Midstream Business Magazine - August 2011

Editor's Note

Any Means Possible

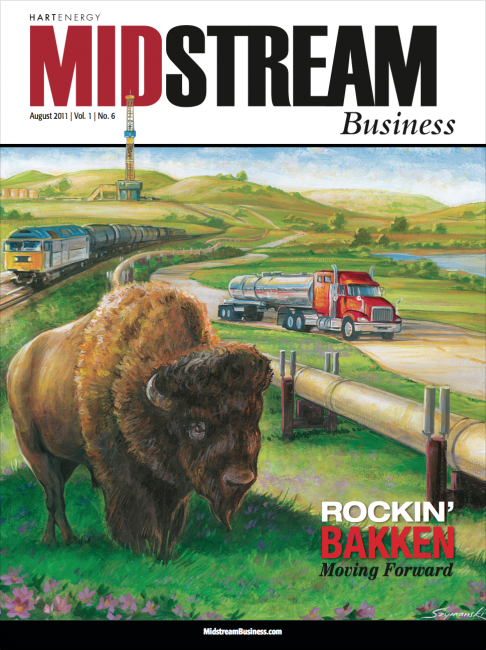

Just a few years ago, who would have predicted that a midstream energy magazine would feature trucks and trains on the cover? Yet, such atypical modes of oil and gas transportation are appropriately representative of the slate of take-away methods in North Dakota and other oil and natural gas liquids plays such as the Eagle Ford. Companies are getting their production to market by any means possible.

Mid-Year Review Shows Growth

During the first half of 2011 alone, some $40 billion has been spent on debt, equity, mergers and acquisitions deals, all targeted toward growth, and most driven by the unconventional plays.

Construction Update

Capacity Crunch

This month’s construction report features several capacity-increase projects for existing infrastructure.

Construction Queue

This month, many new construction projects focus on relieving Midcontinent and Gulf Coast capacity constraints for liquids-rich production.

Feature

Analysts’ Midyear Outlook

Following a review of the first half of the year, energy analysts say the outlook for the midstream industry is good, but better for some companies than others. Here’s why.

Avoiding Planning Pitfalls

Effective planning, thoughtful contracting and project management oversight can help companies avoid pitfalls.

Bakken Opportunities

The U.S. has a new favorite hydrocarbon play, and its name is the Bakken. Yet, producers find themselves challenged as they struggle to get abundant oil, gas and natural gas liquids to market. In an area lacking sufficient midstream infrastructure, opportunities beckon for pioneering midstream developers.

Bakken Overdrive

After idling along for many years, the Bakken oil play of North Dakota kicks into overdrive.

Bush Speaks Out

Arguably, being president of the United States is one of the toughest jobs around. But, it also has its bright spots, according to former President George W. Bush.

Executive Q&A: Hess Strategies

Hess Corp. is a big oil company with a big heart to match. Recently, the company announced a sizable donation to groups focused on North Dakota’s flood relief efforts, despite the fact that its operations in and around the state’s Bakken oil and gas play represents only a small part of its international oil and gas holdings.

Gas Processing Mid-Year Review

Gas-processing companies are ramping up their capacities to serve ever-increasing rich-gas production. While 2010 shows a modest increase from 2009 in capacities and throughput, 2011 is shaping up to be a blockbuster year for growth.

Gas Storage Mid-Year Review

Gas-storage capacity exceeds demand, but for how long? Here, industry executives weigh in on the likelihood of gas-storage expansions and the drivers that make them profitable.

INGAA Study Executive Summary

The natural gas and natural gas liquids midstream sector will require some $10 billion per year, or a total of about $251.1 billion by 2035, to meet projected infrastructure needs, according to a new ICF International report.

Marcellus Ethane Solutions

The greatest profit potential from the Marcellus’ liquids-rich-gas window is becoming less elusive as producers, pipeline operators and end-users work to capture the revenue reward.

MLP May Mayhem

Energy master limited partnerships (MLPs) booked impressive total returns in 2009 and 2010, especially relative to the broader markets. The asset class managed to extend this outperformance during the first quarter of 2011.

