French oil and gas major Total’s South African offshore discovery could contain 1 billion barrels of total resources and is “probably quite big,” CEO Patrick Pouyanne said Feb. 7.

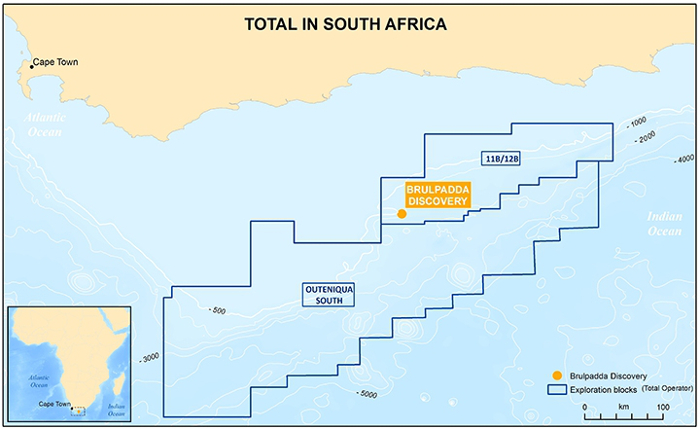

Total said it had made a significant gas condensate discovery after drilling its Brulpadda prospects on Block 11B/12B in the Outeniqua Basin.

“It is gas condensate and light oil. Mainly gas. There are four other prospects on the license that we have to drill; it could be around 1 billion barrels of total resources of gas and condensate,” Pouyanne said.

The Brulpadda well encountered 57 m of net gas condensate in Lower Cretaceous reservoirs. The well was extended to a final depth of 3,633 m and has also been successful.

“With this discovery Total has opened a new world-class gas and oil play and is well positioned to test several follow-on prospects on the same block,” Total’s senior vice president for exploration, Kevin McLachlan, said in a statement.

South Africa, which imports most of its refined petroleum products and crude oil, welcomed the announcement.

“It is potentially a major boost for the economy,” mineral resources minister Gwede Manthashe said in a statement.

South Africa wants to build its gas network and has previously mentioned the possibility of importing LNG from Mozambique, where a gas pipeline already supplies most of the gas South Africa uses to power its industrial heartland in the north.

The proximity of the find to Mossel Bay’s gas-to-liquid plant is also a boon, said national oil and gas company PetroSA.

“We potentially could be supplied by Total with gas and condensate, which means the GTL refinery can be ramped up ... it is currently running below 50 percent of its design capacity,” PetroSA acting CEO Bongani Sayidini said.

Brulpadda is one of several high-profile exploration prospects for Total, which has said the field could hold between 500 million to more than 1 billion barrels of oil equivalent.

After the confirmation of Brulpadda’s potential, Total and its partners plan to acquire 3D seismic data this year, followed by up to four exploration wells on the license, the company said.

Total has a 45% working interest and is the operator of Block 11B/12B, which covers an area of 19,000 sq km.

Other partners include Qatar Petroleum, CNR International and Main Street, a South African consortium, holding 25%, 20% and 10% stakes, respectively.

Recommended Reading

Moda Midstream II Receives Financial Commitment for Next Round of Development

2024-03-20 - Kingwood, Texas-based Moda Midstream II announced on March 20 that it received an equity commitment from EnCap Flatrock Midstream.

Humble Midstream II, Quantum Capital Form Partnership for Infrastructure Projects

2024-01-30 - Humble Midstream II Partners and Quantum Capital Group’s partnership will promote a focus on energy transition infrastructure.

Mike Howard Joins Atlas Energy Solutions’ Board

2024-02-15 - Mike Howard brings more than 28 years of midstream energy experience to Atlas Energy Solutions’ board of directors.

Genesis Energy Declares Quarterly Dividend

2024-04-11 - Genesis Energy declared a quarterly distribution for the quarter ended March 31 for both common and preferred units.

Sunoco’s $7B Acquisition of NuStar Evades Further FTC Scrutiny

2024-04-09 - The waiting period under the Hart-Scott-Rodino Antitrust Improvements Act for Sunoco’s pending acquisition of NuStar Energy has expired, bringing the deal one step closer to completion.