France’s Total and partners will resume drilling at the Brulpadda prospect offshore South Africa in December, a minority partner in the field said on Feb. 27.

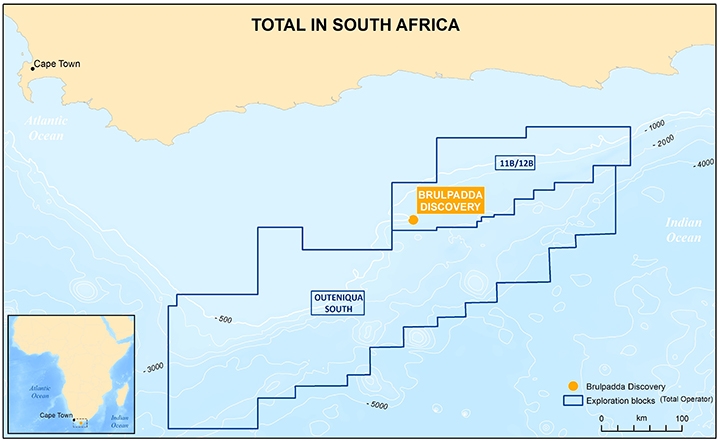

Brulpadda, in Block 11B/12B, is a gas condensate discovery that could hold total resources of 1 billion barrels of oil equivalent, Total said on Feb. 7.

“We will come back in the next summer window in December and drill up to four exploration wells,” Garrett Soden, CEO of Africa Energy, which holds a 4.9% effective interest in the block, told Reuters on the sidelines of an energy conference.

The drilling costs will lower to about $100 million per well, he said, from $154 million for the first well drilled.

Total has a 45% working interest and is the operator of Block 11B/12B, which covers an area of 19,000 sq km.

Other partners include Qatar Petroleum, CNR International and Main Street, a South African consortium in which Africa Energy owns 49%, holding 25%, 20% and 10% stakes respectively.

South Africa is the company’s key market, said Soden, but Africa Energy is also looking at new oil and gas assets on the continent’s west coast.

“We are also looking all the way up to Senegal on the west coast. On the Offshore, that is where we see the opportunities. We are looking at Equatorial Guinea, Ghana, Gabon, Cameroon,” he said.

The firm owns 90% interest in another South African field, called Block 2B, off the country's west coast and it plans to find a partner to drill a well there within the next 12 months.

Soden said the company was ready to cut its majority stake and sell operatorship if needed.

“In general when we look at new ventures we typically want to be non-operator and have between 5 and 25% to have an interest in multiple opportunities for success.”