NGL Pipelines Outperform E&Ps

After a lackluster performance in May, pipeline master limited partnerships (MLPs) stabilized in June.

Pipeline Mid-Year Review

With the growth of shale play production, infrastructure projects are on the rise throughout the U.S. Here’s the breakdown.

Private Money

A trio of private-equity providers finds the midstream sector a hot ticket for investment, despite the competition of cheaper capital.

Proxy Fight

An unusually competitive fight for a pipeline company breaks out after two companies vie for ownership of Southern Union Co.

Riding The Bakken Rails

Given the frustration Bakken oil producers face with the lack of takeaway capacity to serve their wells, a new local railway loop, loading system and storage hub will be a welcome addition to the area’s infrastructure.

Texas Energy Banking

The financial crisis in 2009 closed some doors and opened others. Here, a finance team helps its bank find new opportunities in Texas.

The Noble Niobrara

The current multi-regional scale and successes in North American shale-resource development, and the potential for large-scale development in the Bakken play in North Dakota, appear to have captured the media’s primary focus.

Top Ten Reasons

Thanks to surging production, natural gas prices fell to an average of about $4.25 per million Btu in 2010. That price reduction, of about $3 per million Btu, is now saving U.S. consumers some $65 billion per year. And that’s just one of the top ten reasons why natural gas is going to be the fuel of the future.

True Moves

One of the major challenges is trying to identify what exactly the Bakken will look like over the next five to 10 years and to try to right size the infrastructure accordingly.

Urban Tank Farm

Typically, storage-tank farms are built away from urban areas. But what can operators do when the neighborhood grows up around it?

Alerian Index

MLPs Bounce Back in June

During June, the Alerian MLP Infrastructure Index (AMZI) rebounded from May’s underperformance and was up 1.3% on a total return basis, versus Standard & Poor’s 500 Index, which fell 1.7%.

MLPs Pull Back in May

NAPTP Conference highlights capital shift from natural gas to crude oil and liquids projects.

Finance Matters

Competition for Midstream Assets

As most midstream veterans are aware, the public capital markets (equity and debt) drive midstream merger and acquisition (M&A) activity and valuations and to a lesser extent, organic growth activity.

Midstream Bottlenecks In The Value Chain

The oft-overlooked midstream part of the oil value chain is getting increasing attention as conditions in the sector impact economics and operations in both the upstream and downstream segments of the oil business.

Midstream Movers

Meet Chris Booth

Spending time on drilling rigs before he was old enough to drive, Chris Booth knew that he was meant to be a part of the energy industry.

Meet Paul Homik

The juxtaposing idea that the energy industry can simultaneously be a small world and a vast expanse of unexplored business terrain is one with which Paul Homik can agree.

News Flow

In The Pipeline

Gas-to-liquid (GTL) technology, which can be used to convert natural gas to transportation fuel, makes Chesapeake Energy Corp.’s chairman and chief executive, Aubrey McClendon, “optimistic about the U.S. natural gas industry,” he says. In fact, McClendon is “readying new investments” in the technology, he divulged to attendees at Hart Energy’s recent Developing Unconventional Oil (DUO) Conference.

NGL Frac Spread

Cracking Capacity Returns

Recently, ethane margins have improved greatly due to the return to operation of all ethane-cracking capacities after several facilities were offline during the past few months.

Ethane Margins Down Due To Cracking Capacity Shortage

After a strong spring, ethane margins began to tumble as the season began to come to close. Natural gas liquid (NGL) prices had benefited from increased cracking from ethylene producers, as it is more profitable as a feedstock compared to naphtha.

Transaction Update

Mid-Year Deal Flow

The first half of 2011 saw major midstream financial transactions, either announced or completed, totaling nearly $40 billion.

Summer Sees Slow M&A Activity

The overall number of mergers and acquisitions in the midstream sector slowed moderately in the summer. On noteworthy deal was Western Gas Partners LP’s agreement to acquire the Bison gas treating facility and related assets in Powder River Basin from Anadarko Petroleum Corporation for $130 million.