Transocean’s Deepwater Titan is the second 8th-generation drillship in its fleet. (Source: Transocean)

Despite suffering an adjusted net loss of $74 million during fourth-quarter 2023, offshore drilling company Transocean is in the midst of an upcycle, which CEO Jeremy Thigpen presciently predicted in the company’s third-quarter 2023 earnings call.

Now it just needs to pay off.

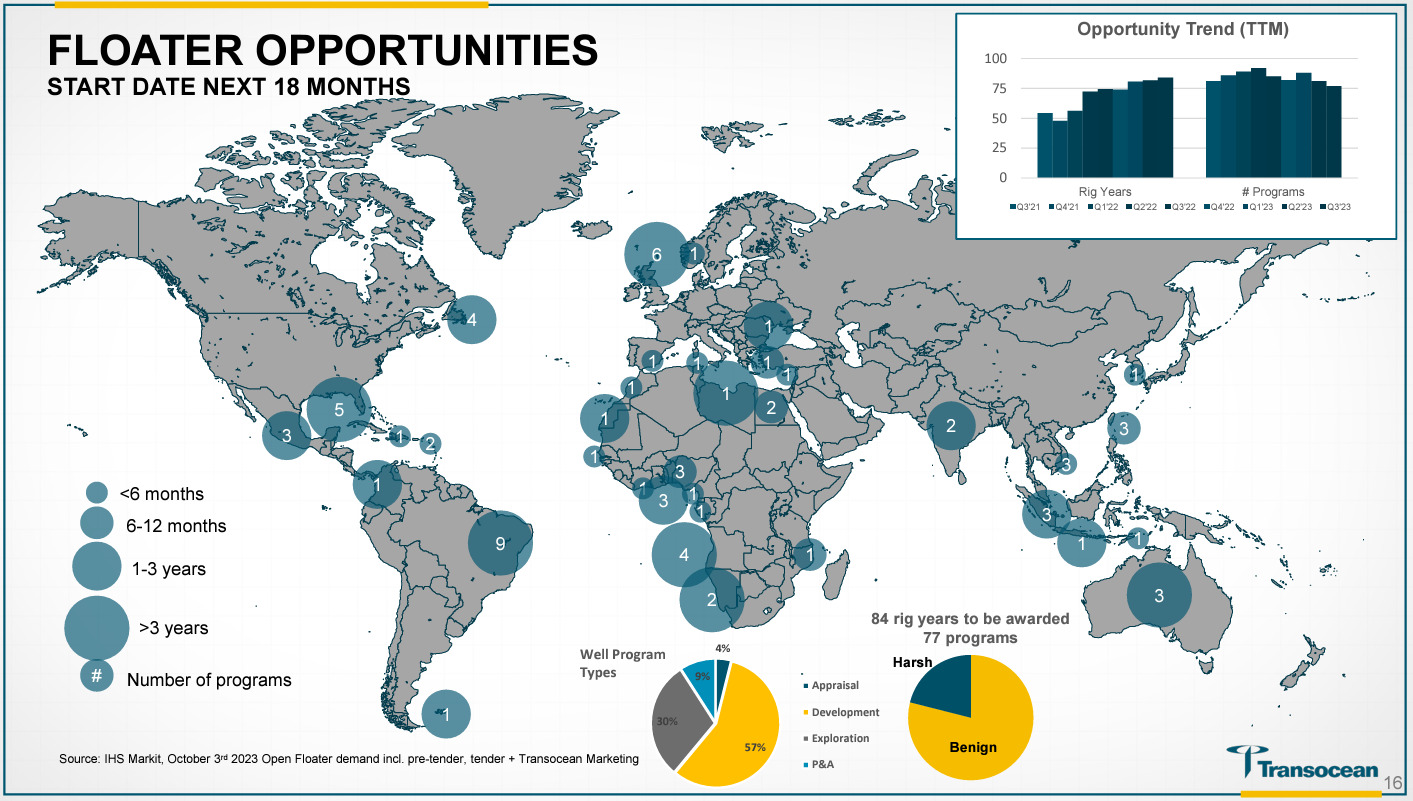

After a tough fourth quarter, Transocean expects to see a meaningful increase in demand for “longer-duration contracts and expects significant opportunities over the next 18 months,” according to a Feb. 21 report by Evercore ISI. Transocean expects seven incremental rig lines to be awarded in Brazil, increasing the rig count in the region to 36 rigs by the end of 2025; steady demand in the U.S. Gulf of Mexico (GoM); and 13 programs to commence in the next 18 months, Evercore said.

“While deleveraging continues to be a concern, we believe Transocean’s ability to generate significant operating leverage, economies of scale and free cash flow should enable the company to accelerate organic deleveraging, which could potentially allow the company to begin returning cash to shareholders in the form of dividends and share repurchases,” Evercore analysts wrote.

During Transocean’s Feb. 20 earnings call, Thigpen said that 2023 “was a very productive year for the company.”

