Oil and Gas Investor Magazine - October 2021

Magazine

Ships in 1-2 business days

Download

In this issue:

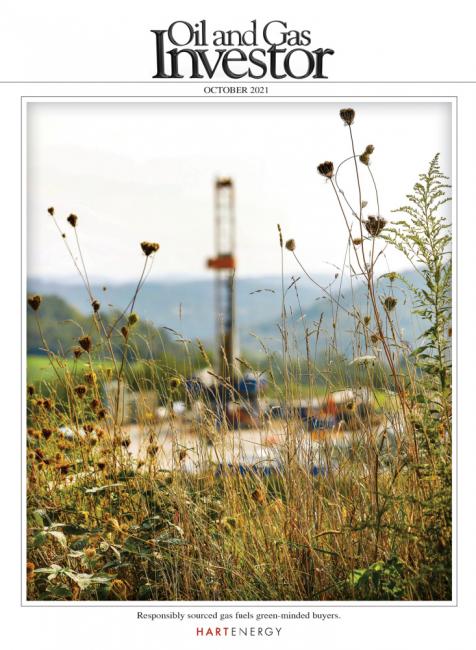

COVER STORY:

Responsibly Sourced

EXECUTIVE Q&A:

Unstoppable Devon

INVESTMENT STRATEGIES:

Probing the Buyside

CRYPTO MINING:

From Commodity to Currency

THE PATH FORWARD:

Busting Myths of Oil’s Demise

ENERGY TRANSITION PART III:

The Need for a Second Pathway

DEBT CAPITAL:

Sustainability-linked Bonds

ENERGY INSIGHTS ROUNDTABLE:

Capital Thinking

Cover Story

Responsibly Sourced: US Shale and the RSG Premium

Buyers’, investors’ and others’ growing demands for carbon-lite fuels and ESG in operations have U.S. gas producers and shippers stepping up to differentiate themselves from peers. The prize may be a higher price per Mcf for their products. Or it may simply mean continued existence.

Feature

Busting Myths of Oil’s Demise

Deloitte analysts find that while peak growth has passed, the industry will remain on solid ground for the foreseeable future. But how companies choose their competitive positioning will determine the new energy order.

Energy Insights Roundtable: Capital Thinking

A webinar hosted by Stephens Inc. focused on the big energy picture as well as how post-2020 recovery looks for the industry.

Energy Policy: Undermining the Competitive Advantage of US Oil and Gas

The budget reconciliation package that is moving through Congress has a number of damaging provisions to the U.S. oil and gas industry.

Energy Transition Part III: The Need for a Second Pathway

Carbon capture, utilization and storage technologies play a critical role in the energy transition. Will the oil and gas industry learn to adapt?

Flared Gas Crypto Mining: From Commodity to Currency

Once gone to waste, flared gas is becoming the energy source of choice to power advanced computing systems used for cryptocurrency.

Oil and Gas Debt Capital: Sustainability-linked Bonds

Sustainability-linked bonds can improve a company’s capital structure on potentially favorable terms. But energy companies must thoughtfully craft measurable and meaningful KPIs to catch this financing green wave.

Oil and Gas Investment Strategies: Probing the Buyside

The choice is to invest in oil and gas equities or wait on the sidelines. Some buysiders see opportunity.

Unstoppable Devon: Executive Q&A with CEO Rick Muncrief

When Devon Energy Corp. and WPX Energy Inc. merged to combine strengths during the 2020 downturn, they proved one plus one equals three times the value. Looking ahead, could the new company be the next E&P juggernaut?

A&D Trends

Oil and Gas Investor A&D Trends: So Little Noises

Shell recently ditched its prized Permian Basin assets citing emission goals. It was therefore interesting to hear ConocoPhillips, the buyer, trumpet, more than once, how far the transaction would go toward helping the Houston company reduce its emissions.

At Closing

Oil and Gas Rallies, But What’s Next?

In fits and starts, the oil and gas industry has been rallying all year, but it still faces uncertain times ahead. Oil and Gas Investor Executive Editor-at-large Leslie Haines explores what to expect in the final months of 2021 and more in her monthly At Closing column.

From the Editor-in-Chief

From Oil and Gas Investor Editor-in-Chief: Souki’s Optimism

Even at $5 per Mcf, natural gas prices are cheap, says Tellurian Inc.’s co-founder Charif Souki. And the rest of the world is willing to take it off your hands for decades to come, he projects—despite the noise that says otherwise.