More than 90% of the Utah Ute tribe’s income is from energy development on its 4.5-million-acre reservation, and the tribe says XCL Resources’ bid to buy Altamont Energy shouldn’t be blocked. (Source: Shutterstock.com)

Public comments on Utah oil producer XCL Resources’ plan to buy neighbor Altamont Energy have garnered some Uinta Basin interest owners’ support, most vocally by the basin’s largest minerals owner: the Ute Indian Tribe.

“The Federal Trade Commission must uphold its trust responsibility to the tribe,” the Fort Duchesne, Utah-based Ute Indian Tribe of the Uintah and Ouray Reservation wrote to the FTC. The public-comment period closed on April 15.

The tribe reported the FTC should approve the XCL-Altamont deal “without any undue delay,” citing the FTC’s own mandate to promote competition “without unduly burdening legitimate business activity.”

More than 91% of the tribe’s revenue is from energy development on its 4.5-million-acre reservation, funding 60 tribal departments that have more than 450 employees.

“Energy development on our lands supports thousands of jobs and hundreds of millions of dollars in economic development,” the tribe wrote.

Its minerals income “cannot be fully realized when the … federal trustee obstructs industry partners from operating in the free market.”

2022: FTC enters

FTC involvement in the pending XCL-Altamont deal stems from a 2022 decision to forbid XCL’s private-equity owner EnCap Investments from putting the Utah property it acquired from EP Energy into XCL.

EP Energy was Utah’s No. 1 oil producer, averaging 19,240 bbl/d in 2021, according to state data; XCL was No. 3 with 11,700 bbl/d.

In blocking that deal, the FTC concluded XCL would control too much of the Uinta’s waxy oil production that Salt Lake City-area refiners’ slates are geared to handle.

EnCap sold the EP Energy property instead to Houston-based publicly-held Crescent Energy Co., now the state’s No. 3 oil producer with 21,000 bbl/d in January, according to state data.

XCL, which is the new No. 1 oil producer nevertheless due to its drilled and completed (D&C) work since 2021, surfaced 48,000 bbl/d in January; the No. 2 producer is Ovintiv Inc. with 27,400 bbl/d.

Altamont Energy ranked No. 8 with 7,000 bbl/d.

Total Utah oil production in January was 178,600 bbl/d.

A condition of the FTC ruling in 2022 required EnCap to get approval before it or a portfolio company buys any oil property in a seven-county area that includes the Uinta Basin through 2032.

Meanwhile, in approving EnCap’s sale of the property to Crescent, the FTC required Crescent to seek approval before selling it before 2026 to any non-Uinta operator and before 2032 to an existing Uinta operator.

Ute, other comments

The Ute tribe wrote to the FTC this month that the 2022 decision has already affected development on its land and that it wasn’t consulted before the decision was made.

Meanwhile, some of the Altamont leasehold includes Ute minerals, it added.

“Currently, these assets are being held by Altamont with little or no production, which prevents the tribe from reaping the full economic potential from its mineral estate. XCL, meanwhile, is an established producer with a strong track record on our reservation.”

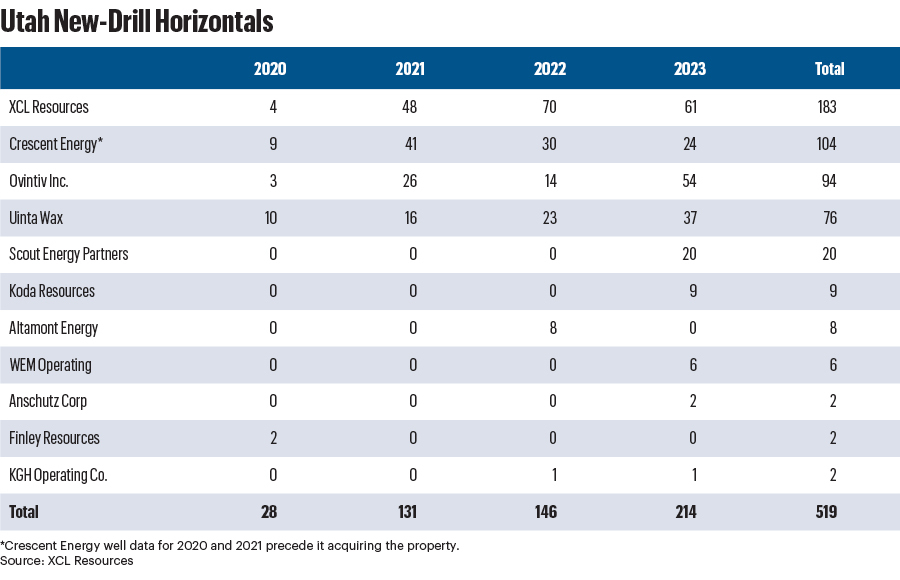

According to XCL, Altamont drilled eight horizontals on its Utah property out of the 519 drilled in the past four years among all operators in the state.