Future opportunities beckon

In regards to the future, the rig market is booming with opportunity.

“Over the past nine quarters, the number of tendered rig years has increased by 90% to 91 rig years,” said Keelan Adamson, Transocean president and COO. “Our customers’ programs have increased and continue to increase in duration.”

In Brazil, Petrobras alone was awarded seven rig lines, with five more expected to be awarded by second quarter 2024.

The U.S. GoM has several tenders and negotiations ongoing, but since the Atlas, Titan and Stena Evolution already have contracts in the area, Adamson expects most demand requirements over the next 18 months to be met by rigs already in the region.

“We continue to be encouraged by demand in West Africa and currently expect that up to 13 programs will commence in the next 18 months. Notably, half of these programs are at least 2 years in duration,” Adamson said.

Demand in West Africa is steadily growing as well. In Namibia, TotalEnergies, Shell and Galp Energia have recently made significant discoveries, leading Adamson to surmise that most of the four rigs currently in the area will have their contracts extended. In Nigeria, Shell has issued its multiyear tender, and Chevron and Exxon are expected to follow suit in the first half of this year. Angola also has seven rigs under contract with operators such as TotalEnergies, Exxon Mobil and Azule Energy.

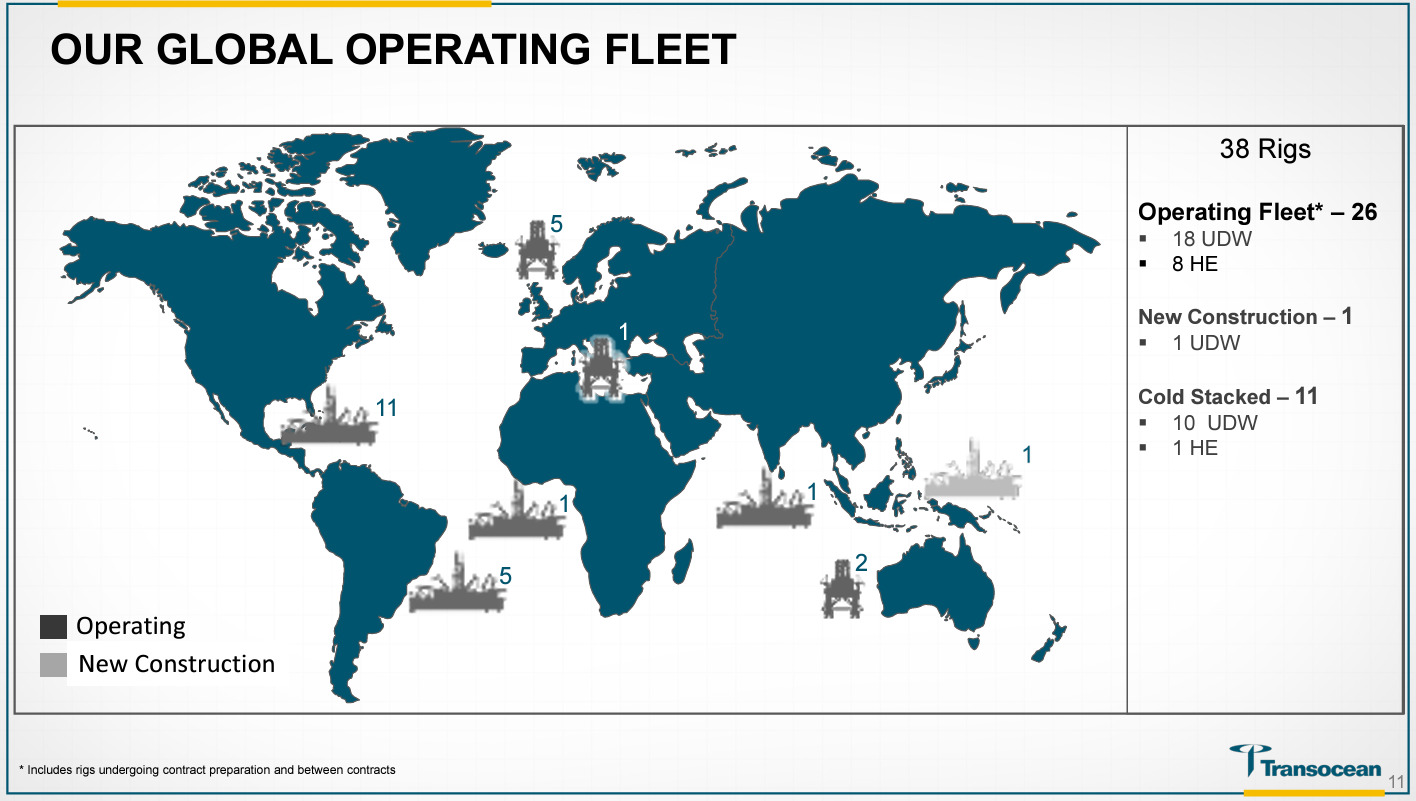

As a part of Transocean’s effort to focus on a fleet full of high-specification, ultra-deepwater and harsh environment floaters, the company sold its Paul B. Lloyd Jr. and Transocean Leader rigs, signaling its exit from the moored 4th-generation semi-submersible asset class.

