Oil and Gas Investor Magazine - December 2019

Magazine

Ships in 1-2 business days

Download

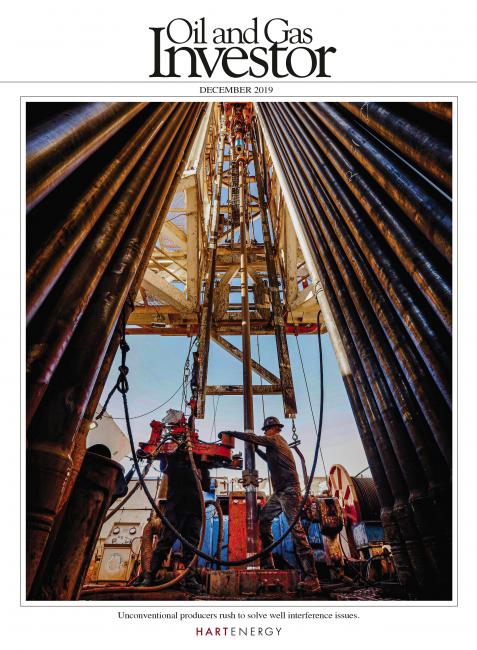

The idea of a successful oilfield development program has not changed over the 150-plus years of hydrocarbon exploration, but the tools used and the knowledge required that provide the means to the end continues to evolve. The goal remains to drain the highest percentage of oil and gas with the least amount of capital investment, writes Oil and Gas Investor Senior Editor Blake Wright. This issue of Oil and Gas Investor explores resolve to unconventional producers' recurring issues with well interference.

Also in this issue:

- Operators are learning the hard way that parent-child well interaction is damaging to both their field developments … and their bottom lines.

- With few capital options, and external uncertainties ranging from OPEC actions to election outcomes, E&Ps are increasingly being asked to prove their prowess to generate free cash flow.

- Tight-rock operators are testing EOR ideas to produce more oil where they’ve already made hole. Here are some of their findings.

Cover Story

Problem Child

Operators are learning the hard way that parent-child well interaction is damaging to both their field developments…and their bottom lines.

Feature

E&P Industry Outlook: Downshifting To Make It Through 2020

With few capital options, and external uncertainties ranging from OPEC actions to election outcomes, E&Ps are increasingly being asked to prove their prowess to generate free cash flow.

Executive Q&A: Do The Right Thing

Former Covey Park Resources co-CEO John Jacobi shares his views on challenges facing the industry today, how the deal went down with Comstock Resources and why industry stakeholders need to take ownership of righting the ship.

NGL Outlook: A Light At The End Of The Tunnel?

Macro trends show NGL production growth slowing down, allowing higher U.S. LPG exports in the year ahead.

Shale EOR: Found Oil

Tight-rock operators are testing EOR ideas to produce more oil where they’ve already made hole. Here are some of their findings.

Special Report: The Physics Limits Of Green Dreams

A scientific “miracle” will have to happen in order for the world to achieve a new energy economy.

Venado Oil & Gas: Built To Thrive

In three short years, Venado Oil & Gas built a formidable position in the Eagle Ford Shale with a staggering sum of private-equity capital. And it has no intention of selling anytime soon.

Young E&P Entrepreneurs: Start Them Up

In an unpredictable market, newly minted E&Ps have abandoned the old models of building ready-to-drill assets and instead are forging ahead with new models, operating strategies and leaders.

A&D Trends

A&D Trends: Titanium Sponge

Third-quarter conference calls indicated prudence reigns among the E&Ps, and most people would say thank you and amen to that.

At Closing

OGI At Closing: Go-Go Becomes Slo-Mo

Third-quarter conference calls indicated prudence reigns among the E&Ps, and most people would say thank you and amen to that.

E&P Momentum

E&P Momentum: Déjà Vu All Over Again

Cyclic gas injection as a form of EOR is producing 80% to 100% gains in incremental oil in the Eagle Ford Shale.

From the Editor-in-Chief

From OGI Editor-In-Chief: A Going-But-Not-Gone Concern

Say it ain’t so! Chesapeake Energy Corp. alerted investors about a possibility it would be unable to remain a going concern through next year if low commodity prices persist. But is it really a big deal?

On the Money

On The Money: E&P Drama Or Default At Year-End?

Will some drama unfold for E&P companies at year-end, good or bad, as often in the past for the oil and gas industry?