Whiting Petroleum Corp. (NYSE: WLL) nearly doubled its 2017 capex as crude prices stabilize following a two-year rout, according to a Feb. 21 report.

However, shares of the Denver-based company were down 3.5% after the bell as the oil producer's revenue fell below analysts' expectations due to a steep drop in production.

Oil companies are betting big on a continued rise in crude prices by buying up acreage and raising capital spending. Following this trend, Whiting boosted its 2017 capex to $1.1 billion from $554 million in 2016.

The company's production fell 23.4% to 118,890 barrels of oil equivalent per day in the fourth quarter ended Dec. 31.

Whiting's net loss available to common shareholders widened to $173.3 million, or 59 cents per share, in the quarter from $98.7 million, or 48 cents per share, a year earlier.

Excluding items, Whiting posted a loss of 28 cents per share, smaller than the analysts' average estimate of 32 cents.

The company's operating revenue fell 18% to about $342.7 million. Analysts had estimated revenue of $355.2 million, according to Thomson Reuters I/B/E/S.

Whiting is North Dakota's largest oil producer. The company has about 738,479 gross (443,125 net) acres in the Williston Basin, including acreage in the Bakken/Three Forks Play, according to a Feb. 14 presentation.

Recommended Reading

Exclusive: Calling on Automation to Help with Handling Produced Water

2024-03-10 - Water testing and real-time data can help automate decisions to handle produced water.

Exclusive: Chevron New Energies' Bayou Bend Strengthens CCUS Growth

2024-02-21 - In this Hart Energy LIVE Exclusive interview, Chris Powers, Chevron New Energies' vice president of CCUS, gives an overview of the company's CCS/CCUS activity and talks about the potential and challenges of it onshore-offshore Bayou Bend project.

Exclusive: As AI Evolves, Energy Evolving With It

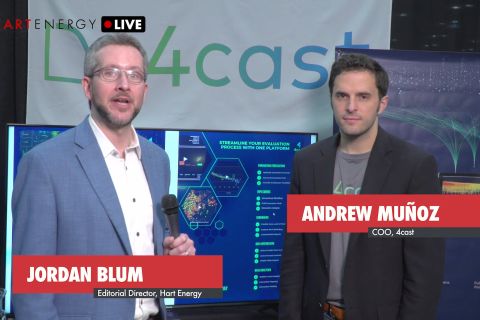

2024-02-22 - In this Hart Energy LIVE Exclusive interview, Hart Energy's Jordan Blum asks 4cast's COO Andrew Muñoz about how AI is changing the energy industry—especially in the oilfield.

Exclusive: Liberty CEO Says World Needs to Get 'Energy Sober'

2024-04-02 - More money for the energy transition isn’t meaningfully moving how energy is being produced and fossile fuels will continue to dominate, Liberty Energy Chairman and CEO Christ Wright said.

Chesapeake, Awaiting FTC's OK, Plots Southwestern Integration

2024-04-01 - While the Federal Trade Commission reviews Chesapeake Energy's $7.4 billion deal for Southwestern Energy, the two companies are already aligning organizational design, work practices and processes and data infrastructure while waiting for federal approvals, COO Josh Viets told Hart Energy.