The majority of Transocean’s high-specification, harsh environment semisubmersibles are contracted through 2025. Day rates have been near $500,000, which Adamson expects to continue. Incremental supply is expected to increase midway through 2025 as contracts begin to expire.

Due to increased rig activity, including the Deepwater Mykonos, People Orion, KG2 in Brazil and Transocean Endurance in Australia, the company expects adjusted contract drilling revenue of first quarter 2024 to reach $780 million. Operating and maintenance expenses are expected to be $545 million—lower than fourth-quarter 2023 because of reduced activity by the Transocean Barents and the sale of the company’s 4th-generation rigs.

Based on its 96.5% revenue efficiency, full year 2024 guidance estimates the adjusted contract drilling revenues will range between $3.6 billion and $3.75 billion.

Hitting the ground running

Last year also marked the beginning of a transition for Transocean as contracts for rigs began to generate higher revenue than ever before. Transocean delivered adjusted EBITDA of $738 million on $2.9 billion of adjusted contract drilling revenues.

“We hit the ground running in January with a number of significant contract announcements that added approximately $880 million in backlog. These included harsh environment and ultra-deep water fixtures in various jurisdictions around the world.”

Average daily revenue for its ultra-deepwater fleet increased to $432,000 per day in the fourth quarter compared with $360,000 per day in the first quarter. The Deepwater Titan was a large contributor to the uptick in revenues after it began operations in May with Chevron in the GoM. The Deepwater Titan is only the second 8th-generation drillship in world. The other, the Deepwater Atlas, is also owned by Transocean. Both rigs are operating in 20,000-psi fields in GoM.

Thanks to Titan’s five-year contract with Chevron, Transocean was able to raise $525 million from debt investors. The transaction helped prop up Transocean’s share price as the drilling market improved.

The company ended 2023 with $3.2 billion of backlog. Transocean Barents was awarded a contract for $465,000 with OMV Petrom that includes a rate increase to $480,000 for each day it has to operate beyond its initial contract of 540 days. Deepwater Skyros was given a three-well extension in Angola at a rate of $400,000 per day. The Skyros contract is expected to extend the current term of the rig through May of 2025. Deepwater Invictus has a 40-day GoM contract.

While Thigpen called 2023 a “strong year of contracting,” he does recognize that some investors have been concerned by the slower pace of contract awards towards the end of the year. He attributed the slower pace to customer focus on an extended duration of contracts and longer lead times to contract commencement. Prolonged contract negotiations bode well for the company as it “demonstrates our customer's confidence in the longevity of this upcycle and their commitment to the offshore market,” he said.

Fourth-quarter results

Fourth-quarter adjusted contract drilling revenues for Transocean increased by $27 million to $748 million, with daily revenue averaging $408,000—and a resulting adjusted EBITDA margin of 16%. The increase was driven by higher rig efficiency and increased rig utilization, as some of Transocean’s fleet had been undergoing contract preparation in the third quarter.

As rigs began to come back online, operating and maintenance expenses during the fourth quarter reached $569 million, up $45 million from the prior quarter.

Even with the increase, Transocean’s reported revenue was below expected guidance primarily due to its Deepwater Mykonos rig’s late start and lower than anticipated revenue from the managed pressure drilling services for the Deepwater Conqueror.

Cash provided by operating activities was $98 million during fourth-quarter 2023. The sequential increase was primarily due to the timing of interest payments and increased collections from customers partially offset by decreased cash collected from, and increased payments to, our unconsolidated affiliates.

Fourth-quarter 2023 capex of $220 million were primarily associated with the newbuild ultra-deepwater drillship Deepwater Aquila, which the company acquired in the third quarter, making it the eighth 1,400-ton rig in fleet. The ship is expected to begin a contract in Brazil towards the middle of 2024.

Recommended Reading

Riley Permian Announces Quarterly Dividend

2024-04-11 - Riley Exploration Permian’s dividend is payable May 9 to stockholders of record by April 25.

Matador Resources Announces Quarterly Cash Dividend

2024-04-18 - Matador Resources’ dividend is payable on June 7 to shareholders of record by May 17.

Permian E&P Midway Energy Partners Secures Backing from Post Oak

2024-02-09 - Midway Energy Partners will look to acquire and exploit opportunities in the Permian Basin with backing from Post Oak Energy Capital.

Texas Pacific Land Approves Three-for-one Stock Split

2024-03-10 - Each stockholder of record as of March 18 will be distributed two shares for each share owned.

JMR Services, A-Plus P&A to Merge Companies

2024-03-05 - The combined organization will operate under JMR Services and aims to become the largest pure-play plug and abandonment company in the nation.