Fayetteville

Rig Counts , Unconventional

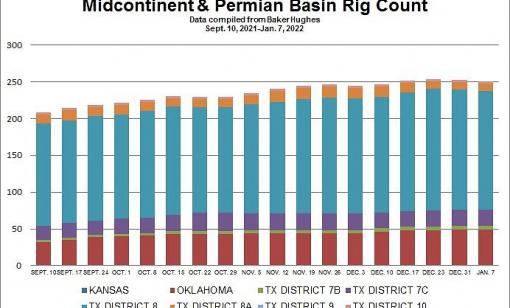

Chart: Midcontinent, Permian Basin Rig Count as of January 7, 2022

Kansas, Oklahoma, Texas Dist. 7B, 7C, 8, 8A, 9, 10

Shale Plays , Acquisitions & Divestitures

Presidio Petroleum Reportedly in Talks to Buy Exxon Mobil Shale Gas Assets

Exxon Mobil’s XTO Energy unit has been seeking buyers for its holdings in the Fayetteville Shale in Arkansas, part of the company’s drive to raise cash by shedding unwanted assets.

Acquisitions & Divestitures , Trends , Mergers

Energy A&D Transactions from the Week of Nov. 17, 2021

Here’s a snapshot of recent energy deals including the acquisition of Veritas Energy’s nonop position by Northern Oil and Gas in a transaction worth over $500 million in the Permian Basin plus a $2.5 billion Freeport LNG deal.

Acquisitions & Divestitures , Trends , Mergers

Energy A&D Transactions from the Week of Nov. 10, 2021

Here’s a snapshot of recent energy deals including Continental’s entry into the Permian through the $3.25 billion acquisition of Pioneer’s Delaware Basin position plus Southwestern acquires another private Haynesville producer.

Acquisitions & Divestitures , Trends , Mergers

Energy A&D Transactions from the Week of Nov. 3, 2021

Here’s a snapshot of recent energy deals including the $1.8 billion sale of Oasis Petroleum’s midstream affiliate and the closing of Chesapeake’s Vine Energy acquisition.

Shale Plays , Acquisitions & Divestitures

PHX Minerals Adds onto SCOOP Position, Sells Fayetteville Package

The transactions are an important step in the execution of PHX Minerals’ corporate strategy to transform into a pure play mineral and royalty company launched almost two years ago, says CEO Chad Stephens.

Shale Plays , Transactions

Exxon Mobil Launches US Shale Gas Sale to Kick-start Stalled Divestitures

The assets are among gas projects with declining production and market value as Exxon Mobil focuses on newer ventures in Guyana, offshore Brazil and Texas's Permian Basin.

Exploration & Production , Natural Gas , Shale Plays

Changing Energy Landscape Creates Natural Gas Opportunities for E&Ps

Some natural gas plays that have been out of the E&P limelight in recent years could make a resurgence, analyst says.

Unconventional , Liquefied Natural Gas (LNG) , Natural Gas , Shale Plays

How US Shale Gas Fits in Evolving Global Market

U.S. natural gas production is declining as domestic consumption falls but global demand, including for LNG, is adding to optimism.

Business , Health, Safety & Environment , Shale Plays

ESG And Energy

Some say broader environmental, social and governance measures are a must in support of a global decarbonization campaign.