U.S. investment fund Harbour Energy Ltd. formalized its $10.36 billion bid for Australia's Santos Ltd. on May 17 but failed to sweeten its offer, dashing hopes of a higher price and sending the oil and gas producer's shares lower.

A successful bid would mark the biggest takeover of an Australian oil and gas producer, but Adelaide-based Santos has indicated the company may be worth more because of recent gains in the oil price.

Santos shares dipped 2% to sit below the offer price, with analysts suggesting the company may reject the bid as too low. The broader market was down 0.3%.

RELATED: Santos Suitor Harbour Works To Seal Takeover Plan

"With only two weeks since the AGM where the [Santos] Chairman implied this offer was not sufficient, we would anticipate the board recommending to reject," Macquarie analysts said in a client note.

Santos said it would consider the offer, which had the same U.S. dollar value as a previous indicative bid from Harbour, and urged shareholders to take no action.

Harbour declined to comment.

The bid would give Harbour access to a recently revived company with a low cost of oil production and stakes in LNG in the Asia-Pacific, where demand is soaring.

While Harbour did not change the value of its formal offer, Santos said it had now specified it would pay cash to shareholders other than China's ENN Ecological Holdings Co. Ltd. and Hony Capital Ltd., which together own 15.1% of the company.

ENN and Hony would be able to roll their existing Santos shares into a new Harbour investment vehicle and get shares in that new entity, Santos said.

The initial Harbour offer was valued at about A$6.50, based on the foreign exchange at the time, but oil prices have risen about 17% since then, leading some analysts to say Harbour would need to raise its offer to A$7.00 a share to succeed. Santos shares were trading at A$6.20 on May 17.

Santos opened its books to Harbour in April after the private equity-backed firm returned with its fourth proposed offer since August.

Recommended Reading

TGS, SLB to Conduct Engagement Phase 5 in GoM

2024-02-05 - TGS and SLB’s seventh program within the joint venture involves the acquisition of 157 Outer Continental Shelf blocks.

StimStixx, Hunting Titan Partner on Well Perforation, Acidizing

2024-02-07 - The strategic partnership between StimStixx Technologies and Hunting Titan will increase well treatments and reduce costs, the companies said.

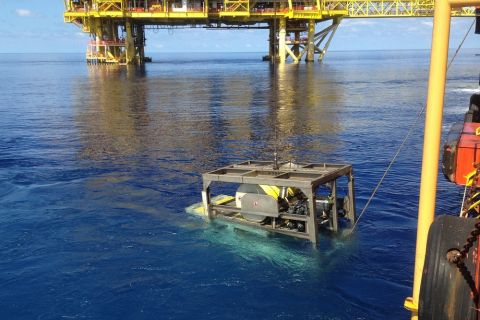

Forum Energy Signs MOU to Develop Electric ROV Thrusters

2024-03-13 - The electric thrusters for ROV systems will undergo extensive tests by Forum Energy Technologies and SAFEEN Survey & Subsea Services.

Axis Energy Deploys Fully Electric Well Service Rig

2024-03-13 - Axis Energy Services’ EPIC RIG has the ability to run on grid power for reduced emissions and increased fuel flexibility.

TotalEnergies Rolling Out Copilot for Microsoft 365

2024-02-27 - TotalEnergies’ rollout is part of the company’s digital transformation and is intended to help employees solve problems more efficiently.