Houston-based independent VAALCO Energy Inc. laid out plans on Jan. 27 to grow its asset base through its newly appointed president, William R. Thomas.

With over 30 years of experience in the international energy industry, Thomas has led the growth of a number of E&P companies, which the VAALCO board believes will support the company’s inorganic growth ambitions, according to the company news release.

“We are at a key inflection point for VAALCO,” Andrew Fawthrop, VAALCO’s board chairman, said in a statement. “Our strategy is to grow the company, both by developing our existing asset base and through M&A.”

VAALCO is an established operator within the West Africa region. The company holds a 31.1% working interest in the Etame Marin Block, located offshore Gabon, which to date has produced over 110 million barrels of crude oil and of which the company is the operator.

Effective Feb. 1, Thomas will be responsible for VAALCO’s strategic M&A activity. Meanwhile, the company’s CEO, Cary Bounds will manage the other aspects of the business in his ongoing role.

“Mr. Thomas has many years of successful M&A experience and is highly qualified to lead VAALCO’s growth,” Fawthrop added in his statement. “We believe that with Mr. Thomas as president focusing on external growth and Mr. Bounds managing our ongoing operations, VAALCO is well-positioned for the future.”

Thomas joined the VAALCO board in April 2019 and has been serving as a non-executive director. He will continue to serve on the board, the company said. With the appointment, the VAALCO board will continue to have five members, three of which are independent.

According to his biography on the VAALCO website, Thomas has successfully built, managed and monetized several emerging-market oil companies during his career.

In 2001, he was a founder and appointed CEO of Urals Energy NV, which became Russia’s largest independent oil company. He later was a founder and CEO of Urals Energy Public Co. Ltd. and led the company to a successful IPO on London’s AIM stock exchange in 2005.

Since 2010, through his wholly-owned entity, Texas Oceanic Petroleum Co., Thomas has negotiated transactions involving E&P companies around the world including in West Africa.

Thomas entered investment banking in 1986 with the M&A department at Bankers Trust Co. where he represented energy clients in major transactions. Previously, he had served in the international division of Pennzoil Co.

Recommended Reading

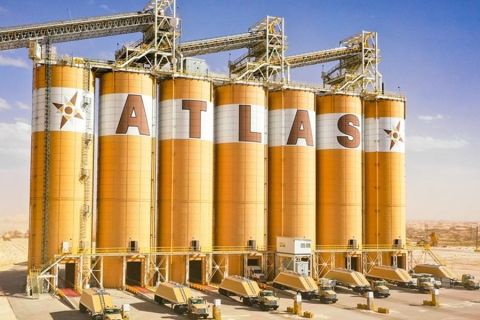

Fire Closes Atlas Energy’s Kermit, Texas Mining Facility

2024-04-15 - Atlas Energy Solutions said no injuries were reported and the closing of the mine would not affect services to the company’s Permian Basin customers.

Coalition Launches Decarbonization Program in Major US Cities, Counties

2024-04-11 - A national coalition will start decarbonization efforts in nine U.S. cities and counties following a federal award of $20 billion “green bank” grants.

Exclusive: Scepter CEO: Methane Emissions Detection Saves on Cost

2024-04-08 - Methane emissions detection saves on cost and "can pay for itself," Scepter CEO Phillip Father says in this Hart Energy exclusive interview.

Majority of Recent CO2 Emissions Linked to 57 Producers - Report

2024-04-03 - The world's top three CO2-emitting companies in the period were state-owned oil firm Saudi Aramco, Russia's state-owned energy giant Gazprom and state-owned producer Coal India, the report said.