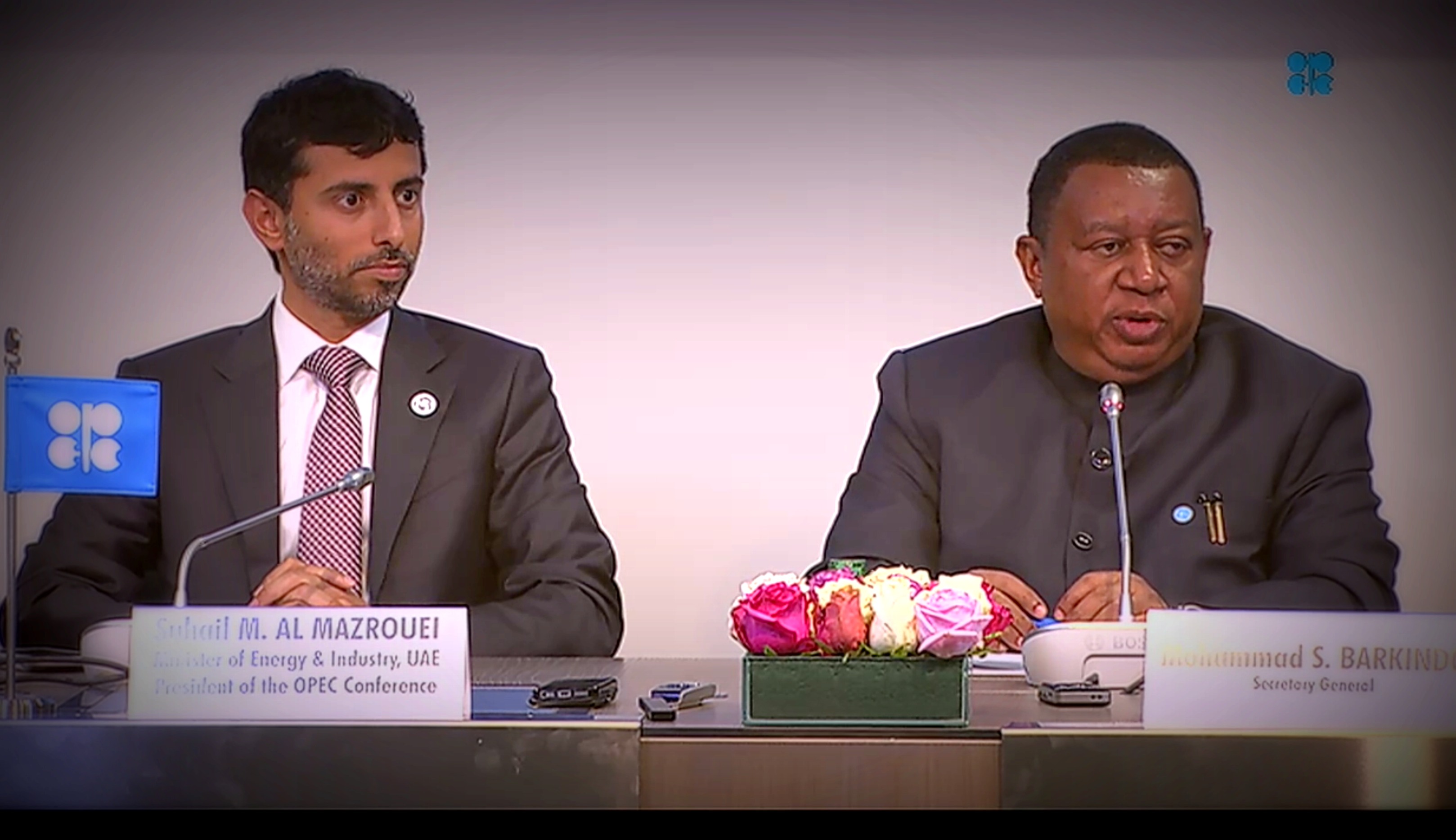

Still, how the agreed upon production increase is allocated between OPEC and its allies has not been decided yet, Suhail Mohamed Al Mazrouei, United Arab Emirates’ Minister of Energy and Industry, said at a press conference following the OPEC meeting.

Though, Al Mazrouei, who is also president of the OPEC conference, reassured the crowd that the group will not target anything above the current allocation numbers.

Oil prices rose upon news of OPEC’s modest output increase. Benchmark Brent crude jumped $2.19 per barrel to a high of $75.24 before slipping to about $75 by 8:05 a.m. CST (13:05 GMT). West Texas Intermediate crude futures were $1.80 higher at $67.34.

Hart Energy spoke to Stephen Beck, senior director of North American shale at Stratas Advisors, for his take on the OPEC meeting earlier this week.

“I think what is most likely to come out of this meeting is, officially, we continue on the path we are already on. No change to the official position of curtailments through the end of the year. Unofficially, I believe that Saudi Arabia will continue to monitor the markets closely and make sure the markets are adequately supplied,” Beck said. “But I don’t think that is going to lead to any market disruptions or supply disruptions. What I believe is that it will prevent any change in the official position of OPEC but Saudi Arabia will monitor.”

Slaughter pointed out in his note on June 21 that U.S. shale producers also remain a wildcard for global oil markets.

While U.S. crude oil production is projected to increase by 1.4 million bbl/d in 2018, a lack of pipeline capacity in the Permian Basin plus a heightened focus on capital discipline in the upstream sector could impact future supply.

“U.S. producers are not a party to the production restraint agreement and are generally seen as beneficiaries of the rise in prices that the deal partially created,” he said. “However, they are currently experiencing infrastructure constraints which, along with an emphasis on financial discipline, could limit their ability to meet global demand.”

U.S. shale executives including John Hess, CEO of Hess Corp. (NYSE: HES), and Scott Sheffield, executive chairman of Pioneer Natural Resource Co. (NYSE: PXD), were expected to meet with OPEC ministers during the group’s meeting in Vienna June 22-23.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

EOG Secures Award to Explore Abu Dhabi for Unconventional Oil

2025-05-16 - U.S. shale giant EOG Resources will evaluate 900,000 acres in a hydrocarbon-rich basin in Abu Dhabi under a new concession agreement with ADNOC.

BOEM to Offer 15,000 Blocks in Gulf Oil and Gas Lease Sale

2025-06-25 - BOEM is proposing a royalty rate of 16 ⅔ percent for both shallow and deepwater leases—the lowest rate for deepwater since 2007, the agency said.

Kongsberg Maritime to Equip New Construction Vessels for Sea1 Offshore

2025-06-04 - Kongsberg Maritime and Sea1 Offshore will also collaborate on a study to measure emissions reductions.

US Oil/Gas Rig Count Down for 11th Week to Lowest Since 2021, Baker Hughes Says

2025-07-11 - U.S. energy firms this week cut the number of oil and natural gas rigs operating for an 11th week in a row for the first time since 2020.

Wyoming Governor: Bet on Powder River Oil to Beat Market Challenges

2025-06-12 - Wyoming’s Powder River Basin has taken a quieter role in recent years as oil producers focused on the Permian. But state leaders remain confident, betting on a rebound in oil production from the once-promising shale play, Gov. Mark Gordon said in an exclusive interview.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.