Among those, XCL drilled 183; Ovintiv, 94; Uinta Wax Operating, 76; Crescent Energy, 128; and Scout Energy Partners, 20.

Crescent Energy reported earlier this year that it is finding that doubling the proppant load in its lateral completions is resulting in 50% more oil production.

The FTC has not stated when it expects to make a decision.

A total of 10 comments to the FTC were received by the April 15 deadline. In comparison, the commission received 29 comments in the 2022 matter.

Of the 10 new comments, three were not posted, three were posted but withdrawn and the four that remain on view were posted by Uinta neighbors—all stating support of the XCL-Altamont deal.

Concerning those not posted, the FTC said that in some instances, “agencies do not publicly post all comments received. … The number of accessible comments, therefore, may be lower than the total number of comments listed in the card below.”

Scout: Good deal for all

Of the three posted but withdrawn, two were by “Anonymous” and one by an individual who self-identified as Mike Chambers.

Hart Energy viewed one of the posts by Anonymous before it was withdrawn. It called for the FTC to forbid the deal. Instead, “we should nationalize the industry to begin phasing it out and use the assets to transition more quickly to renewable resources.”

Among the public-to-view comments, Uinta producer Scout Energy Partners, the No. 6 Utah oil producer in January with some 12,000 bbl/d, wrote, “We think XCL acquiring Altamont’s assets is a good outcome for this area, for other operators and all stakeholders involved.”

Privately held and consisting of five active funds, Scout operates in eight states, producing some 110,000 boe/d on more than 4 million acres.

It added that “Altamont is a very small operator with limited access and expertise needed to develop its properties.”

Also, “there is no expected change to the competitive landscape post-deal, including as to the supply to Salt Lake City [oil refiners],” Scout reported.

“Uinta waxy crude oil is a grade … that competes with other crudes in the Salt Lake City region and across the Lower 48. The vast majority of XCL’s crude oil is sold in the Gulf Coast and [Midcontinent] regions because the Salt Lake City refineries are full.”

WEM, Rig II

Provo, Utah-based Wasatch Energy Management’s WEM Operating wrote that the deal would mean “the mineral owners whose interests are controlled by Altamont will then benefit from XCL’s greater ability to meaningfully develop their minerals, creating value for those royalty and working interest owners and generating tax revenues.”

It added that denying approval to XCL and Altamont “would compromise the Uinta Basin's developmental trajectory, … stifling competition … and curtailing efficient producers like XCL from enhancing supply and pioneering innovations for the region and the industry overall.”

Non-op Uinta interest-owner Rig II LLC, which also owns trader MC Oil and Gas LLC and shipper Foreland Transportation Inc., wrote that denying XCL “does not allow any growth to any of my business.”

“Altamont is a very small operator with limited access to capital needed to develop its properties,” WEM reported. “… If the FTC does not allow the transaction to close, we believe it is very harmful to the future of Uinta Basin.”

A “no” from the FTC would discourage investment—by both newcomers and existing producers—and “it will limit the most efficient producers, like XCL, from continuing to grow supply and innovating new ways for the Uinta Basin to succeed,” WEM concluded.

Back-story

EP Energy’s assets were carved out of integrated operator El Paso Corp. when Kinder Morgan wanted to buy El Paso’s midstream assets but not its E&P business in 2012.

An investment group led by Apollo Global Management bought the E&P unit and took it public in early 2014.

EP Energy filed for bankruptcy protection in 2019. Post-reorganization in 2020, EP Energy’s new owners, who had been its debt-owners, sold the portfolio to EnCap for $1.5 billion.

The assets were in Utah and South Texas.

The Utah property was to go to XCL and the South Texas property to EnCap portfolio company Verdun Oil.

In settling with the FTC in 2022, EnCap sold EP’s Utah property to Crescent Energy.

Recommended Reading

US Oil, Gas Rig Count Falls to Lowest Since January 2022

2024-05-03 - The oil and gas rig count, an early indicator of future output, fell by eight to 605 in the week to May 3, in the biggest weekly decline since September 2023.

Pemex Reports Lower 2Q Production and Net Income

2024-05-03 - Mexico’s Pemex reported both lower oil and gas production and a 91% drop in net income in first-quarter 2024, but the company also reduced its total debt to $101.5 billion, executives said during an earnings webcast with analysts.

Chouest Acquires ROV Company ROVOP to Expand Subsea Capabilities

2024-05-02 - With the acquisition of ROVOP, Chouest will have a fleet of more than 100 ROVs.

SLB, OneSubsea, Subsea 7 Sign Collaboration Deal with Equinor

2024-05-02 - Work is expected to begin immediately on Equinor’s Wisting and Bay Du Nord projects.

SilverBow Makes Horseshoe Lateral in Austin Chalk

2024-05-01 - SilverBow Resources’ 8,900-foot lateral was drilled in Live Oak County at the intersection of South Texas’ oil and condensate phases. It's a first in the Chalk.