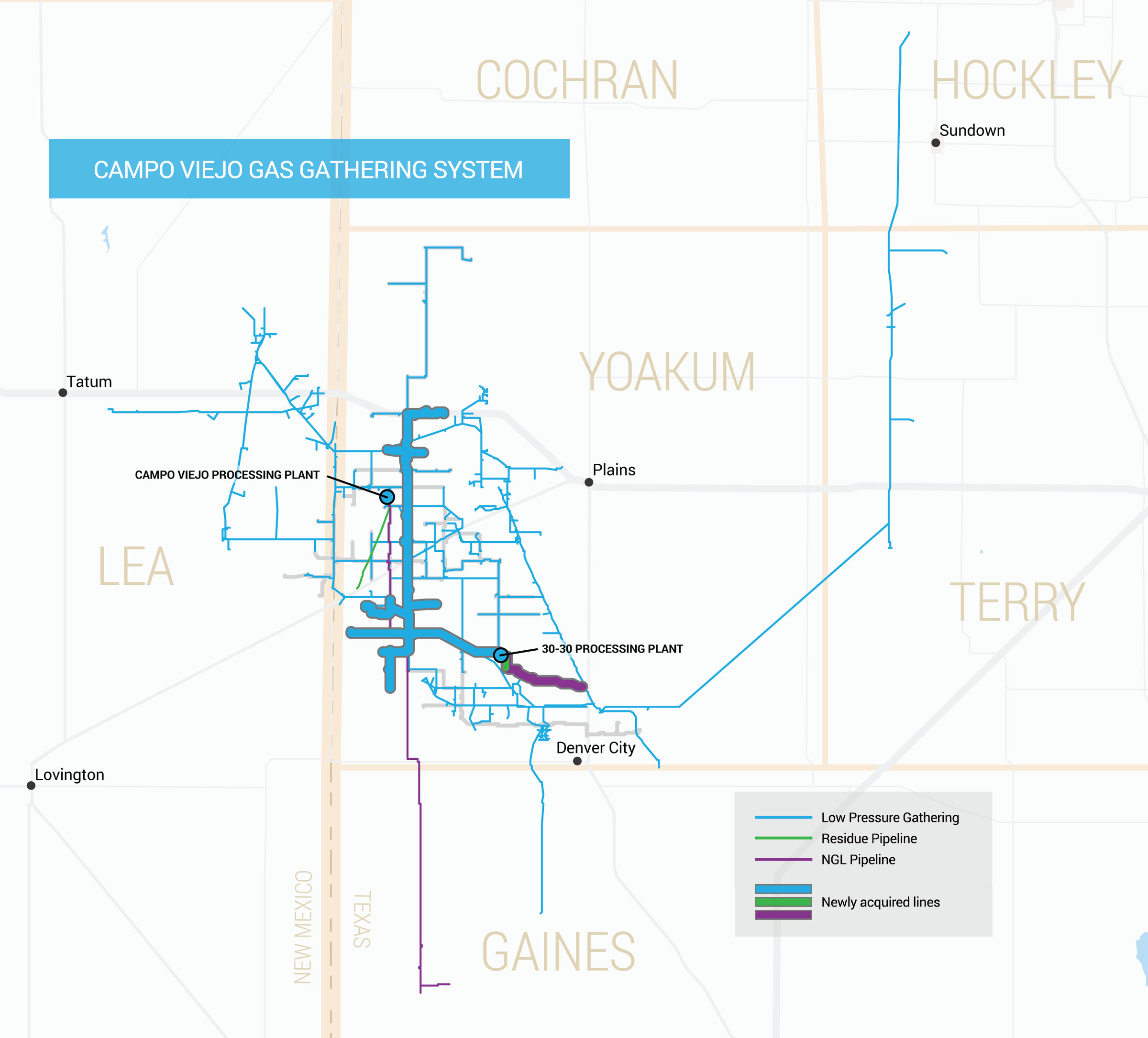

SAN ANTONIO—Stakeholder Midstream LLC announced Dec. 15 it has acquired gas gathering and processing assets from Santa Fe Midstream LLC.

Located in Yoakum County, Texas, the assets include Santa Fe’s 30-30 Gas Treating and Processing Plant, low-pressure gas gathering pipelines, downstream residue and NGL lines, and a long-term acreage dedication from an established San Andres oil and gas producer. The Santa Fe System will complement Stakeholder’s existing Campo Viejo Processing Plant and gathering system currently serving San Andres producers on the Northwest Shelf of the Permian Basin.

The acquisition brings the combined systems’ gas processing capacity to approximately 85 million cubic feet per day, total gathering pipeline mileage to approximately 450 miles and total acreage dedications to the combined gas systems to greater than 200,000 acres.

“We entered the San Andres play in 2016 due to the unique blend of production stability and growth potential, and that thesis has been validated by our customers’ performance,” said Stakeholder Co-CEO Robert Liddell. “Despite a challenging commodity environment in 2020, our system volumes continued to grow year over year and we expect that trend to continue. This consolidation enhances Stakeholder’s capabilities to provide even better service to our customers.”

The Santa Fe acquisition follows Stakeholder’s August 2020 purchase and integration of a crude gathering system owned collectively by Walsh Petroleum Inc. and Burk Royalty Co. Ltd. The August acquisition brings pipeline mileage on the crude oil gathering system to approximately 150 miles and acreage dedications to the crude system to approximately 150,000 acres. The San Andres Crude Gathering System includes 60,000 barrels of storage and is connected to Phillips 66, Plains All American and the Centurion Pipeline System.

Hunton Andrews Kurth LLP served as legal counsel to Stakeholder with partners Parker Lee and Taylor Landry in the lead roles from the firm’s New York and Houston offices, respectively. Kirkland & Ellis LLP served as legal counsel to Santa Fe. Partners Kevin Crews and Thomas Laughlin led the Kirkland & Ellis team from the firm’s Dallas office.

Recommended Reading

Exclusive: Chevron New Energies' Bayou Bend Strengthens CCUS Growth

2024-02-21 - In this Hart Energy LIVE Exclusive interview, Chris Powers, Chevron New Energies' vice president of CCUS, gives an overview of the company's CCS/CCUS activity and talks about the potential and challenges of it onshore-offshore Bayou Bend project.

Chesapeake, Awaiting FTC's OK, Plots Southwestern Integration

2024-04-01 - While the Federal Trade Commission reviews Chesapeake Energy's $7.4 billion deal for Southwestern Energy, the two companies are already aligning organizational design, work practices and processes and data infrastructure while waiting for federal approvals, COO Josh Viets told Hart Energy.

Exclusive: As AI Evolves, Energy Evolving With It

2024-02-22 - In this Hart Energy LIVE Exclusive interview, Hart Energy's Jordan Blum asks 4cast's COO Andrew Muñoz about how AI is changing the energy industry—especially in the oilfield.

Exclusive: Liberty CEO Says World Needs to Get 'Energy Sober'

2024-04-02 - More money for the energy transition isn’t meaningfully moving how energy is being produced and fossile fuels will continue to dominate, Liberty Energy Chairman and CEO Christ Wright said.

Exclusive: Sabine CEO says 'Anything's Possible' on Haynesville M&A

2024-04-09 - Sabine Oil & Gas CEO Carl Isaac said it will be interesting to see what transpires with Chevron’s 72,000-net-acre Haynesville property that the company may sell.